Below is the link to my interactive timeline of the Wells Fargo Scandal:

Attached is the Google Doc I used to build it:

https://docs.google.com/spreadsheets/d/1AQDIY0MjwmN8BDMpiQX4jJ-UsBTdBo8gLYDc7qWHypI/edit?usp=sharing

genesis domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home3/ascjclas/public_html/wp-includes/functions.php on line 6131news domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home3/ascjclas/public_html/wp-includes/functions.php on line 6131Below is the link to my interactive timeline of the Wells Fargo Scandal:

Attached is the Google Doc I used to build it:

https://docs.google.com/spreadsheets/d/1AQDIY0MjwmN8BDMpiQX4jJ-UsBTdBo8gLYDc7qWHypI/edit?usp=sharing

Coachella Valley Music Festival is the largest music festival in the U.S., and its home, the Empire Polo Fields in Indio, California has become the host to festivals several weekends of the year. These few weekends a year have a huge impact on the area due to the mass amounts of people it draws.

Here’s a breakdown of the economic effects from the two Coachella weekends and Stagecoach in 2016:

Now that there has been Desert Trip, a new festival this year at the Polo Field’s, it is estimated that there has been an economic impact of $805 million in 2016 from the three festivals combined. It will be interesting to see the outcomes and information on the Desert Trip festival’s impact. So far, it has been estimated that Desert Trip brought $250 million into the Coachella Valley economy. This all has been a huge move forward since 2012 when the Polo Field’s contract with Golden Voice begun.

Some of the economic outcomes from Coachella and Stagecoach in 2012 were-

This can partly be attributed to ticket prices increasing and many more people attending each day now.

These effects on Indio’s economy and the Coachella Valley area’s economy have allowed for renovations to business and infrastructure. It has also brought new businesses, hotels and other tourists due to the city’s new “City of Festivals” reputation and mystique. This effects will most likely grow as the festivals continue to grow. The city of Indio recently approved Golden Voice’s proposal to increase Coachella’s attendance by 26,000 people and Stagecoach’s attendance by 10,000 people. The proposal also included expanding the festival site by 42-acres and adding more parking and camping sites. It allows sound checks to start at 8 a.m. instead of at 10 a.m. as well. It is predicted that the growth in attendance would give Indio $1 million more in ticket taxes.

Moving forward, the city of Indio is making efforts to bring more people to their city year-round rather than just during those few weeks during the year.

Sources:

http://www.kmir.com/story/31553258/goldenvoice-proposes-attendance-increase-to-coachella-and-stagecoach

http://www.cvindependent.com/index.php/en-US/news/politics/item/3385-to-lead-the-city-of-festivals-seven-candidates-compete-for-two-seats-on-the-indio-city-council

http://www.latimes.com/business/la-fi-coachella-impact-20160723-snap-story.html

http://www.desertsun.com/story/news/local/indio/2016/03/22/goldenvoice-concerts-coachella-economic-impact/82141410/

http://csq.com/2016/07/gold-mine-desert/#.WDNoOhIrK1s

http://www.cnbc.com/2016/10/07/oldchella-set-to-be-a-boon-of-at-least-250-million-to-coachella-valley.html

The Great Sendai Earthquake happened on March 11, 2011. It was an earthquake of a 9.0 magnitude that caused large tsunami waves as well. The damage from this natural disaster was severe. There were nuclear accidents, thousands of buildings destroyed and damaged, ports were shut down, there were power outages and damaged infrastructure. The estimated cost of rebuilding was $200 billion.

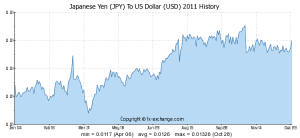

The value of the yen was greatly affected following the disaster. The yen hit a high at 76.25 against the U.S. dollar after the earthquake. The yen was previously at 83.8 on February 15, 2011 before the disaster. This happened because of repatriation of capital- Japanese corporations were exchanging their money they have in other countries for yen to pay for handling the aftermath. The large demand for yen was created so its value went up. What Japan did in an effort to lower the yen was had their central bank was sell yen to weaken its value, but it wasn’t enough to bring it down.

