At the beginning of November, Ma Yun, the founder and Executive Chairman of Alibaba Group, and Tim Cook, CEO of Apple Inc, have both teased a possible “marriage” between AliPay and Apple Pay in 2 separate talks at the Wall Street Journal Digital conference. Since then, speculation went that Apple Pay would open the Chinese market by cooperating with AliPay. A few days later, on November 11, Cai Chongxin, CFO of Alibaba Group, announced that negotiation between Apple Pay and AliPay is going on smoothly, and it’s very likely that Apple Pay will be introduced to China soon, with integration with AliPay.[1]

But why does Apple Pay partner with AliPay? What are the benefits of their partnership, and what are the problems they might have to face? This article will first explain what Apple Pay and AliPay are, and how they function. Then it’ll take a look at the current payment system in China, and Apple Pay and AliPay’s positions in it, to give a general idea about what’s every party’s job in the payment system. Finally, the article will dissect the competing forces within the system, in order to analyze what benefits and setbacks the “battle” will bring to Apple Pay and AliPay’s cooperation.

- What Are Apple Pay and AliPay?

When I first heard the news about the possible cooperation between Apple Pay and AliPay, the questions that popped up in my mind immediately were: What are they? What are the differences between them? Shouldn’t they be competing with each other if they function similarly?

