On August 12, 2014 a California Court ruled that it was legal for the ex-Microsoft CEO and billionaire Steve Ballmer to purchase the Los Angeles Clippers for two Billion Dollars. This astronomical purchase price reverberated across the entire sports landscape as the figure was unprecedented for an NBA franchise.

The shock was further intensified because of the team being purchased. The Clippers were not a jewel franchise or a perennial powerhouse with a long tradition and sterling reputation. At best, Ballmer was investing in potential, as analysts agreed that the Clippers were woefully mismanaged with untapped revenue streams waiting to be exploited. Still, a two billion dollar purchase price was almost four times the highest recorded sale for an NBA franchise up to that point, when the Milwaukee Bucks sold for 550 million dollars earlier in 2014. Based on those figures, the general consensus was, and still is, that it was an expensive premium to pay for upside.

Ballmer is enjoying his purchase

So, how did the NBA achieve such rapid economic development? Just four years prior, the mere thought of a two billion dollar sale would have been laughable. In 2010, the economy was in the nascent stages of its recovery from the Great Recession. The NBA was not immune from the aftershocks of the economic turbulence, and many teams reportedly were losing money each year. With NBA owners suffering stagnant growth in other business interests, franchise ownership was ceasing to offer the benefits of a vanity asset and only serving as a money pit. The reversal in economic fortunes dimmed the allure of commanding an NBA franchise, and in turn both the perception and value of franchises stumbled.

According to Forbes magazine, audited financial documents show that in the 2009-2010 season, 23 of the 30 NBA franchises were unprofitable with an aggregate loss of 340 million dollars. This represented a slight improvement from the prior year when 24 teams were in the red and total losses were closer to 370 million dollars.

Admittedly, the NBA themselves painted a dire image of the league’s financial stability in order to better position themselves for the 2011 Collective Bargaining Agreement negotiations. However, Forbes was aware of this maneuver by the NBA and still presented their own estimates, which are acknowledged as unbiased and third party. Some of the figures and the accounting measures used are up for debate by Forbes competitors. For instance, 538.com founder Nate Silver has favored operating margin over operating income as the best indicator of an NBA franchise’s economic health.

Even with some debate over the specific valuations, as of 2010 there was a general consensus that the NBA as was struggling to keep pace with the growth of its bigger and more popular, domestically at least, competitor: the NFL.

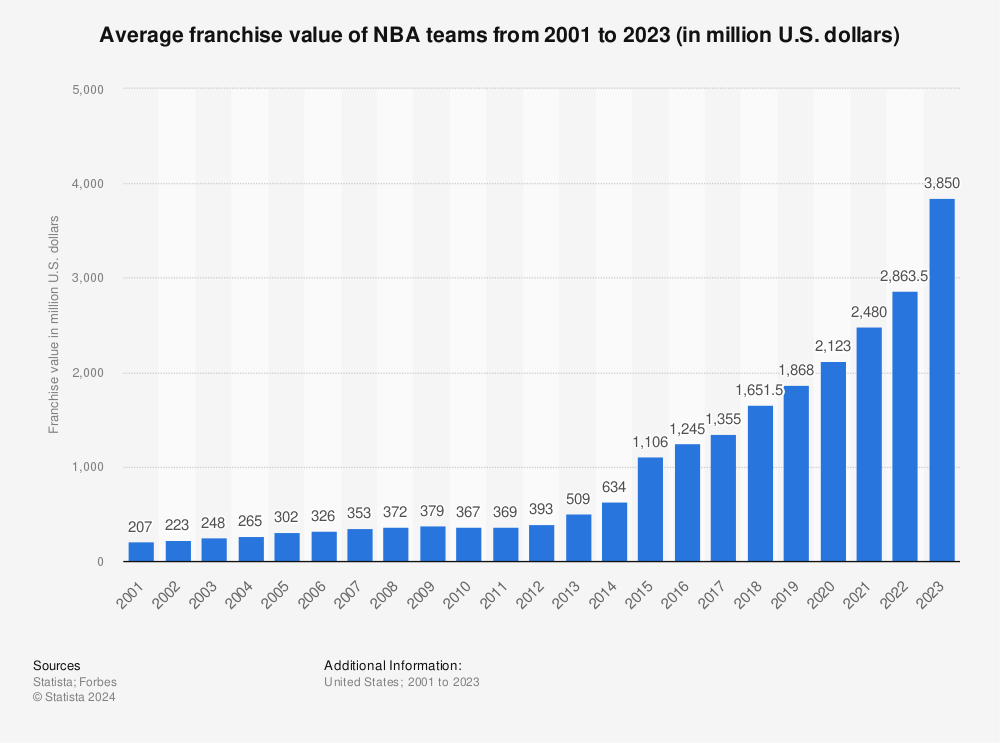

Fast forward to the present day and the NBA is experiencing valuation growth unheard of outside of Silicon Valley. What makes this even more unique is the fact that the NBA is a relatively mature industry, yet valuations have increased six-fold for some franchises. The Clippers who in 2011 were valued at 302 million dollars sold for six and a half times that only three years later. The Knicks in 2016 are now valued at 3 billion dollars, the Lakers at 2.7 billion dollars, and the Bulls at 2.3, close to 500% increases respectively. The average NBA team is now worth over one and quarter billion dollars when only five years ago the teams were at around 340 million.