When the value of the yen is higher than foreign currencies, it makes it too expensive for the rest of the world to be able to buy Japan’s exports and makes it less desirable. So, if the yen is high this is very bad for Japan because 14% of their economy is based on exports. For example, every one yen move versus the U.S. dollar will cost Toyota $380 million a year. Also, the natural disaster’s immediate damage hurt their trade because it caused supply chain disruption. This is because Japan plays a large role in the global supply chains because they not only export parts of products but finished products as well. Japan’s large companies that have exports such as Toyota, Nissan, Sony and other tech and auto industry companies had to halt production because of damages.

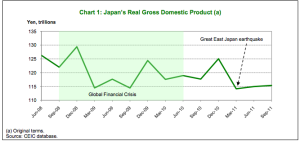

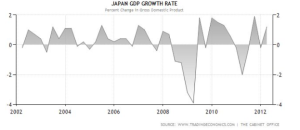

Because Japan’s production and trade was halted following the earthquake because of damages and increase of the yen, Japan’s GDP growth halted as well. Their national savings went down because they were spending it on repairs and their debt increased as well. At the time, Japan’s economy was the third largest in the world that accounted for 8.7% of the world’s GDP. But, this natural disaster moved Japan from this spot. Here is a brief look at how their GDP staggered from the disaster: in 2010 it was 42935.3, in 2011 it was 42824.7 and in 2012 it was 43658.2. The fall from 2010 to 2011 is bad because usually just a small amount of growth is bad; no growth to where it is negative is very bad (and this is what happened). But, Japan’s economy was able to get back in the steady direction it was going by 2012. Since the disaster, Japan’s growth has fell behind other large economies so it has not contributed to the growth of the global GDP.

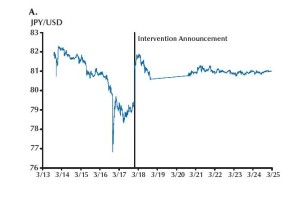

Japan was able to recover and able to maintain its economy because of the G7 Intervention that took place following the disaster and the sharp increase in the value of the yen. The G7 is made up of some the nation’s wealthiest countries, this includes the United States, Canada, France, Germany, Italy, Japan, and the United Kingdom. This group meets annually to discuss global economics, international security, and energy policies. They met on March 18, 2011 in regards to Japan’s economy after the earthquake and agreed to start selling the yen to makes the value of the yen go back down. The group wanted to decrease value of the yen so Japan could recover and they could continue trading with them. If Japan’s yen stayed at that very high level it would have affected the world’s trade in horrible way. Following the G7, the yen weakened and went back to 80.94 against the US dollar. Because of this, Japan’s economy was able to start recovering because they could resume exporting their goods (a large driving factor of their economy). Other countries were able to buy

Japan was able to recover and able to maintain its economy because of the G7 Intervention that took place following the disaster and the sharp increase in the value of the yen. The G7 is made up of some the nation’s wealthiest countries, this includes the United States, Canada, France, Germany, Italy, Japan, and the United Kingdom. This group meets annually to discuss global economics, international security, and energy policies. They met on March 18, 2011 in regards to Japan’s economy after the earthquake and agreed to start selling the yen to makes the value of the yen go back down. The group wanted to decrease value of the yen so Japan could recover and they could continue trading with them. If Japan’s yen stayed at that very high level it would have affected the world’s trade in horrible way. Following the G7, the yen weakened and went back to 80.94 against the US dollar. Because of this, Japan’s economy was able to start recovering because they could resume exporting their goods (a large driving factor of their economy). Other countries were able to buy

their exports because the value of the yen leveled-out to where the exports were affordable to other countries again. Without this intervention we most likely would have seen a rippling effect from Japan to the rest of the world causing other economies to weaken because of the disruption of trade. The global GDP was still able to grow in the year of 2011 following the earthquake, but it did not continue to grow at the same rate as it was from 2010 to 2011; this could be partly due to the disruption of trade in 2011 because of the halt of Japan’s production and exports that impacts the rest of the world.

