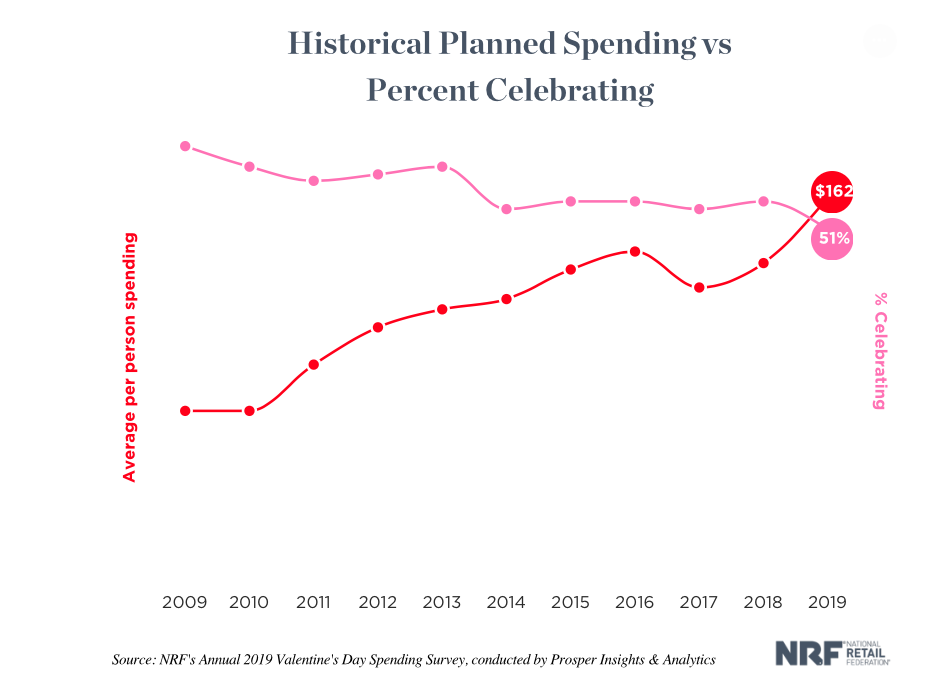

There is no doubt about it: February is a rough month to be single. With retailers everywhere fueling Valentine’s Day, one can’t help but feel at least a little left out. But who is Valentine’s Day really for? In theory, it is to celebrate your loved ones, especially your significant other. In practice, however, many feel that Valentine’s Day is more for consumerism and retailers more than anyone else. With companies and retailers making massive profits every February, Valentine’s Day has been dubbed a Hallmark Holiday, curated to make people feel like they need to spend money to prove their love. In fact, one 1994 study surveyed 105 men “found that though they primarily associated a feeling of love or friendship with Valentine’s Day, a sense of obligation was a close second.” (theatlantic.com). With the percent of people planning on participating in Valentine’s Day hitting an all time low in 2019 (only 51% of people), it is clear that individuals aren’t buying gifts because they want to, but because they feel like they have to.

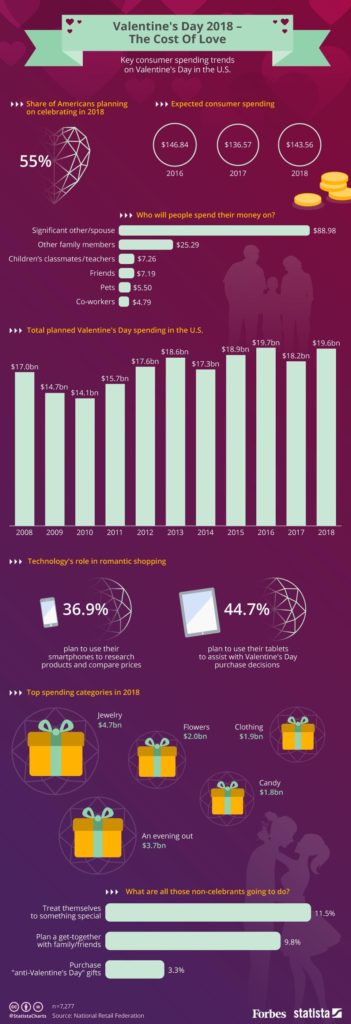

But just how much are people spending out of obligation? As it turns out, quite a lot. In 2019, “celebrants were spending a record amount of $161.96 per person. That beat the 2016 record of $146.84. It’s also 13 percent more than the $143.56 spent in 2018.” (National Retail Federation). On average, men spend as much twice as much as women for the big day, which can be explained by the antiquated social expectation for men to demonstrate their ability to provide for women financially (thebalance.com). And while you may feel victorious when you buy your spouse the purse she’s been eyeing for months, no one wins more than retailers during the season of love. In 2019, shoppers funnelled a record high of $20.7 billion dollars into the economy, according to the National Retail Federation. The industries profiting most from love (and obligation) are “jewelry at $3.9 billion, clothing/lingerie at $2.1 billion, flowers at $1.9 billion, candy at $1.8 billion, gift cards at $1.3 billion and greeting cards at $933 million” (FoxBusiness.com). Tiffany & Co. , for example, saw “better-than-expected results with overall worldwide net sales rising 15 percent” during the first quarter of last year, which Valentine’s Day falls under (The Financial).

Consumer spending statistics tell us that spending for Valentine’s Day is on the rise, despite the fact that the number of people participating in the holiday seems to be falling. How can we explain this phenomenon? While I cannot pretend to have all of the answers, one possible explanation is increased consumer confidence due to an expanding economy. The U.S. economy has been steadily growing over the past few years and this leads people to feel secure in their financials. When people feel richer, they are more likely to splurge a little extra for special events like Valentine’s Day. So while five years ago, you may have bought your boyfriend the speaker system that costs $400, you are feeling financially strong this Valentine’s Day season and decide to buy him the $700 set instead. He’s a lucky guy…this year.

Regardless of whether you are buying out of devotion or out of societal pressure to live up to your role as ‘good significant other,’ the fact stays the same: you are buying. And as long as consumers continue to keep the holiday alive with gifts and special outings, retailers and Valentine’s Day will live happily ever after, oh so blissfully married by fervent capitalism and heart-shaped boxes.