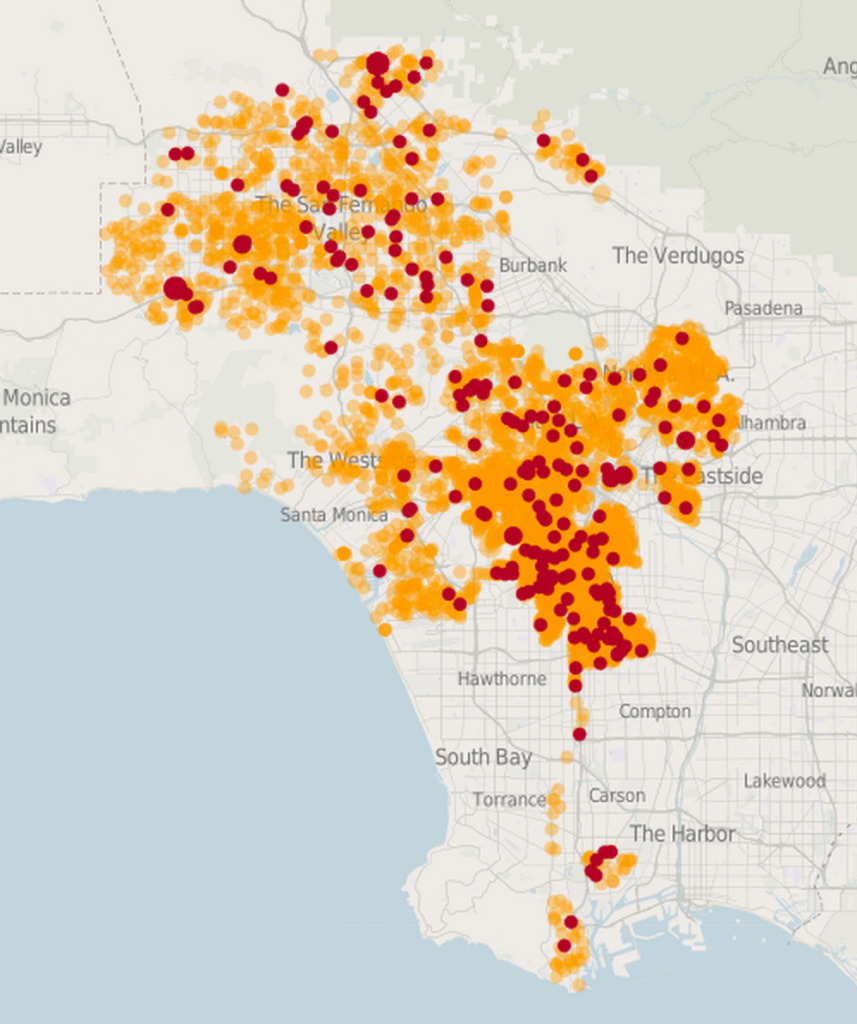

All foreclosures on the city’s registry as of summer 2014. | LA Times map with Housing and Community Investment Department data

The little teal house in Watts with the front garage and a concrete driveway was foreclosed early in 2013. Over the next year and a half, squatters invaded and wrecked the place. The trash heaped up into tall piles in the living room and hallways.

“It’s a drug house, the weeds are overgrown, it’s blight,” said activist Joanne Kim from the nonprofit Community Coalition, describing this location and the symptoms of others like it, left abandoned for more than a year.

Eventually activists banded to get together to draw the city’s attention and kick out the intruders.

Still, the house remains on L.A.’s foreclosure registry.

“Everyone has to take of their homes,” said Kim. “But the banks are not taking care of these properties.”

That can lead to a number of harmful side effects, like depleted property values, which in turn discourage business and investment.

A study by the Federal Reserve of Atlanta found that foreclosed properties likely sell at a discount because they’re in worse condition than surrounding properties. At the same time, nearby properties in good condition experience price drops as well. The study found “social costs” are especially harmful in neighborhoods with abandoned properties.

“These costs would seem to be especially acute for vacant properties, which are more likely to attract criminal activity (resulting in higher municipal costs) and be in worse physical condition (depressing property values),” said the report, written by economist W. Scott Frame.

L.A.’s foreclosure registry lists 5,599 properties that were registered in 2014. Some estimate that many other homes foreclosed in 2014 haven’t yet made it onto the list. Because the registry only got started this year, any previous data collected by the Housing and Community Investment Department has not yet been published. Anecdotally, there have been reports of foreclosed homes sitting vacant as far back as 2009.

The California Reinvestment Coalition has estimated that homes in foreclosure drop 22 percent in value. Homes within an eighth of a mile of foreclosed properties can subsequently drop 0.9 percent in value.

On a state level, the CRC report estimates that California homeowners are feeling their property values go down by $424 billion.