their exports because the value of the yen leveled-out to where the exports were affordable to other countries again. Without this intervention we most likely would have seen a rippling effect from Japan to the rest of the world causing other economies to weaken because of the disruption of trade. The global GDP was still able to grow in the year of 2011 following the earthquake, but it did not continue to grow at the same rate as it was from 2010 to 2011; this could be partly due to the disruption of trade in 2011 because of the halt of Japan’s production and exports that impacts the rest of the world.

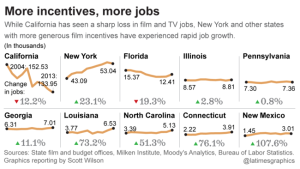

Runaway production is when film and television productions are filmed and produced outside of the U.S. or outside of Los Angeles. Productions are being lured in all directions to leave Hollywood due to film tax incentive programs. It is estimated the California lost over $9.8 billion dollars due to runaway production before crafting their own film tax incentive programs. The original California Film & Television Tax Credit Program that was passed in 2009 to be effective from 2011 to 2014 was a $100 million-per-year incentive plan. The program included a 20% tax credit for feature films and new television series and independent film. This plan had a cap of $50 million for the films. The eligible films to receive the tax credits were chosen through a lottery system. This program is administered by State Film Commission called the California Film Commission (CFC). Their responsibility is to attract and retain motion picture production in California.

After the first program was made, filming in the LA region bounced back. According to the CFC, 229 projects were completed during the first film tax credit program and these projects received $447 million worth of tax credits. These projects went towards the total production spending in California that went up to $3.7 billion during that time period. The total, including the incomplete projects that received tax credits during the program, was that the $800 million tax credits under the program could be partly responsible for the $6.1 billion production spending in California between 2011 and 2014. But, it is estimated that about a third of the projects that received tax credits from the first program would have been made in California either way. This is what makes this program unclear of whether it was actually worth the money.

This whole concept of California having a film tax incentive program stemmed from having to keep up with other states that created these programs first. Starting in the early 2000s states such as New Mexico, Georgia, New York, Louisiana and North Carolina started making film tax incentives. These states created these programs in hopes to start a new industry in their state to create new jobs and in turn boost their state’s economy.

Georgia’s first tax incentive program was introduced in 2002. The state’s second and most progressive tax incentive, the Georgia Entertainment Industry Investment Act began in May 2005 and was later updated in May 2008. Their program has a 30% tax credit for films. The amount of tax credits Georgia has included in their programs has grown from $10.3 in their original Act to $504 million currently.

Another state that had a program early on was Louisiana. They enacted the Louisiana Motion Picture Tax Incentive Act in July of 2002. Their program included the the Investor Tax Credit of 30% for films with no cap and the Labor Tax Credit of 5% credit for payroll expenditures on Louisiana residents. From these aspects, this stimulated filming in the state and employment of their own residents.

As these states continued to tweak their programs, California wanted to tweak their original program as well. Hollywood wanted to pass a new incentive plan that included more money for films but it was difficult to show tax payers that the initial plan was worth the money in the first place and now it is even more difficult because the amount they wanted to include increased a lot. In order to evaluate the economic effects of a film tax credit program it is important to separate the new spending resulting from it and the spending that would have happened regardless of the credit program existed. In efforts to separate these and give tax credits to the projects that they actually need to target, their new incentive plan was tailored further. This plan further specified which project would get the tax credits in order for it to be more reasonable and effective in reaching its goal. The goal of the new program, the California Film & Television Tax Credit Program 2.0, is to keep the productions that are currently filming in California there and for new productions to choose to film in California. Another hope is for these financial incentives to make California competitive enough amongst other states and countries to show executives the benefits of filming in the L.A. region because of the access to experienced crews and the element of being close to their L.A. homes since the business is run out of Hollywood.

