I woke up Monday morning (after Halloween weekend), waking up to check social media and experience just for a brief moment, through the small window held in the palm of your hand, the events that took place this past weekend. In previous years, this Monday social media feed had been filled with pictures and videos of friends in their Halloween costumes and the various parties they went to. However, this Monday morning was filled with pictures of all my friends at music festivals. The two major music festivals that occurred this past weekend were Escape All Hallows Eve hosted by Insomniac and HARD Day of the Dead hosted by Hard. The presence of music festivals has been felt since the days of Woodstock, however the frequency of music festivals has risen dramatically in the past few years and its economic effects have not gone unnoticed.

The biggest Electronic Dance Music Festival on the west coast takes place in the middle of June in the infamous city of Las Vegas. This event that attracts over 345,000 festival goers for 3 days is called Electric Daisy Carnival or EDC. Mixjunkies.com reports that “since moving to Las Vegas in 2011, Insomniac has helped generate more than $621 million for the Las Vegas economy. Tickets sales report that festival goers come from all 50 states as well as 48 international countries.

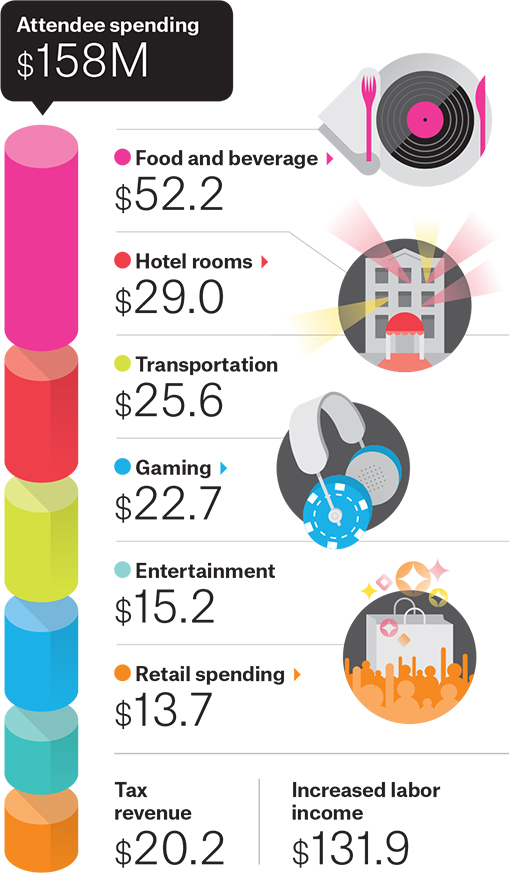

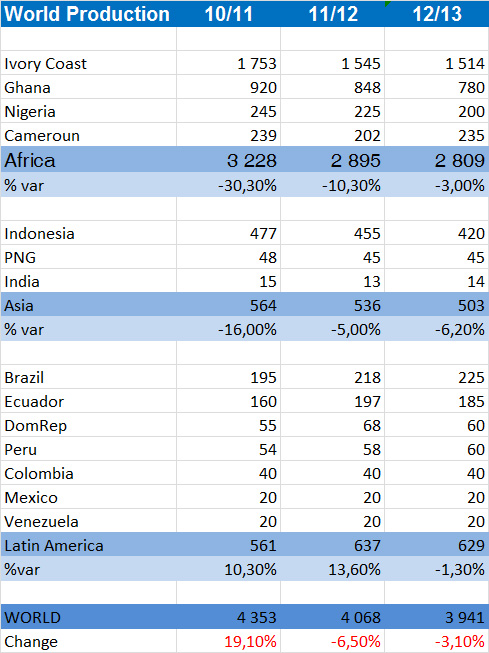

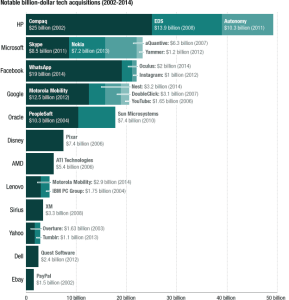

How does EDC create so much revenue? Well people need places to stay, food to eat, gambling to be done, and day clubbing before the event actually happens. EDC actually creates $20.2 million dollars in tax revenue for Clark County. This graphic puts all the expenses into perspective.

EDC is not the only major music festival that generates this much revenue. The four biggest music festivals in the world include EDC, Ultra in Miami, Tomorrow Land in Belgium, and Tomorrow World in Atlanta. Insomniac has also seen how successful EDC is and has hosted EDC is several different locations such as EDC Puerto Rico, EDC Orlando, EDC UK, and EDC Mexico.

With the rise of the internet, the amount of DJ’s that have entered the scene has exponentially grown. As DJ Shadow stated in 2012, “we are living in a musical renaissance.” Baby boomers grew up with rock and roll, Gen X’ers had hip hop and punk rock, the millennials have EDM or electric dance music. Calvin Harris, the highest paid DJ names by Forbes, racked in a whopping 66 million over that past 12 months. The age od EDM has taken over radio stations like KissFM and countless music festivals will continue to emerge in the coming years.