The north polar view of the world is not a common perspective, most of us may know it from the white on blue flag of the United Nations. However this view of the world may become increasingly common as the effects of climate change on the Arctic Ocean have opened new opportunities for Arctic trade routes. The opening of these trade routes is of particular interest to certain actors and nations and has the potential to change the face of global trade.

The Polar Paths for Shipping (The Globe and Mail)

A dream of the seventeenth century explorer, Henry Hudson, the fabled Northwest Passage over Canada was first navigated in 1906 by the Norwegian Roald Engelbregt Gravning Amundsen, who was also the first explorer to reach the South Pole. The other Arctic Sea route is the Northeast Passage over Russia’s northern coast, more commonly called the Northern Sea Route it is a Russian-legislated shipping lane

Scientists predict ice-free summers by the end of the decade and navigable winters by the mid 21st century. Regardless of how one may feel about environmental politics, the question of the polar caps melting is not one of “if” but “when.”

The Russian Federation has already started developing infrastructure to service the Northern Sea Route. Between 2009-2013 maritime traffic has improved from a handful to several hundred. So far Norway and Russia have been the primary navigators but in the past few years Chinese shipping giant COSCO has turned its eyes northward. Huigen Yang, Director General of the Polar Research Institute of China announced in 2013 that as much as fifteen percent of China’s maritime trade may travel the route by 2020.

A visual comparison of the Northern Sea Route (Blue) to the Suez Route (Red). The Northern Sea Route is 40%, or 12-15 days shorter than the traditional Suez route. (via wikimedia)

The Arctic region is governed by a combination of international agreements such as the UN Convention on the Law of the Seas (UNCLOS) and multilateral governance institution such as the International Maritime Organization (IMO, a UN Agency) and The Arctic Council (AC). The Arctic Council is made up of the eight nations that intersect the Arctic Circle: The United States, Canada, Russia, Norway, Finland, Iceland, Sweden, and Denmark by virtue of Greenland. In the past few years the AC has passed agreements on search and rescue and the IMO is finalizing a shipping ‘polar code‘ that is expected to be in place by 2016.

Most data estimates suggest that roughly 90% of mercantile trade is shipped. For China the potential of arctic routes could represent savings of hundreds of billions of dollars “Once the new passage is opened, it will change the market pattern of the global shipping industry because it will shorten the maritime distance significantly among the Chinese, European and North American markets,” said Qi Shaobin, a professor at Dalian Maritime University according to China Daily. Not to mention China’s traditional route to European ports passes through pirate infested waters that the Arctic Route would avoid.

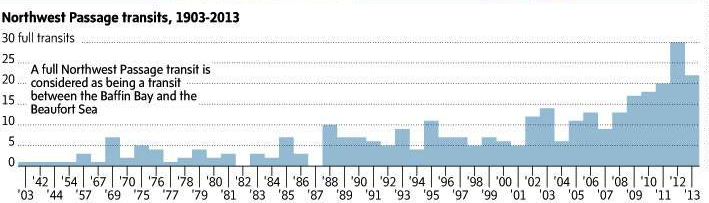

Infrastructure is still the key obstacle to the expansion of trans-Arctic trade. So far Russia has been the only player to make significant commitments to development by reopening research stations and arctic ports. Canada has done little aside from accepting a legal framework on paper. Notwithstanding there has been an increase in maritime activity through Canada’s Arctic waters:

At a meeting in Stockholm with USC students in the summer of 2012 Gustaf Lind, the Swedish ambassador to the Arctic Council, accepted the possibility of Arctic Ocean Trade routes but noted “I don’t think we will see much shipping for quite some time.” Mike Keenan, an economist at the Port of Los Angeles, noted “you need long stretches that are regularly free of sea-ice and right now you don’t have that.”

There is an undeniable economic advantage to Arctic Trade Routes to connect not just China to Europe but China to the East Coast of the United States. Currently the typical shipping time from Shanghai to Rotterdam is twenty-five days, from Shanghai to Los Angeles is thirteen days and then seven days by rail to reach New York. Rotterdam to New York is another nine day sail. However a Northern Sea Route to Rotterdam from Shanghai would shorten the journey to ten days making a Sail from Shanghai to New York via Rotterdam last nineteen days. This number could be even shorter without a stopover but it already is faster than the current path from Shanghai to New York taking rail from Los Angeles.

The Port of Los Angeles, which along with the Port of Long Beach is the busiest container port in North America, is currently the fastest way for good from China to reach consumers in most of the United States. It represents a huge economic asset that handles $260 billion of trade throughout the US. According to Keenan “3.6 million jobs throughout the U.S. are related to the port’s activities.”

Whether Arctic Sea Routes posed a challenge to the port’s position seems an unlikely prospect for the port to consider in the near future. In addition to the infrastructure problem Keenan noted that “there’s simply too many variables to make any predictions for the port.” In terms of adapting to a changing trade environment “there’s a limit to what [the port] can do if you have a serious time advantage.” Keenan further noted that “the priority should be to focus on climate change and sea level rise” and pointed to the Port’s respectable environmental record and investment in clean technology.

Perhaps it is too early to quantify the effect of Arctic Sea Routes on global shipping but even if there is a long term threat to the Port of Los Angeles the sheer volume of trade between Asia and Los Angeles accounts for over ninety percent of the port’s volume. Mike Keenan asserted “cargo will always come here.”

Sarkis Ekmekian is a junior at USC, majoring in communication. He’s taking four classes, is the show-runner for Speakers’ Committee, public relations chair at Trojan Pride, and is a campus centre consultant at the Ronald Tutor Campus Centre.

Sarkis Ekmekian is a junior at USC, majoring in communication. He’s taking four classes, is the show-runner for Speakers’ Committee, public relations chair at Trojan Pride, and is a campus centre consultant at the Ronald Tutor Campus Centre.