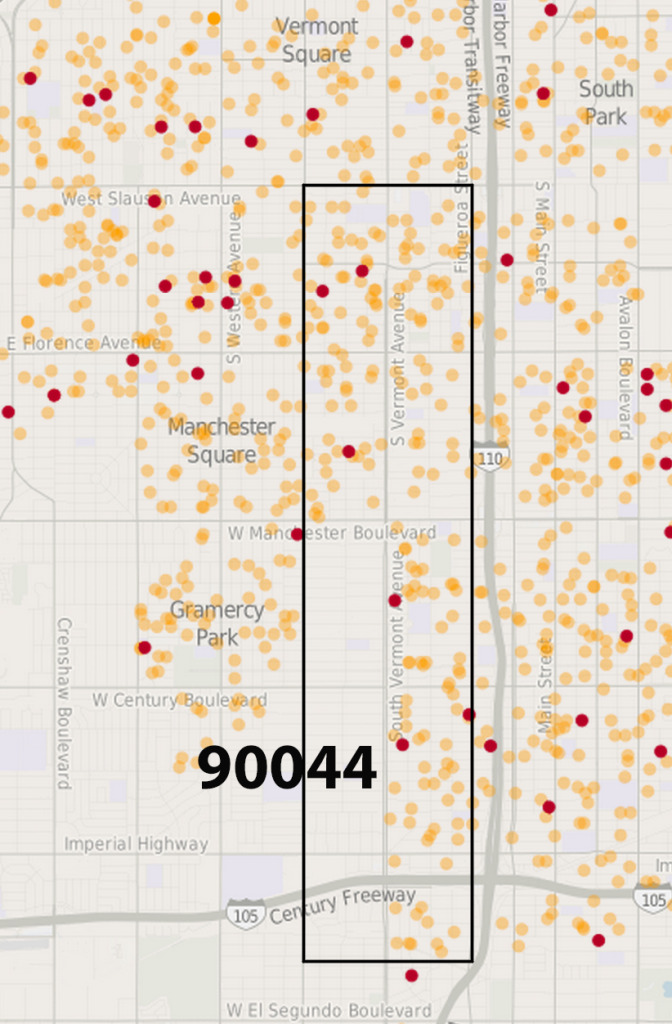

The registry lists more than 200 foreclosed on the property register for 2014. | LA Times map with Housing and Community Investment Department data

Areas like South Los Angeles with many low-income homeowners have suffered the most, and continue to have some of the greatest concentrations of foreclosures in the city.

Even as foreclosure rates have decreased considerably even over the past two years, the rates are higher in South L.A. than neighborhoods north of the 10 Freeway, according to John Perfitt, director of Restore Neighborhoods L.A.

Take the 90044 zip code, for example, with 206 foreclosed properties listed on the city’s registry.

According to the website RealtyTrac, 0.2 percent of the area’s homes consists of foreclosed homes. This number is twice as high as California’s — 0.1 percent.

By Zillow’s measurement, the area has 6.9 foreclosed homes out of every 10,000, while Los Angeles has 2.2 foreclosed homes out of every 10,000.

The neighborhood’s “Market Health Index,” a Zillow measurement that takes into account a neighborhood’s amount of foreclosures and the number of days listings spend on Zillow, is just 4.3 out of 10, while the city’s as a whole is 8.2.

In Los Angeles, the median home price is $525,200, according to Zillow, at the rate of $371 per square foot. In the 90044 area of South L.A., the median home price is $291,400, at the rate of $243 per square foot.

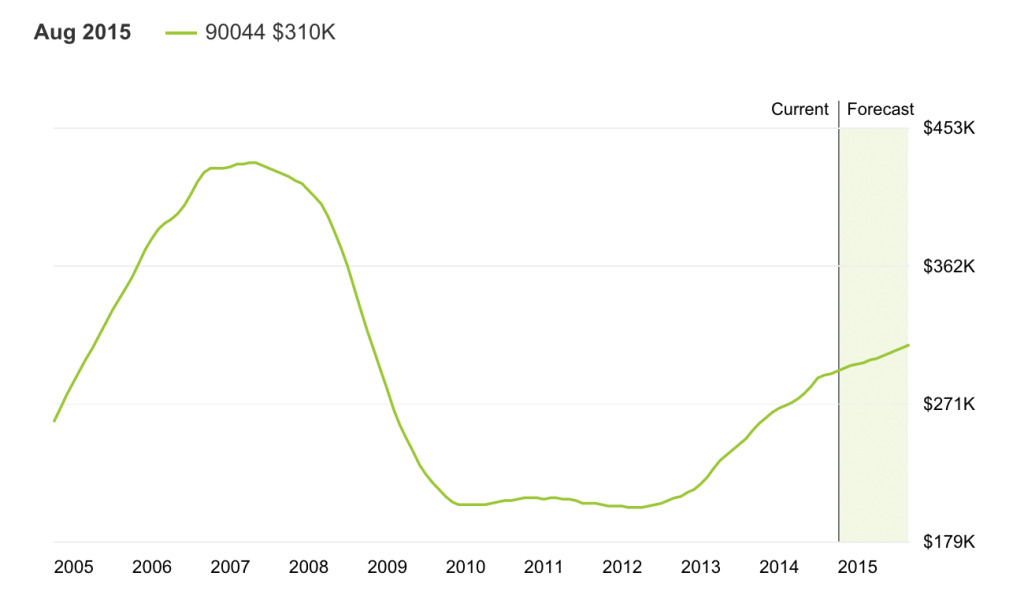

That figure represents growth. After dropping to a several year-long plateau of low property values after the recession, the numbers appear to be going up.