The program is a $330 million-per-year incentive plan which started in 2015 after being passed ultimately in August 2014.

Some new features of the plan varying from the original:

-The length of the program is now a longer period of 5 years

-It expanded eligibility to films with larger budgets (over $75 million), TV pilots and 1 hour TV series

-It has a new ranking system for selection based on jobs and other criteria instead of the original lottery which could select any project randomly (this is a focus on job creation)

-Projects being filmed 30 miles outside of the Hollywood area would get a 5% boost to keep them in-state (this is targeted towards visual effects and sound studios in the Bay Area)

-It caps the amount of a movie’s budget that can earn tax credits at $100 million

From this program, the hope is also for these financial incentives to make California competitive enough amongst other states and countries to draw executives to see the benefits in filming in the L.A. region because of the access to experienced crews and the element of being close to their L.A. homes since the business is run out of Hollywood.

According to FilmLA, since the 2.0 program was enacted overall filming in L.A. went up by 11.4% in the first quarter of 2016 in comparison to the first quarter of 2015 when the new program began. They reported that L.A. had a total of 9,703 shooting days since it was enacted and the total shooting days in all of 2015 was 8,707 days. The peak was in 1996 with 14,000 shooting days (this can be a goal to hopefully get back to). The local unions in Los Angeles have reported that they have reached capacity employment as well according to FilmLA.

But, California’s program has very tough competition currently. Georgia has recently developed its own $2 billion film industry, which has led to the start of being coined as “Y’allywood”, or the Hollywood of the South. Georgia is ranked third in the U.S. for film production now and it is the fifth in the world. This can largely be due to the Georgia Entertainment Industry Investment Act which was most recently modified in 2008. From this Act, Georgia gives a 20% tax credit to any film that spends $500,000 or more there during production and 10% tax credit supply for including the state logo in the film’s credits. So Georgia gives a total of 30% in tax credits. This is just the baseline for those films starting at $500,000, a big difference in comparison to California’s plan. Other factors working for Georgia right now include its international airport, the biodiversity in their land for shooting and many new sound stages that have been built.

But, Georgia’s goal varies from California’s. Georgia hopes to make film a new industry in their state. This plan’s ultimate goal from the tax credits is to eventually attract enough companies and productions that will stay in Georgia long-term, instead of being in California or other competing states.

(California Film & Television Tax Credit Program 2.0. – made to counter-act the outcomes shown in the graphic above)

And it seems to be working so far. Ledger Enquirer newspaper states that, ” The state’s estimated $53 million tax credit for 2013 added over $6 billion to Georgia’s economic activity, with a growth rate of 55 percent. That’s quite a return on investment”. But the growth in Georgia could be seen as too much, because the film industry is growing so fast that there is a shortage of crew members for the productions. Local universities are adjusting their curriculum to prepare more workers for production jobs in the state, according to AJC Newspaper.

It is hard for California’s program to compete with theirs because they do not cap, more money is allocated to the program and it spans a longer period of time.

A drawback of the results so far from California’s 2.0 program is that even though there are more films being shot in California again, it is not the large ones. This is because of the cap. So these films still seek out the states or countries that do not cap their tax credit programs.

