Money. Just saying it feels good. It rolls so smoothly off the tongue that come close to the “-ey”, you just want to scream “monAYYYYYYY.” It’s why this class has been my favorite class. I love telling people

“Yeup, my class has got the word money in it. I know, pretty cool.”

But in all seriousness, my understanding of money was naïve to say the least, before I took this class. I never understood the real value of money –only that I had to spend it wisely and have a lot of it. So, it wasn’t until after taking this class, JOUR 469 (or 467), I finally began to understand the real value of it.

It’s quite funny when I think about the fact that it was on my first day of class I learned that all the value (gold) that money(US) once had, was gone. I wondered how in the world this country could run on money with imaginary value. My professor explained that if you close your eyes, click your feet and just pretend –voila, it actually began to make some sense.

I started by becoming very conscious of money. Knowing where all these imaginary dollars went — grocery stores, Starbucks, liquor shops and Panda Express. I thought that if the Treasury lost the value of the dollar, then I might as well make my own value for it. So I did. But I always came to the same conclusion: that money was merely a form of exchange to receive some beneficial service. Also, that I could never have enough of it, because I was (and am) always running out of it.

Money then began to sink its feet deeper into my mind and put me deeper into desperation. In distress, I thought to myself: why should money hold so much power over our daily lives? The truth as I came to see it, was that every single person was on the borderline of being in debt. A single dollar had the capability of being the tip of the ice berg into debt while also being the single source out of it.

We all have the ability to live within our means, but it’s the option of being abundantly wealthy that drives our motivations and inspirations into the heavens or drags it into hell. And that’s what I mean by being borderline in debt: money holds more value than gold or imagination; it holds our decency as people.

If out of a blue day a coffee shop decided to raise its price for a small coffee by a dollar, you best believe people are going to be upset. Not just because they have to give more for that same cup of coffee, but because now they receive a little less for $3. Yes, Mr. Treasurer needs to back the dollar, but Jerry isn’t worried about that. He’s worried about his job, his family and his survival.

Now imagine in sequence all the people in the world who can’t afford clean food and water, the people who are hundreds of thousands of dollars in debt and then those who can’t afford to get educated. For them debt is something their born into and it only continues to grow as they resort to harder ways to become wealthy.

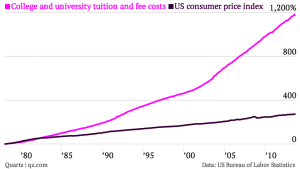

Now imagine myself. A guy, who at one point knew just as much as nothing about money, but is lucky and fortunate to get an educated understanding this money driven world a.k.a. globalization. . I’ve landed quite a handsome debt in dollars, but it holds no bearing on the infinite value of living in a world that relies on money. Which is why education should be above all else and never to be restricted or exploited by the role of money. Money if imaginary only relies on the will of the people and therefore assumes the responsibility of empowering the people, not the other way around. If we are to continue living in this world controlled by money, then education should be at the very least free, accessible and without debt.

Through all the pain for a bigger gain, for a wider eye and a better mind, I’ve enjoyed this class thoroughly.

Thanks,