A former co-founder of a travel management company, Greg Mayben in 2013 co-founded SkyCorporate – a corporate short-term rental company based in Los Angeles Downtown – with his partner Temil Marmon who was an experienced realtor. And he called this company a product of “marriage” between traditional real estate industry and traditional hospitality services.

Six years before founding SkyCorporate, Marmon owned a 22-unit apartment building and signed 12-month leases to tenants in one business district of New Mexico, where few local people tended to live or extend leases. So he started looking for a change. Almost at the same time, Mayben, had spent 25 years in travel services, started looking for a challenge.

“I mean real estate is very fragmented. That reminds me of travel service was three decades ago,” Mayben said. “I saw it’s getting ready for change. I don’t really want to be a part of the old-school business model, which is typically brokerage, whether it’s commercial or residential.”

Unlike many shared housing or short-term vacation rentals that AirBnB (an online platform where people rent out vacant rooms) heavily emphasizes, SkyCorporate only engages individual units and provides economic short-term rentals for business travelers who look for longer temporary stays in certain neighborhoods.

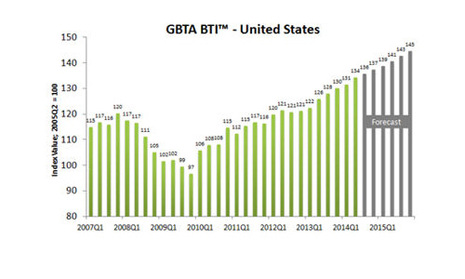

According to the newest forecast by Global Business Travel Association (GBTA), the individual business travel volume is expected to grow 2.3 percent in 2014, while the spending is expected to increase 7 percent year-over-year; group travel volume is expected to decline 3.3 percent, while spending is expected to 5.9 percent year-over-year.

The continuous strong demand in business travel represents the growth of the economy, but meanwhile, revealed a potential force behind the growth of cheaper short-term rental market. Compared to most hotels that usually charge from $4,500 to $6,000 for a month, SkyCorporate only charges $3,500 to $6,000 for one- or two-bedroom unit, with full service, fully furnished and private space. Also, it usually accepts up to two tenants to move into its property. The term of booking is around 92 days on average.

“We need a 92-days continuous window of availability for clients being able to come and book,” Mayben said. “We only take vacation rentals as a filler.” That being said that if the travelers have booked 90 stays but left 15 days till next booking, the company will fill in with vacation travelers who only want to stay a few days.

This constant booking is seen more profitable than traditional real estate. The vacant homes provided for companies like SkyCorporate are generally owned by aged residents, who have invested most of their retirement accounts in this housing market. SkyCorporate refers itself as corporate housing company as well as a “tenant with benefits.” The owners are responsible for purchasing furniture which usually cost $10,000 for one-bedroom unit and $15,000 for two-bedroom unit. On the other hand, SkyCorporate rents these homes, markets them, manages them and promises to take only 12 percent out of monthly revenue.

This ideal model seems very tempting but not really acceptable for most home owners, even though SkyCorporate promises that they can make more money than they can.

“Here you have these small property owners who just don’t understand and is fearful and says ‘No’; and here you have the other property owners who fully understand and want to participate, but don’t want take any risks,” Mayben said. “They just want a share of the income.”

Emphasizing the location and requiring understanding from home owners, SkyCorporate found it very difficult to find a proper owner to cooperate. Also since people still have low confidence in this new business, many owners still have hard time to provide flexible prices when contracting with rental companies. Tim Sokoloff, who adopts the methodology that’s similar to SkyCorporate, said the revenues of this short-term rental service are negative at least during the first couple of months.

Sokoloff started “LA Travel” in June 2014 providing tour and rental services. He listed two studios and one apartment on AirBnB. These properties belong to his friends and relatives in Los Angeles, but can hardly make money. In the past three months, Sokoloff has accepted 300 travelers and charges about $35 to $55 per night. The prices are below the average compared to other AirBnB hosts in that area, and Sokoloff needs to pay monthly rent of $1,500 to the owner. To make profit, he has to have at least 20 days booked per month or to work harder on providing more tour services.

“The first month I lost $1,300, the second month I lost $800, and $400 last month,” Sokoloff said. “I can’t afford to buy a new jeans. My shirt is second-handed. This is the world for every entrepreneur!”

Tim Sokoloff’s plan and timeline. He plans on getting $10,000 from banks to purchase a four-unit building. Adding profits made out of tour services, Sokoloff believes, within two years, “LA Travel” will generate $170,000 revenue.

Tim Sokoloff’s dream of future “LA Travel” which, according to himself, is following the hotel business model in Las Vegas.

Same thing happened to Collete Bardos in the first year when she started renting two apartments through AirBnB. These apartments are in the same building, among which only one makes money to cover all the rents and utility fees. Except the one where she’s living, the revenue of the other leasing apartment has gone to non-profit organizations that Bardos works for. According to her, if that one apartment makes at least 24 booking per month, she can make $1,600 after paying the total rents. Then, after paying $150 for parking and $210 for utility fees, she can earn $1,240 a month, which is $14,880 a year.

“The first year we didn’t really make a lot of money, because we bought furniture, bedding and everything,” she said, standing in the living room that was decorated like a vintage store. “From this may, I made a lot of changes: we moved, paid more deposits, but also made more money.”

One apartment with a theme “Paris and Romance.” Bardos said she only rent apartments to women who travel alone or couples.

Unfortunately, losing money is not the only risk Bardos bears, but she’s also afraid of being kicked out by the landlords, because they have written rule that bans illegal sublets.

“This is not going to last forever. Eventually, they (current landlords) are gonna kick me out. It’s only a matter of time,” she said. “I’m thinking about doing short-term rentals like Bed and Breakfast in Hollywood, but still using AirBnB. Or I’m going to buy a house in Spain, move to Spain and do AirBnB there.”

Considering the instability of using private properties to run short-term rental business, people like Bardos and Sokoloff hope to buy houses to make consistent profits safely as their business grow. Nonetheless, they both said they would keep using AirBnB as a major platform and had relied on it to solve current problems, such as transient taxes.

For small companies like SkyCorporate, AirBnB is simply a place to market their brands.

According to Mayben, this January, SkyCorporate abandoned its previous methodology and took a nine-unit building, as they had obtained million-dollar investment from individuals. The amount of investment ranges from $5 million to $17 million, and most of the investment come from Asia.

“The dynamic is that the investors have said to us, ‘rather than us go out, buy properties, and come to you; why don’t you tell us what you need and where you need it, so that we can either buy it or build it’,” Mayben said. “They have the check book and we are setting the requirement.”

The potential revenue in short-term rental is not the only factor that draws the investors into this market. According to Realty Times, tax write-offs for short-term rentals (less than 15 days out of the year) can add to the financial benefits.

The housing market in Los Angeles is recovering, and it even shows an increase in housing prices. Short-term rental market is new. But having all the benefits, it is changing people’s mindsets and shaping the real estate market. Also thanks to online platforms like AirBnB, it certainly has caught a lot of attentions. But still, it is waiting for an effective legislation and regulation over investment, management, maintenance and marketing.

Leave a Reply

You must be logged in to post a comment.