The tax credits included in the program are able to create below-the-line jobs (which are jobs such as lighting technicians, drivers, location managers etc.). The program doesn’t consider the expenditures on the talent which is a big part of a film’s budget (lead actors, directors and producers). The CEO of Independent Studio Services, Greg Bilson, stresses the importance of the consideration of “above-the-line” costs in tax incentive programs, “On an average $100 million film, 80 percent of that is above-the-line. That number will change depending on who’s in it, but even if it’s just 50 percent of the film, if the incentive doesn’t apply to half of a $100 million film, the California incentive compared to other incentives out-of-state and out-of-country is effectively half or less”. This is a contributing factor to why California’s program isn’t keeping large films in the state, the program doesn’t account for a huge portion of the budgets for those films. The high prices for permits, processing and fire department reviews in order to film on location in California are also inconvenient for production and can lead production to go elsewhere.

According to the film industry trade publications such as The Hollywood Reporter, Deadline Hollywood and The Wrap, many states are decreasing the amount of tax credits in their programs. In my opinion, as other states drawback their own incentive programs, California should too. This is because California’s purpose of creating their program wasn’t to create a new industry in the state, like these states’ intention. Its purpose was to compete with the other states’ incentive offers, so if they are bringing down the level of the playing field, California should bring down their incentive program to that level.

Also, I believe that one of the ways to make California’s plan the most effective is if they gave producers something they can rely on for the future. With the plan only spanning over five years, the tax credit situation in California isn’t very dependable for a producer. Now, large productions can take a very long time to make and films can be in development for years while they are in the decision making process of where to film. If the program was over a longer term more companies would also want to invest in the film industry in California specifically and not elsewhere. Because digital media and streaming services have also started to take-off, possibly credits to keep them in California being added on-to the program could be a good idea for preventative measures so they do not leave in the future.

After the results and assessment of the 2.0 I do not think that the same program will be re-approved. I think that a new, scaled-down program involving less money will be made or the 2.0 will gain additions such as tax credits for digital and a longer time period. But, it is difficult to tell now what moves will be made with the effectiveness of the 2.0 being uncertain.

Works Cited

“Are Film Tax Credits Cost Effective?” The Los Angeles Times. N.p., n.d. Web.

By Julia Wick in Arts & Entertainment on Apr 19, 2016 10:37 Am. “Film Production In L.A. On The Rebound Thanks To Tax Credit.” LAist. N.p., n.d. Web. 11 Oct. 2016.

“California Analysts Office Report.” N.p., n.d. Web.

“California and Runaway Production.” Variety. N.p., n.d. Web.

“Costs and Benefits of Film Taxes.” Business Journals. N.p., n.d. Web. 11 Oct. 2016.

“Georgia’s New Hollywood.” Movie Pilot. N.p., n.d. Web.

“Irresistible Film Tax Credits.” Oz Magazine. N.p., n.d. Web.

Johnson, Ted. “Producers Say High Fees at L.A. County Parks Are Hurting Location Filming.” Variety. N.p., 22 Oct. 2014. Web. 11 Oct. 2016.

Lodderhose, Diana. “Runaways Welcome: Countries Offer Incentives to Lure Productions Fleeing Hollywood.” Variety. N.p., 29 Aug. 2013. Web. 11 Oct. 2016.

Michael Thom. “Fade to Black? Exploring Policy Enactment and Termination Through the Rise and Fall of State Tax Incentives for the Motion Picture Industry.” N.p., n.d. Web.

Michael Thom. “Lights, Camera, but No Action? Tax and Economic Development Lessons From State Motion Picture Incentive Programs.” Sage Journals. N.p., n.d. Web.

Paul Caron. “Starstruck States Squander $10 Billion In Film Tax Incentives Producing Minimal Economic Returns.” Tax Prof. N.p., n.d. Web.

“Runaway Production.” Wikipedia. Wikimedia Foundation, n.d. Web. 11 Oct. 2016.

Strauss, Bob. “California Film Incentives Take Spotlight, but Blockbusters Need Greenlight.” California Film IncentivesTake Spotlight, but Blockbusters Need Greenlight. N.p., 06 Aug. 2016. Web. 11 Oct. 2016.

Center, California, and July 2010. Film Flight: Lost Production and Its Economic Impact on California (n.d.): n. pag. Web.

