ChiNext is an important component of China’s multi-tier capital market system, which offers a new capital platform tailor-made for the needs of enterprises engaged in independent innovation and other growing venture enterprises. ChiNext Pioneers represent those entrepreneurs who are trying to start or operate their own businesses in US.

Tianyi Zhong is one of those pioneers who are trying to start their own businesses. After getting his master degree in Information Technology and Services from USC, he and his girlfriend, Yi He opened a Chinese fast food delivery company, Chopopfoods.

“I always want to start my own business…I don’t like the food around our campus…so I think if I have chance to cook I would make it more delicious and healthy…Then I talked to my girlfriend and she supported my idea…Actually USC has a lot of Chinese students,” said Zhong.

After deep conversations with their parents, they decided to start their new business with the money, 50,000 dollars, supported by their parents.

As the largest segment of enrolled international population, USC has 2,515 Chinese students, which ranks NO.1 in US universities, according to annual Open Doors report by the Institute of International Education.

In September, after eight-month preparations, Zhong finally signed a contract with a professional catering kitchen in downtown area, Los Angeles and officially started his business in October.

They set up a website and an app, which both could search their menus and order meals online. After the first month, they built connections with some returned customers and their friends. On Chinese twitter, Weibo, they launched special order promotions for attracting customers and got much more followers than before. However, the booming market didn’t bring them more orders.

“…Eight to nine dollars for a combo is actually cheap for lunch…we plan to have 30-50 orders every day after the first month, but it’s much harder than we imagined…the truth is that we only have less than 15 orders every day…under our expectations,” said Zhong.

In December, China News, one of the largest Chinese news agencies, reported their story on Chinese websites. They were getting popular on Chinese Internet and even attracted Chinese investors who are in US.

“ The investor told me that he could invest around one million dollars…we met once in bay area before…it’s just unbelievable…We are going to meet again after New Year,” said Zhong.

In Las Vegas, Zhong and his girlfriend met their investor Mr. Xi. After two-day negotiations, 10,000 dollars would be put at the beginning stage for new products research such as fresh fruit juice and marketing plans, which means they have to change their original business model.

“ With the money we can hire more people to help us with market research and other stuff…but it’s getting a little bit different with our original goal… we are still thinking over the whole business plan,” said Zhong.

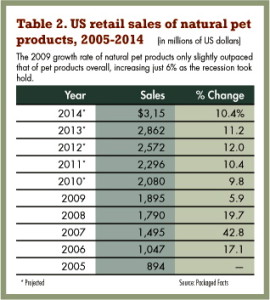

More than 200 million businesses are started in US every year, according to a study released today by the Small Business Administration Office of Advocacy, nearly 20 percent of immigrant-owned businesses started $50,000 or more in startup capital, compared to 15.9 percent for non-immigrant-owned business.

Zhong has entirely stopped his food delivery since February. They might need more time to adjust their dream and try to find a way to achieve it in the real world. They still have a long way to go.