It’s Tuesday, November 6th. Tonight marks the conclusion of election day, the day where Americans will vote to elect or re-elect representatives in the House and the Senate, and, perhaps more importantly, voice the direction in which he or she thinks the country should move. Americans are opinionated, and they’re sharing that opinion. 36 million people voted early in this election, indicating a voting turnout some are comparing to a presidential election.

So why are Americans turning up to vote more than expected? They have something to say.

According to the Pew Research Center, immigration is a top priority for both Republicans and Democrats, and is the most important issue being voted on today among voters, a potential reason voters are showing up in staggering quantities at the polls. As a caravan of migrants moving from Central America towards the United States increasingly became an election strategy over the past two weeks, the topic has emerged as a “closing statement” on the campaign trail, making the issue more immediately relevant. And voters have strong opinions about this. Basic immigration literacy, however, like so many other policy issues, is largely disconnected from reality.

Americans have voiced that immigration policy is a top priority, even a reason they are showing up in record numbers at the polls, but data show that many fail to grasp basic facts about the subject.

More than 42% of individuals polled incorrectly identified that fewer than half of US immigrants are here legally. Current estimates suggest that around 75% of immigrants are in the United States legally. Perhaps even more alarming is the fact that immigration information, supposedly grounded in fact rather than opinion, is so starkly split along party lines.

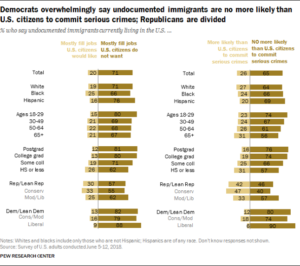

The above graph, reporting public opinion about crime rates, shows a wide spread in public opinion—distinctively along party lines—regarding an issue that is theoretically nonpartisan. While 42% of red voters believe that undocumented immigrants are more likely than US citizens to commit serious crimes, 12% of blue voters hold the same opinion, representing a 30% spread.

While the divide between the right and the left is ever-reported and increasingly evident in everyday interactions, this problem manifests itself in crucial policy discussions. Without basic knowledge of rudimentary facts—facts integral to voters’ most crucial issues—the public is useless in engaging in the meaningful and nuanced conversations that are required to debate immigration policy.

I would argue that the emphasis placed on immigration in the polls is both warranted and necessary. These policies are part of an elite group that impact almost every facet of the American story—GDP, employment, inequality, and social trajectory. But we cannot possibly discuss the true issues behind the policy—issues of economic value creation and job displacement and inequality enhancement—if we do not first address the fact that Americans don’t understand the issues we claim to care the most about.

We should fear—and fight—those who speak (and vote) without adequate information, regardless of what colors they wear.