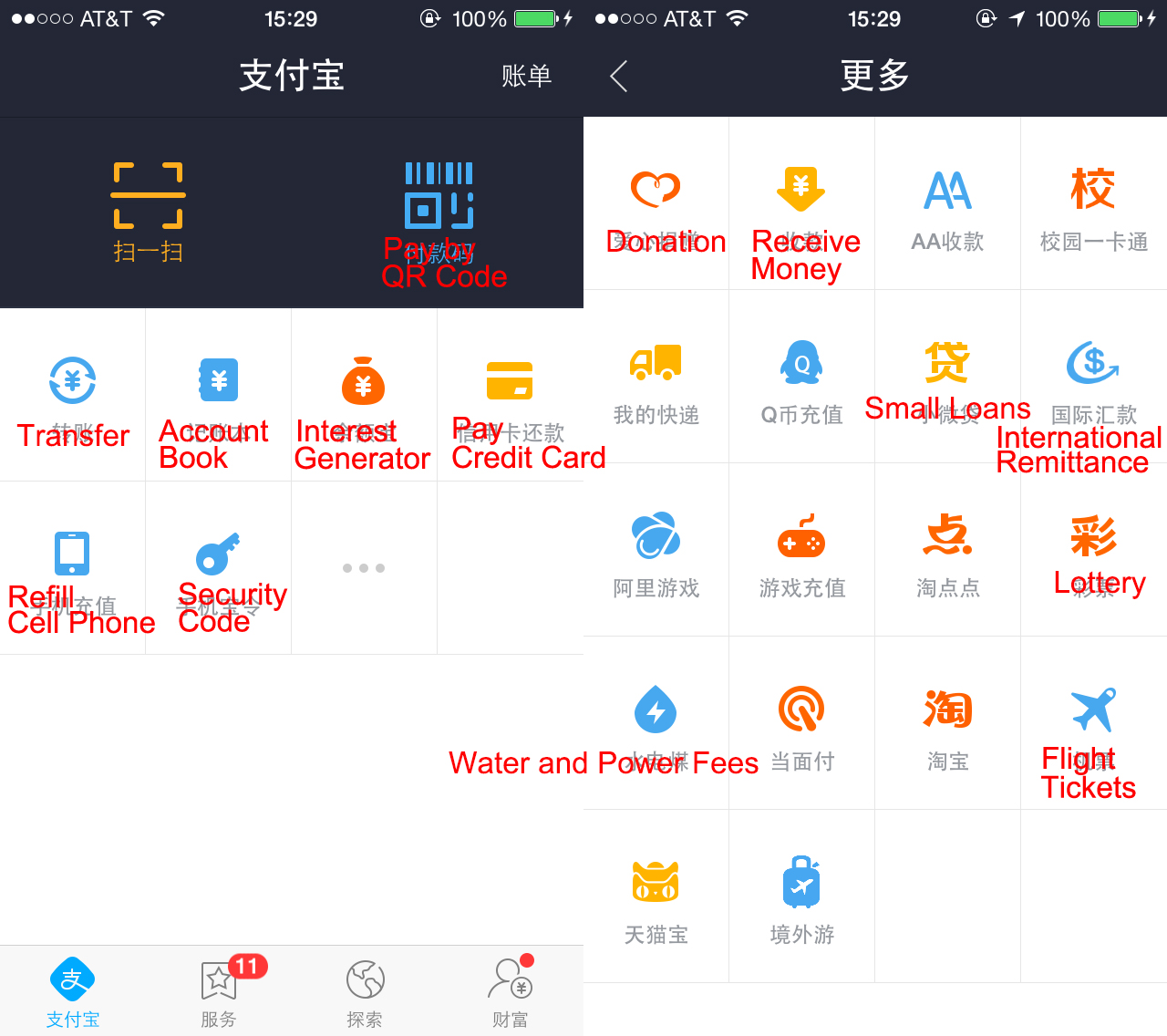

Snapshots of AliPay’s user interface.

AliPay is a third-party online finance platform, which is available in almost all smartphones. Users can link their cards to their personal accounts and make purchases online. However, instead of being merely an online payment platform like PayPal, AliPay offers financing services as well. Users can transfer money, pay their fees, ask for a small loan, process investments, or even make a donation on it. In other word, AliPay is similar to an online banking system – even more than that.

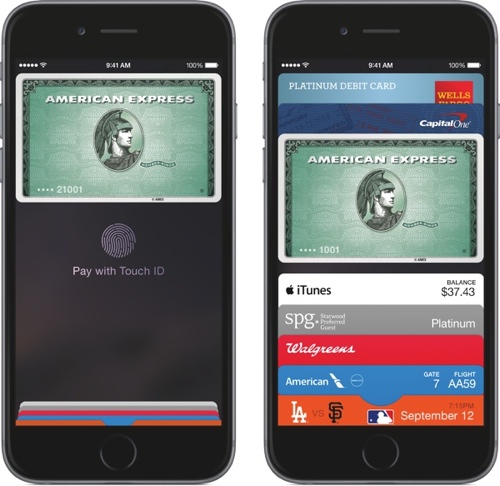

Apple Pay in iPhones.

Resource: http://cdn.macrumors.com/article-new/2014/09/applepaytouchid.jpg

Apple Pay is more like a digital wallet. It provides a mobile payment service which employs Near Field Communication (“NFC”), a set of standards that allow smartphones and similar devices to realize radio communication when touched or brought into proximity, typically 10 cm or less[2]. Users only need to input their card numbers into their iPhone 6/6+ to put the cards into their “wallet.” Before using Apple Pay, they will have to identify themselves by Touch ID, a fingerprint identification system. Then, users just need to get their phones closer to the payment terminals to finish a transaction, and they can finish this step without Internet. Apple Pay now generates 0.15% transaction fees from banks, but the rate is still being negotiated. Apple won’t remember any card information, and it won’t give away any statistics about the transaction to merchants either. In other word, Apple Pay is completely a third party. It only provides the technology to integrate payment methods, and it’s not involved in settlement process between consumers, banks, and merchants. It functions like Outlook: Users can link different email accounts to it, and Microsoft doesn’t care if they’re using gmail or hotmail.