Hall, Gina. “Why Is California Tripling Film and TV Tax Credits While Other States Slash Them?” TheWrap. N.p., 28 Aug. 2014. Web. 04 Nov. 2016.

Office, Legislative Analyst’s. California’s First Film Tax Credit Program (n.d.): n. pag. Web.

A part of this past weekend’s happenings was the well-awaited release of the iPhone 7 on Friday. Since the iPhone 7 and its new features were revealed on September 7th, the public has been eager to have one of their own. Like the arrivals of previous generations of the iPhone, people have ordered theirs ahead of time to be able to have it the first day it is released and many will wait in long lines outside the Apple store just to make the new gadget theirs. Even some of the color options of the new phone have temporarily sold out. There is a lot of excitement around the iPhone 7 for the sake of having it but hopefully, for economists, the iPhone 7 will affect the economy similarly to how the previous iPhone releases did.

The New York Times revealed that “Michael Feroli, chief U.S. economist for JPMorgan Chase & Co., told the New York Times Sunday that there’s evidence that iPhone sales add between one-quarter and one-third of a point to gross domestic product growth.”. Economists have found that the influx of consumer spending is very reliable in the quarter that the new iPhone generation is released. This is because consumers are spending a lot of money during that time then they would usually spend in a month, and there is high demand, it feels like everyone has an iPhone. Apple is the highest valued tech company and 60% of their revenue is from iPhone sales. The new iPhone also stimulates the sales of electronic stores and the phone carrier companies.

Fortune, CNBC and other sources have reported that the iPhone 7 sales are currently in line with the previous iPhone releases. The iPhone sales during the release weekend have increased from each new release. If the trend continues, the iPhone 7 sales during the release weekend should pass the sales of the iPhone 6s release weekend. If it does, it will impact the economy even more that the iPhone 6s release did.

Fortune previously said that, “Around the start of 2015, it was reported that Apple’s iPhone 6 sales were responsible for 10% of all U.S. economic growth…The claim featured a 1.9 to 2.5% growth rate for the U.S. economy between 2014 and the first quarter of 2015 ”. From information gathered about the past iPhone releases, it will be interesting to see how this iPhone release pans out and could affect the economy similarly or differently. It will take time to tell, especially after seeing the sales of the iPhone 7 during the holidays.

Another notion about the iPhone is that it represents America’s changing economy and decline of manufacturing because it is made by the largest tech company in the U.S. economy but it is manufactured outside the U.S. This video from the New York Times was very helpful for my understanding of this topic-

Although, the new iPhone stimulates consumer spending, the company overall could be affecting the economy in a negative way because of the loss of jobs due to the decline of manufacturing, a factor of the economy.

Sources:

http://www.nytimes.com/interactive/2012/01/20/business/the-iphone-economy.html?_r=0

http://fortune.com/2016/09/19/iphone-7-sales/

http://247wallst.com/consumer-electronics/2016/09/20/iphone-7-sales-rate-matches-iphone-6/

www.nytimes.com/2014/10/26/your-money/when-iphones-ring-the-economy-listens.html

http://www.ibtimes.com/apple-iphone-6-has-measurable-impact-us-economy-1713752

http://www.investopedia.com/articles/investing/022316/economics-iphone-aapl.asp#ixzz4Kocccah2

When thinking about the economy and the spending habits of Americans, the floral industry came to my mind because it is a product that Americans shift from feeling obligated to buy (for holidays, special occasions like weddings or funerals) or buy on a whim, and this interested me. Gifting a bouquet of flowers may just seem like a kind gesture, but the state of the floral industry can be an economic indicator.

Although the floral industry is a growing industry now (its total retail sales in the U.S. in 2015 was $31.3 billion, it’s highest sales yet) it’s growth and movement typically mirrors the economy. From this list of floral sales over the years, it is revealed that when the recession hit, the sales fell by $1.4 billion. Since the recession, the floral industry has been able to recover and grow by $2.4 billion in sales. This is $1.3 billion more than the industry’s previous peak in sales before the recession.

