As time has gone on, technological advancements have made certain industries obsolete. Many have argued that peer-to-peer payment systems like Venmo may be well on their way to doing this to the banking industry as a whole.

Venmo, a mobile payment service owned by PayPal, came to be in 2009 when two friends at the University of Pennsylvania brainstormed the idea of the app. The two men were in New York City for a weekend when one of them realized he had forgotten his wallet. When they were trying to figure out the logistics of paying one another back, the idea of Venmo was born. The original prototype sent money through a text messaging system, but it has evolved into the platform we know now, where transactions are all done through the Venmo app itself.

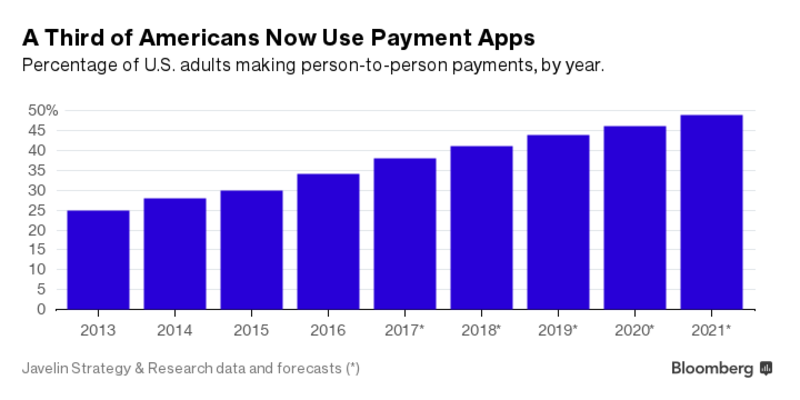

In 2016 alone, $147 billion was transferred using peer-to-peer payment systems, which was up from the $100 billion transferred in 2015. These numbers are forecasted to continue growing to as much as $316 billion by 2020, according to an analyst at Aite Group.

To break those numbers down even further, Venmo users alone transferred $17.6 billion of funds to one another through the app in 2016. This was a 135% increase from 2015. While this seems like a massive amount of money being exchanged, Venmo transactions only accounted for 17% of the total peer-to-peer transfers in 2016. In comparison, $28 billion was exchanged on QuickPay, which is JPMorgan Chase’s comparable peer-to-peer payment system. So, while millennials may think that Venmo is the only mobile payment system in existence, some of the big banks in the U.S. are actually still the biggest players in the game on these technologies.

To break those numbers down even further, Venmo users alone transferred $17.6 billion of funds to one another through the app in 2016. This was a 135% increase from 2015. While this seems like a massive amount of money being exchanged, Venmo transactions only accounted for 17% of the total peer-to-peer transfers in 2016. In comparison, $28 billion was exchanged on QuickPay, which is JPMorgan Chase’s comparable peer-to-peer payment system. So, while millennials may think that Venmo is the only mobile payment system in existence, some of the big banks in the U.S. are actually still the biggest players in the game on these technologies.

In fact, nineteen of the country’s biggest banks have recently come together to launch Zelle, a new peer-to-peer payment service available through an app. Even though the app has large, recognizable banks backing it like Bank of America, Citigroup, JPMorgan Chase, Wells Fargo and more, Zelle’s Summer 2017 launch did not go as well as anticipated. The following are some of the reviews that can be found on iTunes’s App Store, where the app currently has a 2.6 star (out of 5) rating:

In fact, nineteen of the country’s biggest banks have recently come together to launch Zelle, a new peer-to-peer payment service available through an app. Even though the app has large, recognizable banks backing it like Bank of America, Citigroup, JPMorgan Chase, Wells Fargo and more, Zelle’s Summer 2017 launch did not go as well as anticipated. The following are some of the reviews that can be found on iTunes’s App Store, where the app currently has a 2.6 star (out of 5) rating:

“What a horrendously useless app and payment service!”

“I wish I could give zero stars but it is not offered.”

“If you want your funds to disappear without a trace, count on Zelle.”

“The user experience doesn’t even compare to PayPal or Venmo. There are too many screens/legal hoops to jump through even trying to give someone money.”

Even though Zelle did not have the entrance into the marketplace that it probably hoped for, the app store rating has gone up almost a whole point in the past month. So, maybe the Zelle team is working out some kinks and will eventually have a more seamless user experience.

This lackluster launch of Zelle may say more about the intersection of banking and marketing than the platform itself, however. Senior Vice President of a community bank in Iowa (Clear Lake Bank & Trust), Matt Ritter, believes this is an ongoing issue within the banking industry in introducing new products.