Therefore, if Apple Pay cooperated with AliPay, the way they worked together would be that users could add an AliPay account into Apple Pay, and they’d be able to use the money in their AliPay account via Apple Pay,

- The Chinese Payment Eco-System

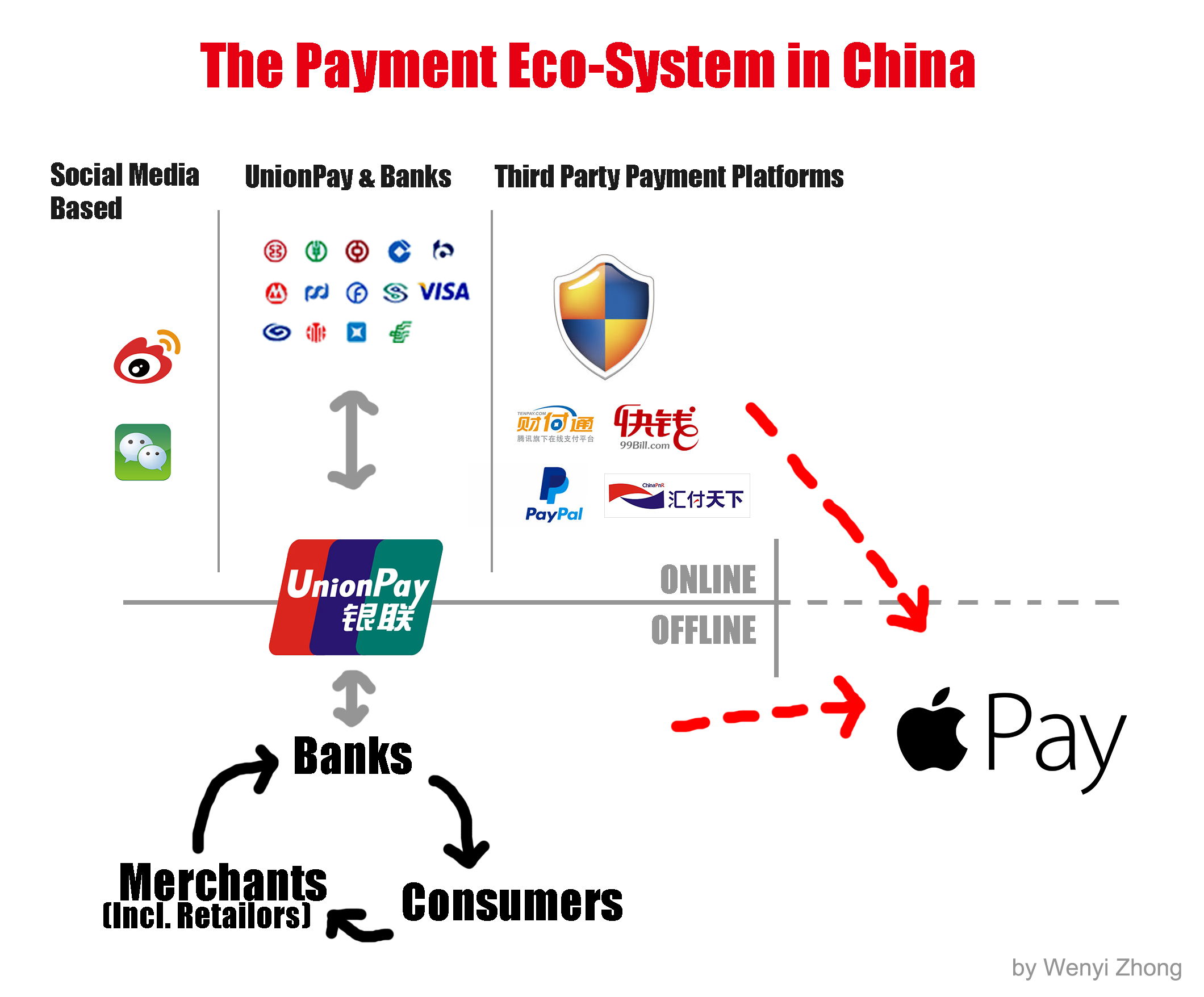

Payment system can be divided into two parts: online and offline. Offline payment system in China is a closed loop consists of consumers, merchants (including retailors, which will be talked about at the end of the article), and banks, and no other party has been able to successfully intervene the process or take another place in it so far.

The structure of the online payment environment is more complicated. In order to understand how it works, it’s important to understand the functions of the government-backed group – UnionPay.

