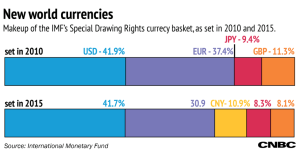

This past week, the International Monetary Fund announced it would introduce the Chinese yuan to their reserve currencies group. The global reserve currency currently consists of the U.S. dollar, the euro, the British pound and the Japanese yen. The elevation of the yuan on a global level will soon make up about 11 percent of the IMF special drawing rights, which is an international reserve asset supplementing the official reserves of the now five main countries of the global reserve currency group.This decision will not go into effect until October 2016, but many financial experts are expecting the internationalization of the yuan to have mixed consequences on other countries and regions of the world like the United States and Europe.

This past week, the International Monetary Fund announced it would introduce the Chinese yuan to their reserve currencies group. The global reserve currency currently consists of the U.S. dollar, the euro, the British pound and the Japanese yen. The elevation of the yuan on a global level will soon make up about 11 percent of the IMF special drawing rights, which is an international reserve asset supplementing the official reserves of the now five main countries of the global reserve currency group.This decision will not go into effect until October 2016, but many financial experts are expecting the internationalization of the yuan to have mixed consequences on other countries and regions of the world like the United States and Europe.

U.S.

Although the yuan will not be an official player in the global reserve currency until next year, investors have already started promoting the positive global impact the change will have on the United States. Former New York City mayor Michael Bloomberg and former Treasury secretaries Henry Paulson and Timothy Geithner are leading a coalition to bring trading of the yuan to Wall Street. According to Wall Street Journal reporter Justin Baer, the group believes the inclusion of the yuan would lower costs for U.S. companies purchasing goods and services from China. They will continue to push for local yuan trading and work with both the Chinese and U.S. governments to develop the best currency trade plan.

Europe

The British pound was the original IMF global reserve currency, until the U.S. dollar surpassed it in the 1920s. CNBC data journalists say since 2010, the pound has held 11 percent of the special drawing rights. However, the eventual addition of the yuan could reduce its holdings to 8 percent. The euro will most likely deal with an even greater loss. When the European union joined in 1999, the euro quickly gained ground accumulating over 37 percent of the special drawing rights by 2010. Now, the yuan could force the currency to reduce its shares for the first time by 6.5 percent. Both of the major currencies in Europe could be facing some stiff competition in the near future as more countries start adding the yuan to their reserve funds. As for the U.S. dollar, it seems like it will continue as the dominant global currency.

The British pound was the original IMF global reserve currency, until the U.S. dollar surpassed it in the 1920s. CNBC data journalists say since 2010, the pound has held 11 percent of the special drawing rights. However, the eventual addition of the yuan could reduce its holdings to 8 percent. The euro will most likely deal with an even greater loss. When the European union joined in 1999, the euro quickly gained ground accumulating over 37 percent of the special drawing rights by 2010. Now, the yuan could force the currency to reduce its shares for the first time by 6.5 percent. Both of the major currencies in Europe could be facing some stiff competition in the near future as more countries start adding the yuan to their reserve funds. As for the U.S. dollar, it seems like it will continue as the dominant global currency.

China

The inclusion of yuan in the reserve currencies group shows how the International Monetary Fund thinks China is ready for the big leagues. On the other hand, it also suggests the IMF wants to push the government of China to make its markets more accessible. Financial reforms in China have slowly increased in the last few years, but now China has the international and economic recognition to potentially move towards a free market economy. In an interview with Bloomberg Business, the head of the People’s Bank of China foreign central banks and global financial companies will not have to go through a pre-approval process to conduct transactions within the country. China is heading in an interesting direction, but time will tell if its new global status will have an impact on its economic policy.

Leave a Reply

You must be logged in to post a comment.