So what drives this exponential and incomparable growth? It’s an array of factors: an ever changing entertainment landscape, the popularity of individual players, a favorable collective bargaining agreement, and scarcity of options with only 30 teams. All of these factors, and many more, are playing their part in this contemporary NBA economic renaissance.

First, and probably most significant, is the rapidly increasing premium content providers place on live sports entertainment. With recorded television, streaming services, and unconventional multimedia platforms battling for consumers attention, traditional cable and television providers are doing their best to hold onto the crown jewel of live television, sports. The scarcity of content worthy of placing viewers in their seats and holding their attention for ad dollars has driven up the future value of television contracts for sports in general. As a fast paced game that connects with millennials, basketball is in a prime position to cash in on the lucrative TV rights deals. As Ben Thompson of the blog Stratchery points out, sports in general are signing such rich deals because “advertisers have nowhere else to go.”

This phenomenon is playing out at the local and national level. One of the driving factors in Balmer’s decision to purchase a franchise was the looming Clippers’ television deal. After the Lakers signed the largest regional TV rights deal in 2011, valued at four billion dollars over twenty years, Balmer felt he was in a great position to increase the Clippers revenue. As of September 2016, Balmer accomplished that goal by more than doubling his annual television deal with Fox Sports, bringing in over fifty million dollars annually while also including clauses for innovative and interactive services. At the regional level, these deals are taking place all over the country, with teams dramatically increasing their television revenue as content starved networks fork over immense amounts of cash for broadcast rights and in turn ratchet up the cost for advertisers.

At the league level, the NBA is mirroring each team’s strategy but achieving it through economies of scale. Since the league can offer a greater breadth and depth of offerings, and is able to negotiate with national networks, their new TV deal is landmark in scope. The strength of negotiating on behalf of a collective was in full effect as the NBA inked a deal in 2014 that will pay the league close to 2.6 billion annually. The deal, which is slated to start at the beginning of the 2016 season, represented an incredible 180 percent increase from the previous agreement struck with Turner Sports and ESPN in 2007. The NBA was a recipient of good fortune and timing on this deal, as they were the only major sports media deal up for negotiation until 2020. The league wide revenue sharing ensures that this deal contributes to each team’s top line growth in a significant fashion.

While TV rights are certainly driving healthy annualized revenue growth, there are other factors at play that also put the NBA in a unique position for this tremendous evolution. If it was just about live content for TV, Major League Baseball’s absolute advantage in games played would be the primary beneficiary of the paradigm shift within entertainment. Instead, it is lagging behind both the NBA and NFL across a wide array of metrics. What also is contributing to the NBA’s growth is the personality and value of its players. Social media has eliminated the middleman between players and their fans, allowing more athletes to build personal brands and connections with fans. This exposure to a wider demographic helps broaden the NBA’s audience and bring in more fans, and with them more revenue from ticket sales and merchandise.

The reason the brand appeal of these players is so significant is the favorable Collective Bargaining Agreement the NBA owners got after the 2011 lockout. The combination of posturing about losses and an incompetent union head placed owners in a prime position to lower wages and cut major cost drivers. NBA teams were able to lower salaries by an average of 280 million dollars per year across the league, which is a little bit more than 9 million dollars per year for the salary cap until the current CBA ends or is renegotiated. (LA Times)

Although NBA salaries skyrocketed this past summer because of the new TV deal, they could have been even higher had the NBA Players Union stood their ground on their share of the revenue instead of decreasing their cut by more than two percent. (LA Times) Couple this with the fact that many superstars are actually paid below their free market value and owners are getting a bargain across the board. For instance, Kevin Pelton of ESPN estimates through his formula that Lebron James production is actually worth close to 100 million dollars annually to the Cleveland Cavaliers, which is more than three times his salary of 31 million dollars next year.

More money should be flying down for Lebron James according to economists

This type of bargain for a major asset is a steal in any business, and it is obvious why NBA franchises are increasing in value so rapidly. They have incredible cost controls, domain over a scarce resource, and have a competitive edge in developing off the court recognition. This is not to mention the vanity aspect of the purchase as well as the fact that the NBA is leading the major American sports in their outreach to China and other global markets.

In times of economic success, scarcity also comes into play. This is variable depending on the economy as a whole, but it is a trend that shouldn’t be ignored. With only 30 NBA teams, and a bevy of egotistical billionaires, pure fundamentals don’t matter as much as having a rare and unique asset like an NBA franchise. It is hard to quantify the economic impact of an NBA team on an owner’s ego, but there is no question that it should be factored into this unrivaled growth. In terms of pure supply and demand, there is an incredible shortage and imbalance with countless billionaires waiting in the wings for an NBA team to fall into their lap.

NBA owner Mark Cuban enjoying one of the rarest assets of all: an NBA title

Overall, the two major internal changes that have served as the catalyst for this furious growth are the shift in compensation formulas and technological adeptness in marketing and branding players. Combine this with an ever changing media landscape, and that is the fuel for a thriving business and exponential growth. That is what the NBA is experiencing, the only question is how long will it sustain this dramatic increase?

Leave a Reply

You must be logged in to post a comment.