China UnionPay is an industry association founded in Shanghai in 2002, and was sanctioned by People’s Bank of China – the Chinese Federal Reserve. It has brought 18 Card Information Exchange Centers – which used to be non-profit organizations located in 18 different cities all over China – together, and is originally mainly responsible for establishing and operating a national inter-bank information exchange network. For example, people could only make a withdrawal from an ATM machine from Bank of China if they were using a card issued by Bank of China. But now, they can withdraw money from any ATM machine with a UnionPay sign on it, since Bank of China is a member of UnionPay. In other word, UnionPay is a platform closely related to the government, and it holds banks together and thus can represent most of them.

Resource: http://pic.iresearch.cn/zt/201306/0066@67468.gif

Resource: http://pic.iresearch.cn/zt/201306/0066@67468.gif

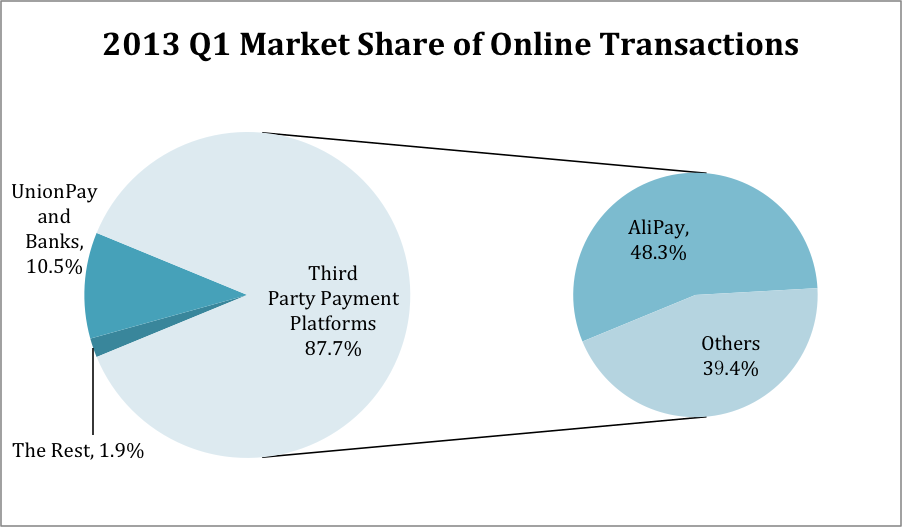

After understanding what UnionPay is, let’s go back and take a look at the online payment system. Online payment service is mainly provided by three types of platforms. The first is online money management platforms, which are led by AliPay. The second is UnionPay, which stands for most banks. Finally, social media based online payment service is now growing by utilizing its huge user base to earn a piece of the pie. However, the most important two are still the third party payment platforms and the bank system. Statistics show that in the first quarter of 2013, more than 87.7% of online transactions were done on the third party payment platform, more than half of which was contributed by AliPay. UnionPay took up 10.5% of the market, and the rest only 1.9%.

AliPay is definitely the bellwether of the whole online payment system. UnionPay is basically monopolizing offline payment, and is trying to gradually take a place in the online payment environment. These two are the most major forces in the current payment system in China. If Apple Pay steps in in the future, it’ll be a third party which not only is able to integrate all payment methods together, but also it’ll help online payment service providers open the door of offline payment system. Obviously, this will bring huge impact to the existing payment eco-system in China.

