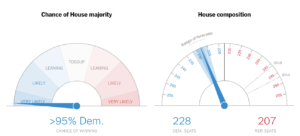

Turns out, mo’ money does mean mo’ problems for many Democratic candidates in the midterm elections– as long as those problems are part of a political agenda. This year, contributions to Democratic campaigns in the midterms have topped $1 billion, while contributions to Republican ones have only reached half of that amount. This high influx of cash has possibly contributed to the Democrats taking the House majority for the first time since 2010, which the New York Times predicts will be at a margin of almost 10%. That would be the highest margin the U.S has seen in years.

Democrats are even getting record funding in deep red districts. Kentucky’s 6th district is notoriously pro-Trump, but this year, things have been shaken up. Retired marine fighter pilot and Democratic candidate Amy McGrath received three times more funding than her opponent Andy Barr. Although incumbent Barr still took the win, McGrath walked away with 47.8% of the vote. To put that in context, Barr’s opponent in 2014 only received 40%.

Donations have also crossed state lines. In the Texas senatorial race, Ted Cruz received $24 million from voters, while his opponent and Democrat Beto O’Rourke received $70 million. The Center for Public Integrity reported that a chunk of O’Rourke’s donations came from notoriously blue states like California and New York. Cruz still beat O’Rourke this year with 50.9% of the vote, but in 2012, he won with 6% more breathing room.

However, my home state of Illinois may best exemplify the effect of campaign donations on election results. Growing up in Chicago, I knew exactly who the Pritzker family was– they have donated countless buildings, parks, and pavilions to the city. They also own the Hyatt hotels. Now, J.B Pritzker is the next governor. While his opponent Bruce Rauner is worth a measly few hundred million dollars, J.B Pritzker is worth well over $3 billion. Moreover, Pritzker’s campaign spent over $170 million dollars, while Rauner spent around $70 million. To put these numbers in perspective, University of Illinois in Chicago Professor Dick Simpson estimates that a gubernatorial campaign might cost $20 million.

So why have so many people been donating to democratic campaigns this year? Some analysts say the reason is Trump. Donald Trump is nothing short of a polarizing figure, and in an effort to take back political power, Democrats are making sure to donate. In 2018, 64% of American political contributions flowed to democratic candidates; In 2014, that number was 48%.

With Democrats pushing such a strong monetary effort this election year, it begs the question: Will donations be just as high in the 2020 presidential election? If Trump is the driving force that motivates people to dip into their pockets, the blue wave may take over.