“Banks and their traditional marketing efforts often fail at generating an interest in new technology that is less expensive to offer and transactions that are more efficient to process,” said Ritter.

Even with these challenges upfront compounded with the fact that some people think that Venmo and other payment systems like it may run physical banks off the market, there are some significant ways in which the existence of peer-to-peer payment systems are positive for traditional banks. For example, since Zelle was created by banks, many bankers are optimistic about its invention and actually hope to adopt the system themselves.

President and CEO of Clear Lake Bank & Trust, Mark Hewitt, thinks the innovation of peer-to-peer systems like Venmo are both helping and hurting the banking industry at the same time.

“The proliferation of Venmo has underscored the need to provide a peer-to-peer solution for community banks like ours. While adding a product like this to our mix was relatively easy, successfully marketing it is much more difficult, especially to users already comfortable with Venmo,” said Hewitt.

As far as Zelle is concerned, he believes that the system is a good way for traditional banks to attempt to compete with these technologies like Venmo.

“Zelle is firmly on our radar, and is likely a product that we will utilize to replace our current peer-to-peer solution. It’s the product of a mega bank consortium, but is also being made available to community banks via our core software providers,” said Hewitt.

Ritter agrees with Hewitt on this point, adding “Zelle is the banking industry’s best response to date to ensure it is not left out of the payments industry altogether. It will allow banks to compete with Fintech solutions like Venmo.”

Because Zelle is directly connected to users’ bank accounts and is run by the banks themselves, Zelle’s creators are hoping that users will feel more confident using it for larger transactions than they might using Venmo. There is even opportunity to move into more business-to-consumer payment options with Zelle, like insurance companies paying their client’s claims via the app.

Another way the entry of Venmo into the market has been a positive force for traditional banks is that it has motivated them to become competitive in this more technologically advanced space. Banks have been forced to adopt the rapid spread of technology and innovate alongside some of the biggest players in the game to best cater to their customers. The spread of Venmo has also spurred banks to take the peer-to-peer idea beyond just millennials. Of course, millennials are the biggest group currently using Venmo, but banks are hoping to take the momentum that Venmo has created and appeal more to a mainstream audience, directed beyond millennial use.

“We’re hoping that by eventually partnering with Zelle we will be able to target not just our young customer base, but also make it the norm for some of our older customers with smartphones to get on board with,” said Hewitt. “It just makes sense for us to market this easier transactional system to all customers since so many are already so comfortable with the peer-to-peer concept.”

One of the largest complaints from Venmo users that Zelle is hoping to solve is the couple days of delay it takes for money to actually get to users’ bank accounts after participating in a transaction on the app. Zelle allows for more instant transactions because the accounts are directly linked to each user’s bank account, rather than being the third-party platform in the exchange.

Banks are hoping to use this to their advantage and get the message across to users that Zelle may be the fastest option.

“It’s hard for us to break into this space since apps like Venmo have such a head start,” said Hewitt. “Many people don’t realize that many banks already are offering our own peer-to-peer products that have a faster settling rate than Venmo.”

Another thing Venmo is lacking that traditional banks are hoping to perfect is the trust issues that often come with having one’s bank account information on a third-party app. Banks can take that hesitation people have of sharing personal information and make them feel more comfortable doing it on an app that was created or is sponsored by their bank, with whom they have already developed a trusting relationship.

Even though peer-to-peer systems have given banks the push they may have needed to appeal more to today’s customers, there are still things that Venmo is providing that banks worry they won’t be able to keep up with.

The most obvious threat to the banking industry that Venmo presents is the loss of fees and revenue streams that come from regular bank transactions like deposits and transfers.

“Fintech companies engaged in the payments industry are largely unregulated and not required to abide by the same rules as banks, placing banks in a competitive disadvantage,” said Ritter. “Because regulations in the banking industry can often flow down to the consumer, the inconvenience this causes can push consumers into non-banking solutions, like Venmo.”

Because so many people use Venmo for the pure convenience of the transactions, banks are having a hard time reminding customers that they have similar systems already in place that may be even more legitimate when it comes to regulations.

Even so, Venmo was the first to make it possible for a person with a Bank of America account to easily make a transaction with a Chase bank customer. Before Venmo, payments of this type were not convenient or easy. Zelle is attempting to fill this gap for customers transferring between the large banks currently using the app, but for customers at a smaller community bank like Clear Lake Bank and Trust, for example, Zelle may still not be implemented for months or possibly years.

Additionally, bankers are worried about the potential growth of Venmo, as there have been talks of the platform developing its own credit card service. Speculators also think the payment platform may move into more traditional banking roles like giving loans and more. Of course, this has banks worried and wondering how they can compete with such a growing platform and user base.