- The Bright Side of Apple Pay’s to Cooperate with AliPay

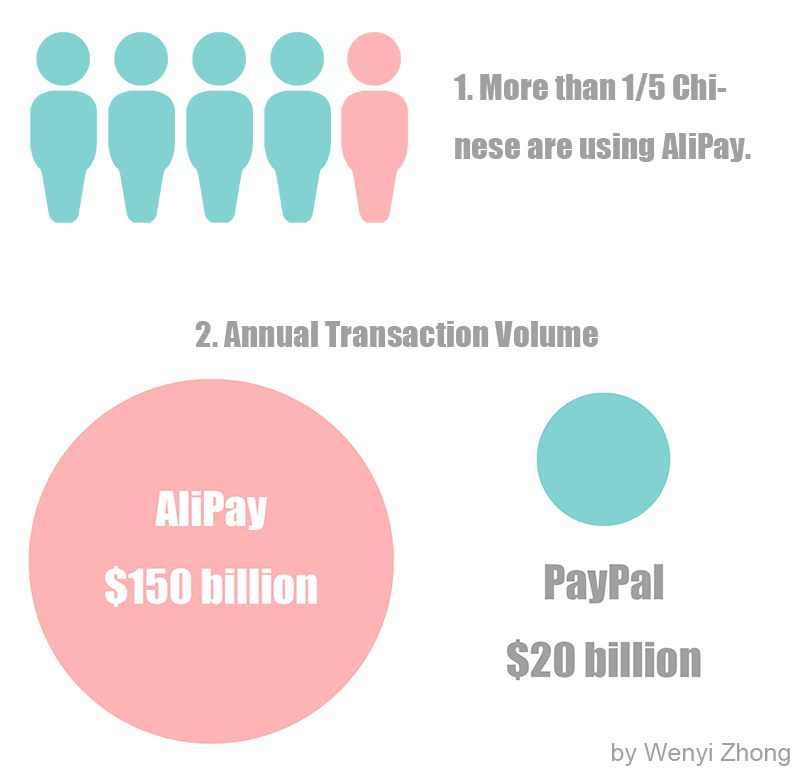

Numbers about AliPay that are good for Apple Pay.

In order to understand why Apple Pay and AliPay intends to work together, let’s first take a look at what benefits their cooperation may bring to both parties. The first benefit for Apple is that if it can successfully partner with AliPay, it’ll be a great opportunity for it to open the Chinese market and make a huge profit. Up to the Chinese New Year in 2014 (at the beginning of February this year), the number of AliPay users had reached nearly 300 million[3]. In 2013, there were more than 2.78 billion transactions happened on AliPay. Its annual transaction volume last year broke 900 billion RMB (around $150 billion), and has become the biggest mobile payment platform in the world. To be more specific, as is shown above, the second biggest mobile payment company – PayPal’s transaction volume in 2013 was about $20 billion[4]. If Apple Pay partners with AliPay, ideally, it may attain more than 1/5 of all Chinese to become its users, and according to its current transaction rate, which is 0.15%, generates millions annual revenue.

Resource: http://www.guopu.cc/hysd/2014/08/29/8b436ecb-54fa-4808-8001-7451678dace1.htm

AliPay users can pay taxi fees by simply launching the AliPay app and using the camera to scan the QR (Quick Response) code, the square matrix barcode in the picture.

