The newest version of WeChat, China’s biggest messaging communication service, brought a bringing a new video capture and sharing feature called Sight. Holding a button to a 6-second video clip and share, sounds familiar?- yes, it’s basically just Vine.

The newest version of WeChat, China’s biggest messaging communication service, brought a bringing a new video capture and sharing feature called Sight. Holding a button to a 6-second video clip and share, sounds familiar?- yes, it’s basically just Vine.

Already impacting the overseas market, Vine’s potential is undeniable. Kids with huge numbers of followers are a great medium to promote a product. Vine, as a simple video-sharing platform, is everything advertisers want.

Sixteen-year-old Lauren Giraldo has 2.8 million followers on her Vine account. Her fans love the six-second videos she posts on Vine, which show what she describes in her profile as “my random life.” The latest clips include her trip to Europe, dancing in a wired cloak, and attending concerts. Whether you like it or not, she has 2.8 million people following these abrupt snippets of her life. The account started as a hobby for her, but she now makes about $2,000 per sponsored vine by simply clicking on the “re-vine” button to share her sponsor’s video.

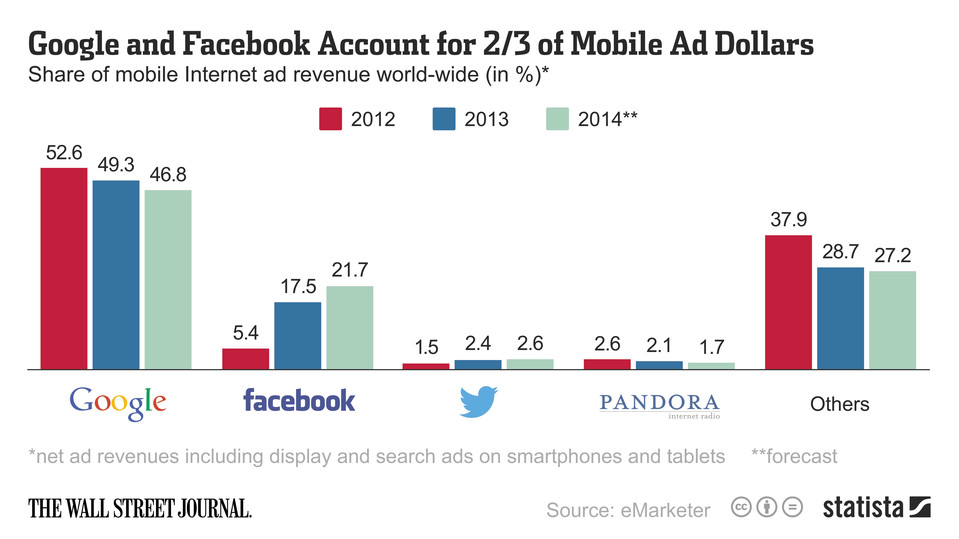

Vine’s parent company is Twitter. Twitter acquired Vine in October 2012 for $30 million in a move widely viewed as a counter to Facebook’s presence in the mobile messaging market. The easiest comparison to Vine is Facebook’s photo-sharing service, Instagram. Instagam stepped into Vine’s territory in December 2012 by launching similar video functionality with a 15-second length.

In terms of functionality, the biggest difference is that Instagram can share videos that are 15 seconds in length as compared to Vine’s six seconds. Instagram also retains many of its photo-sharing options for this new video-sharing functionality, such as filters, importing videos, image stabilization, save to camera roll, and so on. Vine, meanwhile, could not be simpler, with only a “save to camera roll” option.

In terms of functionality, the biggest difference is that Instagram can share videos that are 15 seconds in length as compared to Vine’s six seconds. Instagram also retains many of its photo-sharing options for this new video-sharing functionality, such as filters, importing videos, image stabilization, save to camera roll, and so on. Vine, meanwhile, could not be simpler, with only a “save to camera roll” option.

Instagram users can share posts to Facebook, Twitter, Tumblr, Flickr, email, foursquare, etc., but Vine’s sharing platform is limited to Facebook and Twitter. This could be a reason that brands on Twitter refer to Instagram more than Vine. In a study looking at how often brands posted on Twitter using Instagram or Vine between November 2013 and February 2014, the statistics shows there are 4 times as many brand accounts using Instagram to advertise than Vine.