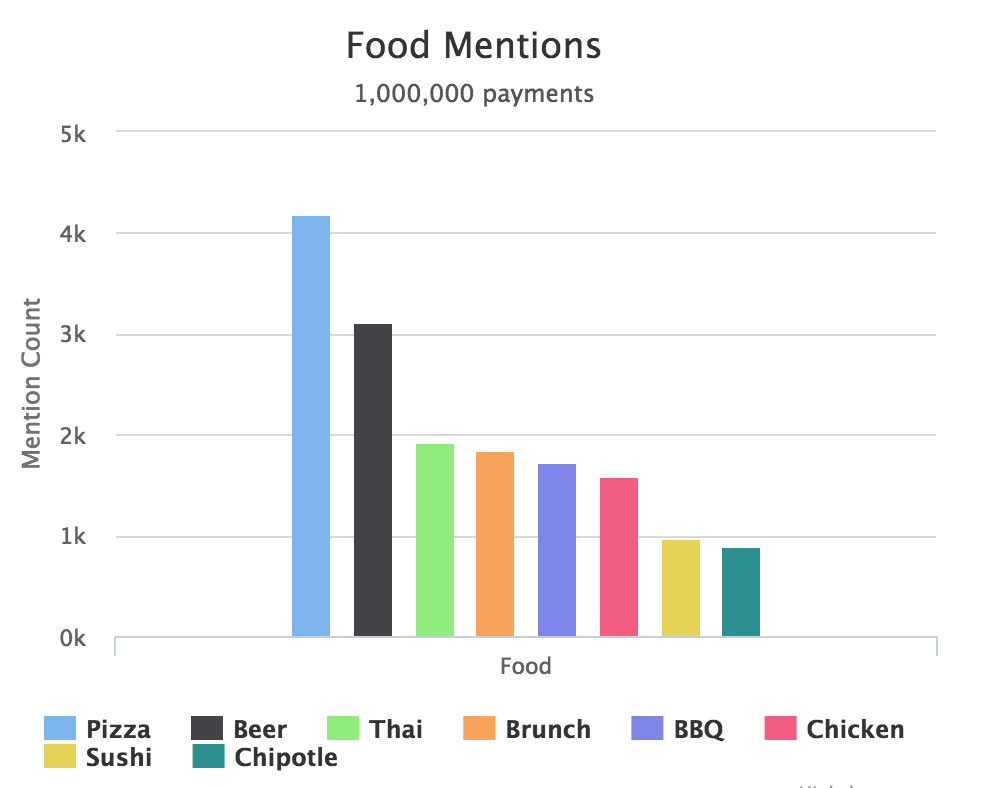

Another feature Venmo has that a traditional banking experience does not provide is the social aspect. Venmo users are doing more than just transferring money to one another on the app. They are using it as a social site with the ability to like and comment on their friends’ transactions. By requiring a description of what the money transfer is concerning, users are able to have fun with it and connect with their frien ds, often using emojis as descriptions. In fact, pizza is the number one most used emoji in the description box, followed by the beer emoji. Additionally, users can connect their profile to their Facebook account, and are then able to see their Facebook friends’ payments to one another coming through, like a news feed. While there are various privacy settings that can be activated and the dollar amount of each transactions is kept private to those outside the transaction, the platform is still used socially and as a way to keep up with friends.

ds, often using emojis as descriptions. In fact, pizza is the number one most used emoji in the description box, followed by the beer emoji. Additionally, users can connect their profile to their Facebook account, and are then able to see their Facebook friends’ payments to one another coming through, like a news feed. While there are various privacy settings that can be activated and the dollar amount of each transactions is kept private to those outside the transaction, the platform is still used socially and as a way to keep up with friends.

“It’s important to remember here that we, as banks, are more interested in the actual deposit, while Venmo is more interested in the customer’s information,” said Hewitt. “That’s where most of the discrepancies lie.”

While the main goal of Venmo may be different than the goal of traditional banks, there is no doubt that each party uses the other to its advantage in the end.

“It is interesting to note that most peer-to-peer solutions still rely on consumer bank accounts, debit cards and credit cards to fund purchases or accounts from which payments are made,” said Ritter. “So, without banks, there really would be no Venmo.”

So, is the existence of Venmo helping or hurting the banking industry, or are the two mutually reliant on one another? It is hard to tell now, but it is clear that peer-to-peer systems are sweeping the nation and are becoming the norm as a payment option. It will be interesting to see how much these systems have advanced in ten or twenty years. Who knows, maybe they will put an end to physical banking structures altogether, or maybe Zelle will catch on and overtake Venmo. We’ll have to stay tuned to find out.