Resource: http://www.hb.xinhuanet.com/2014-03/16/c_119787896.htm

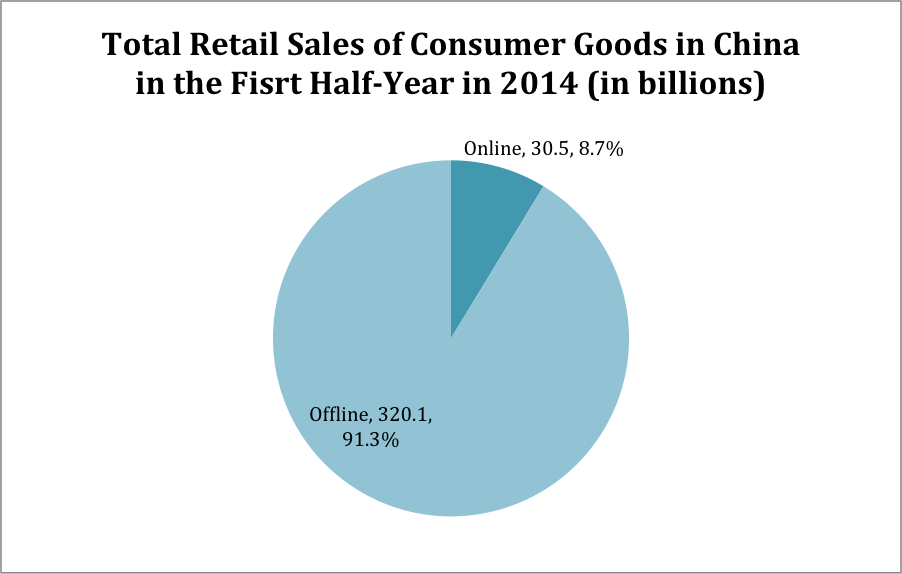

As for AliPay, its biggest win in the cooperation will be that Apple Pay can bring its business to the offline environment. According to the Chinese E-Commerce Research Center, in the first half-year of 2014, total sales online has reached 185.6 billion RMB (about $30.5 billion), but it’s only 8.7% of total retails sales of consumer goods[5]. The offline market is way bigger than the online one, and that’s why AliPay has been trying to penetrate this market, though it’s already the big shot in the online environment. AliPay’s current major attempt to go offline is “pay by QR code,” which means that users can simply pay by scanning a code using the AliPay app in their cell phones. However, this is not helping AliPay to go completely offline. One of the most obvious reasons is that users still need Internet environment to finish the transaction. For example, in the basement in a department store, where the service signal can be terrible, consumers might fail to pay by scanning the code, because their cell phones can’t connect to the Internet to transfer information. But if there’s Apple Pay, and AliPay becomes a “card” in the digital wallet, users will be able to pay offline, because Apple Pay employs NFC, which utilizes radio to complete transaction instead of the Internet. Therefore, cooperating with Apple Pay can definitely push AliPay further in the offline payment system.

- Potential Problems Apple Pay and AliPay might face in the Cooperation

Resource: http://www.dailytech.com/iPhone+6+Helps+Apple+Regain+Market+Share+But+iPhone+6+Sales+are+Weak/article36954.htm

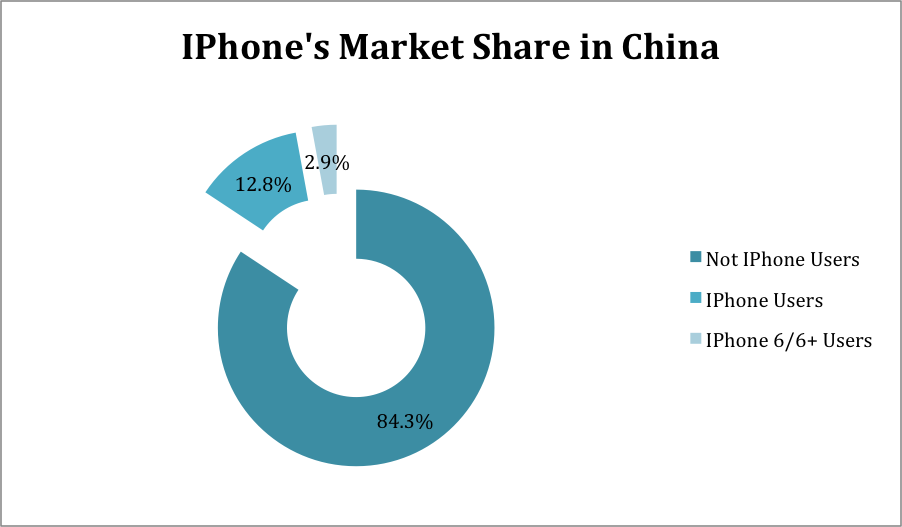

As mentioned, Apple Pay is only available in iPhone 6 and 6 Plus, and this is a critical problem awaiting Apple to solve. According to Kantar Group, a top mobile market research firm, iPhone market share “hit a low in June, 2014 of 12.8%,” but rebounded to 15.7% in October due to the launch of the iPhone 6/6+[6]. That is to say, even if every Chinese has a mobile phone, only less than 3% of them has can have access to Apple Pay. Even if all iPhone6/6+ users have installed AliPay on their phones, Apple Pay would only be able to utilize around 15% of AliPay’s user base. Of course, AliPay’s user base is still meaningful to Apple Pay even so, but low market penetration of iPhone 6/6+, and the fact that Apple Pay is now only available in the latest issued devices, can’t be ignored if Apple Pay really wants to stand firmly in the Chinese market.

