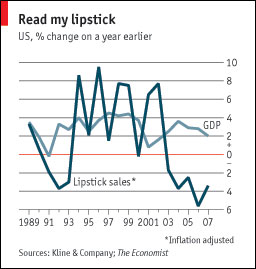

Plastic surgery (otherwise known as cosmetic surgery) for elective reasons is an industry that profits from the will of the people to improve their appearance by going under the knife. This type of surgery is not commonly covered by healthcare – which leaves the patient having to pay the pricey penny for a new appearance. Having disposable income to cover the costs of the surgery, and the ability to take off time from work to recover, are two important factors for this procedure – and the industry took a negative hit when the height of the recession was felt, leading to a downfall in 2009.

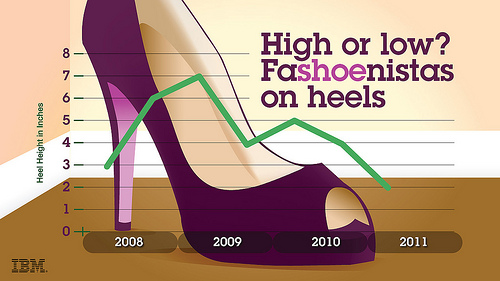

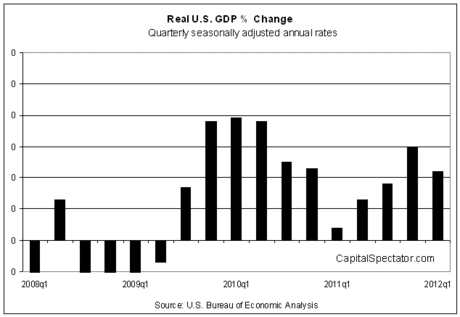

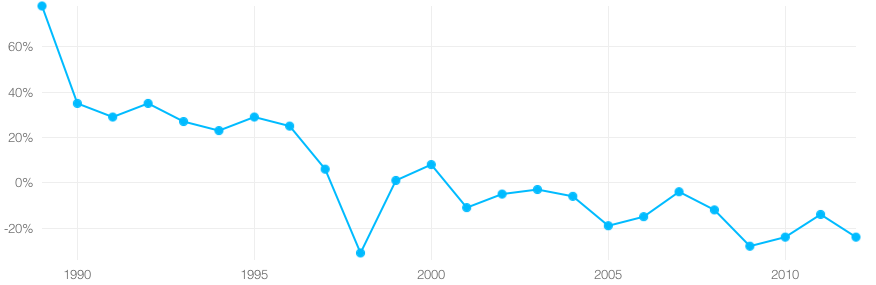

As the figure shows, the revenue of the plastic surgery industry was negatively affected from the recession, as less disposable income was available in the economy. This type of negative change proves to be an economic indicator as this type of surgery relies on the willingness and availability for the population to pay for pricey appearance improvements. As the “dominoes” game analogy would describe it, once the revenue of the plastic surgery fell down, this immediately led to the downfall of employment for plastic surgeons. Once the recession showed signs of improvement and more disposable income was available, there was a positive percent change in revenue and employment. The growth in the plastic surgery field indicated as a beneficial sign for the economy – more money to spend in plastic surgery also meant that the population was feeling confident enough to spend more money on their appearance.

As the figure shows, the growth of plastic surgery was 2.3% from 2008 to 2013; however, this number is expected to further incline as annual growth from 2013-2018 is predicted to be 5.5%.

To understand the entire picture, it is important to consider other changes in the economy that help fuel this increase in growth. First of all, the aging population (specifically the Baby Boomers) will account for a larger portion of the population. With a large section of the population in this age group, services that the older population will desire may create a shift in demands for different industries. The plastic surgery industry will feel this change in a positive manner as aging commonly has a negative connotation in society – but paying for a quick procedure to look a little more youthful will become more of the norm.

Another factor for the positive growth is the increase in technology for less evasive plastic surgery procedures. The money that is available for this type of research is on a different pedestal versus life-saving medical technology – it doesn’t have as much priority. With this in mind, there are still vast efforts for this exploration, which indicates that there are more resources available in the economy for cosmetic purposes as well.

Plastic surgery is a growing field, and signifies the willingness and ability for consumers to pay out-of-pocket costs for appearances. As this industry has grown, so has the public perception of undergoing such surgeries to become more of a common occurrence. Although superficial, this industry is a solid indicator of disposable income that is available for the population to spend.

Source: http://clients1.ibisworld.com/reports/us/industry/ataglance.aspx?entid=4157