After Instagram’s short video service debuted last year, the company now offers two forms of content sharing. Vine still offers its signature 6-second videos, which, one could argue, is no longer as big a draw.

However, on June 7, 2013, four days after Android released a new version of Vine on its system. Vine reached the milestone of having more vines shared on Twitter than were Instagram pictures and videos combined. The user base is still growing, and, with its monetization trend, Vine could be Twitter’s best weapon for holding its valuation in the long term.

As simple it is, Vine seems more interested in giving creators a platform to make more interesting and creative moving imagery. In particular, content that is more “idea oriented.” The 6-second length can be viewed as a challenge, but it can also push users to squeeze only the most useful and important information into the video. In comparison, Instagram’s user base is more likely to document the details of their life no matter how seemingly trivial. The most-shared posts typically revolve around coffee, pets, family party, feet, hands, selfies, and other aspects of users’ daily lives.

Despite having fewer features than Instagram’s new service, Vine’s looping and embeddable function makes it easier to embed content to other websites, circumventing the limitations on sharable platforms to some degree.

Six seconds, looping, idea-oriented: these features are what advertisers are looking for. It mimics the powerful technique of sound-bite advertising, which is characterized by repeating a short phrase or sentence that captures the essence of a certain topic.

Vine, to some extent, achieves that effect. Instagram users upload pictures more than videos, and many users don’t watch videos on Instagram because they tend to take up more memory. Vine videos are very small — usually taking up only bytes. Without so many filters, playing in a loop, users might watch the GIF-like video multiple times, something marketers crave.

People often compare Vine to Instagram because they both offer short video sharing platforms. But in essence Vine is more like YouTube, a platform to share creative video content. The comparison is somewhat ridiculous, though, because there’s no way to put Vine’s 40 million active users into the same context as YouTube’s 1 billion active users per month.

Vine is now in its early stages of growth, but based on the speed at which the number of households with computers, tablets, or smartphones that can film videos is growing, Vine could reach YouTube’s scale much faster than YouTube did. With the now-rapid pace of adoption in the digitalization era, Vine was born in a good age.

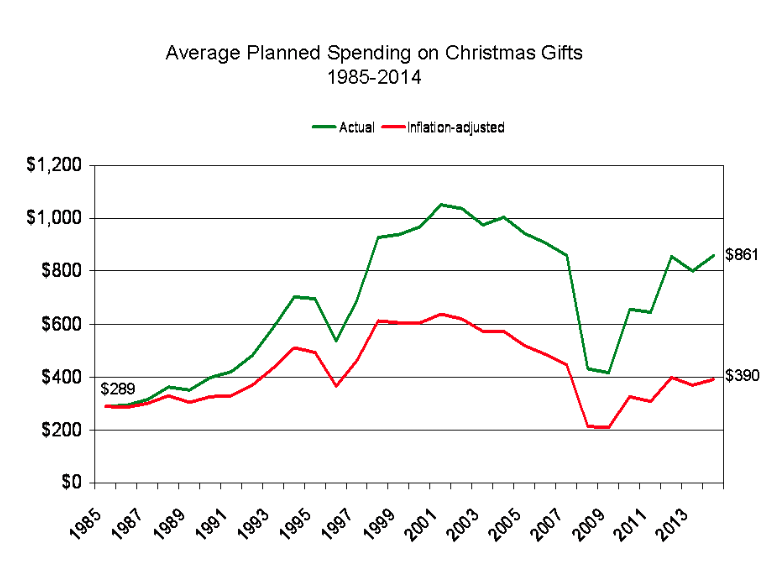

As consumers are shifting from in-store spending habits to online, it is evident that shopping overall is down from previous years. This, in part, could be due to shifting consumer priorities for their dispensable income. In an

As consumers are shifting from in-store spending habits to online, it is evident that shopping overall is down from previous years. This, in part, could be due to shifting consumer priorities for their dispensable income. In an