How Apple Pay and AliPay will split interest is another problem. As mentioned, Apple Pay now profits mainly by charging banks for a 0.15% transaction fee. AliPay charges transaction fees from its partners to generate profit as well. For example, JD.com is the second biggest B2C e-commerce online platform in China[7]. AliPay used to be one of its possible payment methods, and JD.com paid 0.5% fees out of every transaction that happened on AliPay[8]. According to the two companies’ profit pattern, Apple Pay and AliPay will make money from every transaction that uses their services. However, if a Chinese consumer buys a $50 product, and he chooses to use AliPay via Apple Pay, the two companies will have to decide how much they will take respectively from the deal.

Speaking of splitting interest, UnionPay can’t be ignored, and conflicts do exist in the two companies – Apple Pay and AliPay – and UnionPay’s interest. As is mentioned, UnionPay is originally meant to be an information exchange hub for member banks. However, now it has become not only an integration platform, but also a supervisor of the bank system. According to the fifth clause of China UnionPay’s business scope, UnionPay can “set the regulations and standards for inter-bank transactions, and negotiate and arbitrate disputes in inter-bank business[9].”

Even more than that, UnionPay has been called a “monopoly empire” by some mainstream media in China[10], because it has become an organization that is not only pursuing profit, but is utilizing its relationship with the government to reinforce its hegemony in the offline payment system. For instance, banks usually charge restaurants 1.25% transaction fee when they use POS (point of sale) machine, and banks know it is a restaurant that is using the POS machine by MCC – Merchant Category Code. For example, “5812” represents restaurants, “5511” automobiles, and “5311” department stores. Since restaurants belong to entertainment category, its transaction fee is relatively high, and thus many restaurants don’t accept cards – this goes against UnionPay’s interest. Hence, in order to gain more market and ensure self-profit, UnionPay allocates MCC that belongs to other categories to restaurants. If UnionPay allocates “5311” – MCC for department stores – to restaurants, then the restaurants will need to pay only 0.78% transaction fee, which is 0.47% less than what it should be. In other word, UnionPay is no longer a neutral third party which is helping communication between banks, but it has already become a supervisor, even a tyrant who is making self-profit even at the costs of its citizens.

Third party payment platforms dominate most of the online payment market. Offline payment system has been shrinking[11], but it still accounts for significant share of total retail sales. Thus the current situation for UnionPay is that, it’s hard for it to expand its service online since competitors are too powerful, and so it’s endeavoring to protect its leading status in the offline payment market. Therefore, it’s easy to imagine that if Apple Pay and AliPay’s cooperation is going to introduce AliPay into the offline payment environment, UnionPay might utilize administrative measures to impede the process. Actually, UnionPay has already stopped AliPay’s first attempt to step in the offline payment market once. In 2012, AliPay announced that they were going to march into the cash on delivery (“COD”) market, and had worked with Shanghai Commercial Bank to produce 30 thousand POS machines to help the business. Traditionally, handling fees generated by transactions that go through on a POS machine will be divided into 3 parts: merchants take 70%, issuing banks 20%, and UnionPay 10%. However, AliPay’s working with the bank directly had bypassed UnionPay, and had denied it of the transaction fees it could originally make. So in July 2013, UnionPay’s board enacted a regulation that at the end of the year, all UionPay-cards-related offline transactions had to be transferred to UnionPay, and third party offline payment systems had to be incorporated into UnionPay’s clearing system. It meant AliPay would have to not only split up its profit from 10% transaction fee to UnionPay, but also publicize information about offline transactions to it. At the end, AliPay stopped its COD service. The reasons behind AliPay’s move were complicated, but as Xing Li, a reporter at Monkey Weekly said, “On one hand, it was a signal of anti-trust against UnionPay; on the other hand, AliPay was avoiding conflicts with UnionPay, because the offline payment service it had at that time wasn’t that big after all.[12]” AliPay didn’t want to front UnionPay, because UnionPay was politically powerful, and this is why it’s important for Apple Pay and AliPay to figure out if UnionPay is a friend or an enemy.

