Until 1800, China accounted for a third of world economy. In the 1880’s, the U.S. overtook China as the largest economy, a position China had for several hundreds of years. It looks like things will be returning back to “normal” in a generation’s time.

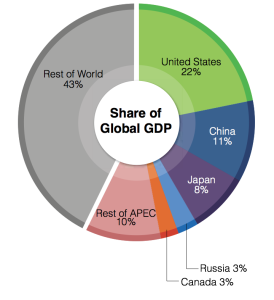

China’s growth record in the past 30 years has been incredibly remarkable, it enjoying a steady growth even during the Financial Crisis in 2008 and comprising 11 percent of global economic output in 2013. Robert Fogel, a Nobel winner in economics, forecasted in 2010 that Chinese total economic output would be $123 trillion in 2040, four times the U.S economy he predicted.

What makes China’s economy look so successful?

The first essential factor would be Chinese government making huge investment in education. Well-educated workers will turn to be highly productive workers. In China, higher education are growing steeply due to enormous state investment. In 1998, only 3.4 million students were enrolled in China’s universities. The fast change was impressive: in 2002, enrollment in higher education increased 165 percent.

Second, Chinese officials may undervalue its economic progress. In service industry, small firms often don’t report their numbers to the government and statisticians always fail to translate improvements of services’ quality into economic progress. A simple example: Chinese hospitals’ registration fee has been remaining at an unaltered ¥10 for more than a decade.

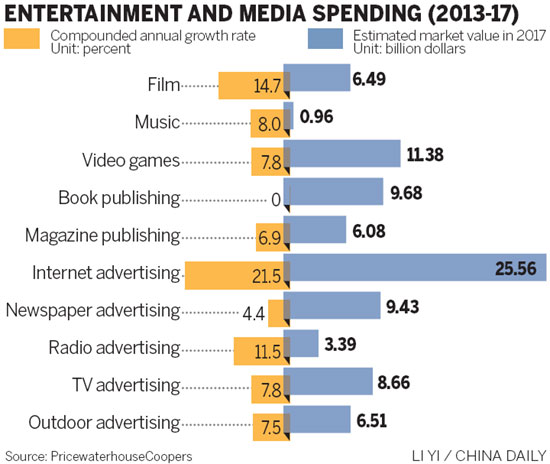

Finally, China is undergoing consumerist tendencies. In Chinese mega cities, there is already a high standard of living. At the same time, a host of policies has been set to encourage Chinese consumers’ appetite.

Everything seems to go well in China. Are there elements hindering its economic development?

“Why will growth slow? Mainly, because that is what rapid growth does.” Episodes of super-rapid growth (>6 percent) are inclined to be extremely short-lived. The median duration of a super-rapid growth episode is nine years. There are only two economies close to China’s current duration — Taiwan and Korea.

During the late 1980’s, it was widely believed that Japanese-style industrial policy, Japanese emphasis on corporate linkages and high levels of investment were keys to rapid growth. At an even broader level, it was widely believed in the early 1960’s that the Soviet Union would quite likely outstrip the United States economically.

But those forecasts were never lucky enough to be realized.

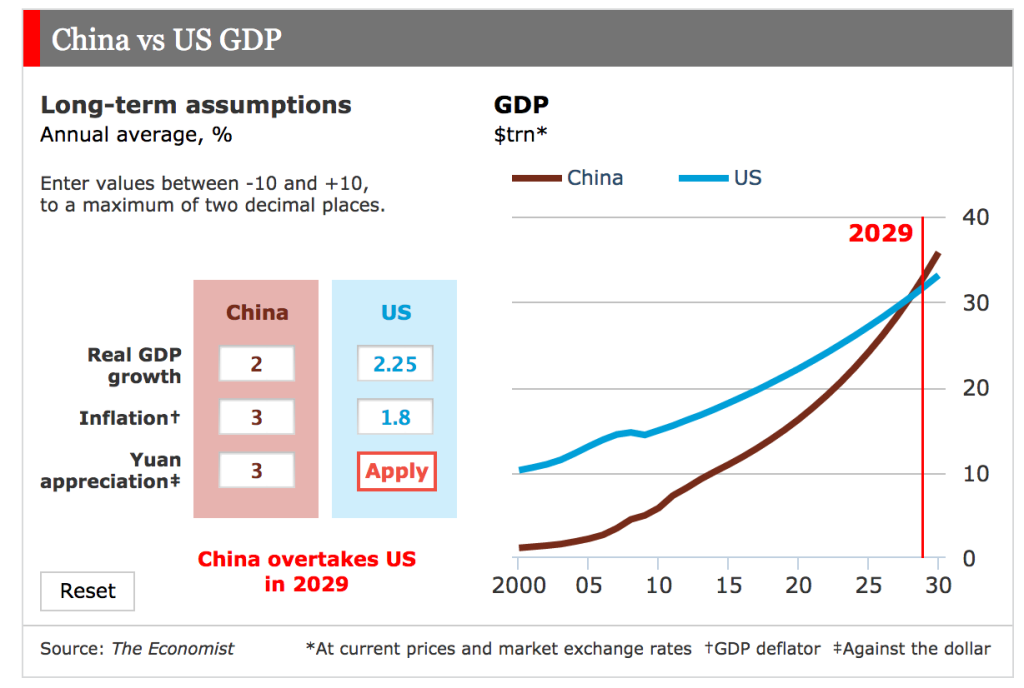

Will China be an exception? According to a prediction by The Economist, even under a moderate GDP growth rate of two percent, China will surpass the United States in 2029. Apparently, it is destined that China will lead the global economy in stead of the U.S. in few decades.

Then what will happen if China’s economy exceeds the size of America’s? Why does China’s return even matter?

A bigger economy will certainly give China global commercial domination. Fluctuations in China’s domestic demand will send ripples around the world. Market surveys will focus on China first. Leadership of international institutions will shift toward China as well. This movement includes the equivalents at that time of the United Nations, the World Bank, the International Monetary Fund, and regional development banks, etc. A more visible shift would be various headquarters moving to Beijing or Shanghai.

Geopolitically, it will necessarily alter the preeminent position that the U.S. has enjoyed since the end of the Cold War, and that Western nations have enjoyed since the 19th century.