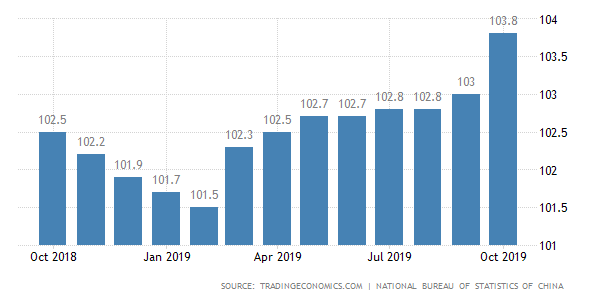

In October, China’s consumer-price index rose 3.8% compared to last year, the National Bureau of Statistics said Saturday — higher than a median of 3.5% predicted by economists polled by The Wall Street Journal, and far outpacing September’s 3.0%.

The Consumer Price Index or CPI measures changes in the prices paid by consumers for a basket of goods and services. It is widely used as an economic indicator. And It is the most widely used measure of inflation and the effectiveness of the government’s economic policy.

According to data released by NBS, “food/tabacco/wine” has the greatest increase, 11.4%, among all other categories. And among all food categories, pork price has the most significant jump: it rises 101.3%, accounting for 2.43 percentage points in the increase of the CPI.

A doubling of pork prices sent Chinese consumer inflation to its highest level in nearly eight years, constraining Beijing’s ability to stimulate the economy as growth continues to slow.

Soaring pork prices lifted overall food-price inflation to a more-than-11 year high, as consumer demand drove up prices for pork alternatives including eggs and other meat products. And the reason behind the price spike was African swine fever, a highly contagious virus that is lethal to pigs but not to humans.

During this summer, I worked as a reporter at “The Paper,” one of China’s most influential digital news outlets. And one of the investigative stories I worked on was about the outbreak of the African swine fever in Chinese rural villages in Jiangsu Province. Dozens of villagers reported large-scale death of pigs due to the disease. The videos they shot showed countless dead pigs abandoned by both sides of the road or in the ditch. They told me that “nearly all the pigs in the village died overnight.”

As a result, they sold the only surviving pigs at a very low price to reduce loss. Some of them sold the dead pigs at an even lower price. This contributed to a declining producer-price index (PPI) — pork-related products could buy the raw pork at a better price. However, the disease caused a sudden decline of pork available to the public and the demand for pork suddenly grow exponentially. Therefore, the CPI increased in response.

Another interesting trend I have noticed during my investigation was that the Chinese government has been trying really hard to cover the fact that the African swine fever has taken over. My story received a prior restraint and did not get published successfully dut to government censorship. During the first months of the outbreak, there was fairly less coverage of the disease in the mainstream media. On one hand, the government officials have announced in public that the fever has been eliminated, and they did not want the public to distrust them. On the other hand, admitting the disease would create a public disturbance that could further push down the pork prices.

However, if the PRC does not address the issue directly and keep avoiding the topic, the situation will continue to worsen and push the CPI to a dangerous level.

While the prices charged by retailers to consumers are in an inflationary spiral, prices China’s factories charge to their clients are in a deflationary spiral. China’s PPI, seen as a key indicator of corporate profitability, dropped 1.6% into the deflationary territory from a year earlier, marking the steepest decline since July 2016. And it’s the result of both demand and supply pressures on the Chinese economy.

On the demand side, the exports weakened because of a slowing global economy and the ongoing trade war with America. Exports from China declined by 0.9% year-on-year to $212.93 billion in October of 2019, following a plunge of 3.2% in September, according to Tradingeconomics.com.

On the supply side, there’s excess factory capacity, due to the building of factories that practically duplicate each other, as discussed in a previous piece here. These factories churn out similar products and engage in a price war.

The increased CPI and decreased PPI may foresee inflation for China, and the Chinese government has to address the issue involved in order to get things back on track for 2020.

Reference:

2019年10月份居民消费价格同比上涨3.8%. http://www.stats.gov.cn/tjsj/zxfb/201911/t20191109_1708139.html.

“China Consumer Price Index (CPI).” China Consumer Price Index (CPI) | 2019 | Data | Chart | Calendar | Forecast, https://tradingeconomics.com/china/consumer-price-index-cpi.

MarketWatch. “China’s Consumer Inflation Hits Nearly 8-Year High.” MarketWatch, 11 Nov. 2019, https://www.marketwatch.com/story/chinas-consumer-inflation-hits-nearly-8-year-high-2019-11-10.

Mourdoukoutas, Panos. “China’s Price Trap.” Forbes, Forbes Magazine, 11 Nov. 2019, https://www.forbes.com/sites/panosmourdoukoutas/2019/11/10/chinas-price-trap/#ecf1c105454d.