Home values in the 90044 zip code from 2005 projected into 2015, according to Zillow.

But there is still the problem of abandoned homes stuck on the market. The longer a house is vacant, according to policy researcher Johanna Lacoe, the greater the chances are for problems such as crime and low property values to accumulate. The time that it takes for the property to switch hands can take a year, or longer.

“If the homeowner leaves during the foreclosure process, that property can sit vacant for a long time before the bank actually has the legal right to go in there and do anything,” said Lacoe, who studied the correlation between foreclosures and crime at USC’s Lusk Center for Real Estate.

In her research, Lacoe discovered that even the appearance of crime can drag down property values.

“It’s a lot about perception — perception about a neighborhood being dangerous, or not,” she said.

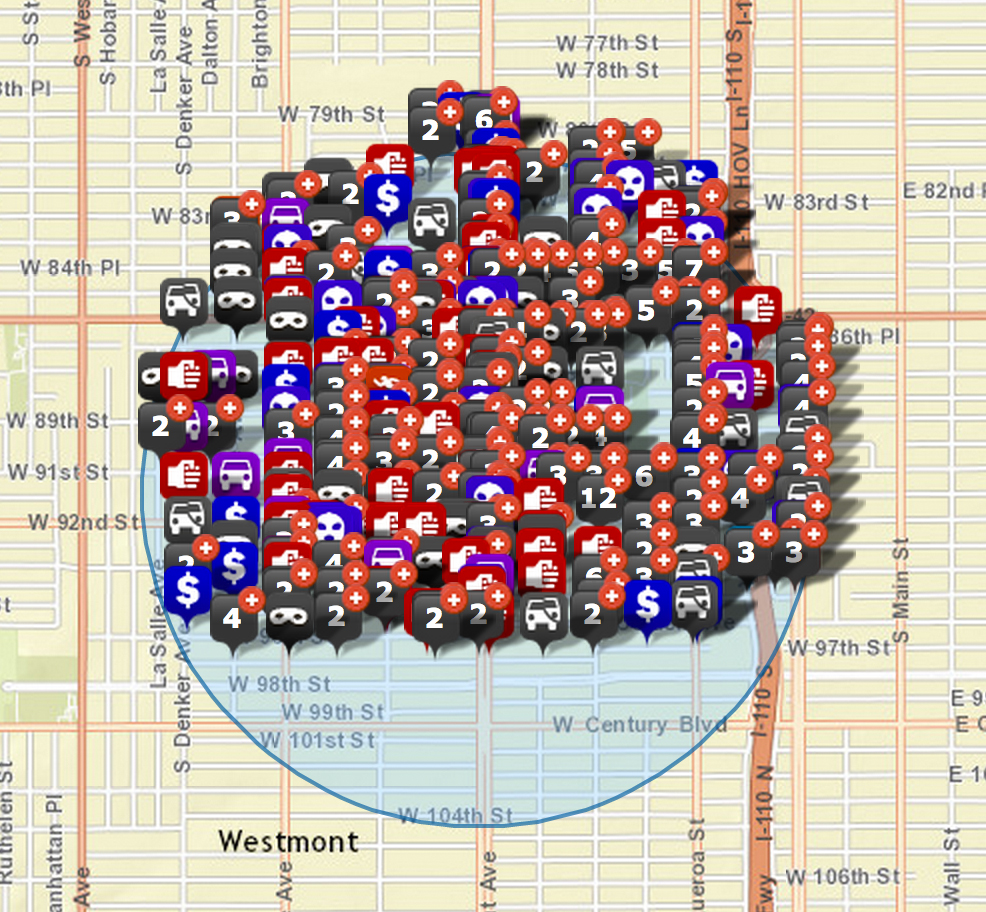

Even beyond appearances, research that Lacoe conducted in New York and Chicago has shown a clear connection between foreclosures and crime. Lacoe found that vacant buildings were both targets for crime (such as vandalism and theft) as well as havens for crime (such as drug sales and prostitution). She also found that crime increases on streets with more foreclosures than other streets.

According to Perfitt from Restore Neighborhoods L.A., it doesn’t take much to spur harmful effects.

“One bad apple in between a few properties, or a few of them on the same side of the street, can have some negative impact on property values and can be the source of problems,” said Perfitt.

Perfitt is trying to help reverse that. Restore Neighborhoods L.A. buys up foreclosed properties too “blighted” to restore, demolishes them, and puts up new homes or pocket parks in their place.

His organization has largely relied on federal grants from the Neighborhood Stabilization Program – created on the belief that “foreclosures in general and vacancies in particular can generate significant social costs in the form of increased municipal expenses and reductions in the value of nearby properties,” according to the report from the Federal Reserve of Atlanta.

The goal is to spur investment in areas that wouldn’t get much of it without help.

“We’re trying to be the vehicle that lenders can feel comfortable that we know the marketplace,” said Perfitt. “We’re helping to mitigate the risk that investors or lenders have about going into these areas.”

Leave a Reply

You must be logged in to post a comment.