From my research, I have found that the floral industry’s state moves alongside the economy’s state, or in other words, the floral industry is in correlation with the U.S. economy. As U.S. consumer spending increases overall, floral sales increase. The average U.S. consumer spending monthly average in September in 2008 before the stock market crashed and the recession began, was $97. From then on after that number fell down to being in the $60-$70 from 2009-2012. Now in 2016, that consumer spending is back to an average of $90 a month. An interesting finding though is that the floral sales biggest time of growth in 2012 was much more extreme than the growth of consumer spending, and the sales have continued at this rate. The alignment of U.S. consumption and floral sales yearly are further depicted in the charts attached.

When consumers have more money Buying flowers to give to someone as a thoughtful gesture or buying flowers for yourself to enjoy can be thought of as being frivolous, this is because the flowers are bound to die shortly after purchasing and are just to be looked at. to spend, and they already typically purchase flowers, they will buy fancier and more expensive flowers. When the floral industry is doing well the economy is as well. But, you can also tell that Americans have less readily available money when they stop spending on floral gifts for loved ones. If floral sales during one of the big bouquet gifting holidays, such as Valentine’s Day or Mother’s Day, isn’t at a similar rate to previous years, this can show that the economy isn’t doing well. This is because people do not have the money to spend on flowers on days that they traditionally buy flowers on. Or those sales can be down because people are buying less expensive flowers than they typically would when the economy is well. The types of flowers being bought and the amount of flowers being bought by consumers can show the economy’s state of being. This makes sense for the floral industry especially since it is a luxury business; people will not buy luxury goods when they think they need to save money or are not financially comfortable.

An interesting note about the floral industry is that demand for flowers has not changed much over time even when the industry has gone through many changes, besides during times of economic instability. The floral industry shifted when America went from an agricultural society to an industrial society. The farming of flowers in the floral market shifted from being grown in the United States to being grown elsewhere and are now imported. Even more recently, the floral industry for the producer took a toll when the 1991 Andean Trade Preference Act was enacted. This act was to motivate South American countries from being involved in drug trafficking to being a part of legal industries, such as growing flowers. This continued to take away from the dwindling amount of flower farms in the U.S. because it has made it more difficult for them to compete with the prices of the South American-grown flowers; now 70% of retail flowers in the U.S. are grown in Colombia. Even local flower farms and retailers have attempted to start movements for consumers to buy locally grown flowers but it has not picked up and the amount of floral imports for American floral companies and retailers has remained.

Like the stable demand for florals, predictions of the floral industry in the future includes the continued growth of the industry due to the shift from Baby Boomers’s spending habits on florals and luxury good to the Millennial’s spending habits for on these goods. From the Retail Feedback Group survey in September 2015, Baby Boomers are more likely than other generations to purchase flowers once a week or every two weeks whereas Millennials buy flowers less often and spend more. As Millennials continue to grow up they will be spending more on florals for events such as weddings, parties, work events and funerals than any generation has before. These occasions are better business for the flower industry, and they will increase alongside the economy’s continued recovery from the recession, since the amount of these events decreased during that time. If the floral industry’s correlation with the economy continues as it has been and if this prediction is correct, the economy can be predicted to grow as well.

https://safnow.org/floral-industry-members-look-ahead-to-2016-with-some-hesitation/

http://www.pma.com/content/articles/2015/11/floral-consumer-trends

https://smartasset.com/insights/the-economics-of-flowers

http://www.aboutflowers.com/about-the-flower-industry/industry-overview.html

http://superfloralretailing.com/january2010/StateIndustry.html

http://www.bls.gov/oes/current/oes271023.htm

https://safnow.org/new-study-provides-insights-three-generations-flower-buyers/