CurrentC is an MCX’s alternative to Apple Pay, which is employed by many huge retailors. Consumers need to launch the CurrentC app in their cell phones, and then use the camera to scan a QR code to pay, or the user can open the app and let the cashier scan the QR code that belongs to him/her to charge money. CurrentC doesn’t take transaction fees from retailors, and that’s why it’s considered one of the retailors’ attempts to kill Apple Pay and credit cards by building their own payment system[13].

Resource: http://venturebeat.com/2014/10/31/why-currentc-is-rightly-demanding-exclusivity-from-merchants/

Last but not least, except for competing forces within different payment service providers, a closely related “outsider” should be taken into consideration as well – the retailors. On one hand, retailors have been trying to get rid of transaction fees from consumers’ using credit cards, and thus they surely don’t want to be haunted by Apple Pay. Now, some leading retail merchants in the U.S., such as Wal-Mart, Rite Aid and CVS, adopt CurrentC, a mobile payment solution provided by MCX instead of Apple Pay, for the reason that they want to eliminate the 2% fee comes with purchases by credit card[14]. If Apple Pay wants to enter the Chinese market, it might have to face the same problem, no matter it’s going to cooperate with AliPay or not.

On the other hand, as mentioned, Apple Pay keeps payments anonymous, which means that retailors can lose valuable information about consumers: what they’re buying, returning, and what might interest them next – data-driven retail marketers won’t be able to stand this. We all know that Starbucks is an Apple-friendly brand[15], but still it shows hesitance in fully embracing Apple Pay. iPhone users are now bale to buy credits via the Starbucks mobile app by using Apple Pay, but there’s no exact timeline for when Apple Pay will be available at the cashier. As Joshua Brustein said in Apple Pay Is Too Anonymous for Some Retailers, “…Starbucks mostly see mobile payments as a way to insinuate itself deeper into its customers’ lives through loyalty programs.” It’s obvious that consumption statistics mean a lot to retailors, and so Apple Pay’s anonymity, which is why some people love it, can actually turn into an obstacle that Apple Pay has to overcome if it’s really going to partner with AliPay and enter the Chinese market.

Personally, I’m looking forward to Apple Pay’s partnering with AliPay. However, in order to ensure that the cooperation will work, both of the companies will need to think about potential problems within themselves, and possible conflicts between every party in the payment eco-system in China. But again, as a consumer and frequent AliPay user, I’m looking forward to the day when I can make a purchase offline by simply a touch of my mobile phone and the payment terminal, no matter using a card or my AliPay account, no matter there’s internet or not.

[1] http://wap.25pp.com/view/67286/

[2] http://en.wikipedia.org/wiki/Near_field_communication

[3] http://ab.AliPay.com/i/dashiji.htm

[4] http://www.guancha.cn/economy/2014_02_17_206550.shtml

[5] http://www.guopu.cc/hysd/2014/08/29/8b436ecb-54fa-4808-8001-7451678dace1.htm

[6] http://www.dailytech.com/iPhone+6+Helps+Apple+Regain+Market+Share+But+iPhone+6+Sales+are+Weak/article36954.htm

[7] http://data.eguan.cn/dianzishangwu_172432.html

[8] http://m.zhihujingxuan.com/17325.html

[9] http://cn.unionpay.com/xiamen/col_84284/file_570818.html

[10] http://view.163.com/special/reviews/unionpay0317.html

[11] http://xqimg.imedao.com/149659cfe1df63fe16d2cf95.png

[12] http://business.sohu.com/20130909/n386188299.shtml

[13] http://techcrunch.com/2014/10/25/currentc/

[14] http://www.businessinsider.com/wal-mart-heres-why-we-dont-support-apple-pay-2014-10

[15] https://www.apple.com/pr/library/2007/09/05Apple-and-Starbucks-Announce-Music-Partnership.html

Leave a Reply

You must be logged in to post a comment.