There is currently a paradox that confronts the restaurant industry. On the one hand, restaurant companies consider the rise of delivery as an increasingly important source of growth. On the other, GrubHub Inc. just announced disappointing quarterly results and said that food delivery is only a means to an end, unlikely to ever be profitable on its own. There is a considerable amount of risk associated with this conclusion from GrubHub toward the broader restaurant industry.

The GrubHub Phenomenon

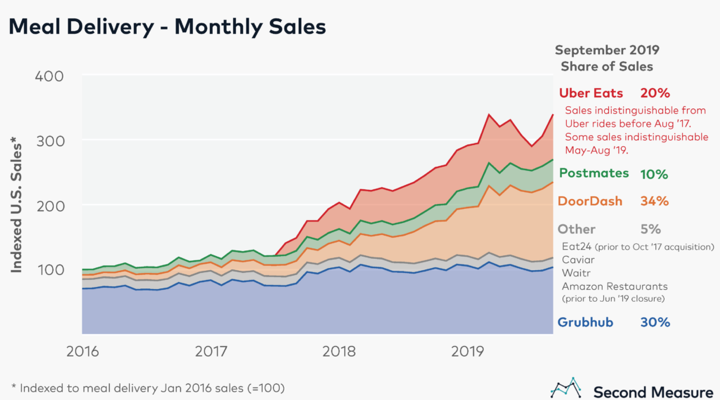

Restaurants have based much of their recent growth on consumer deliveries and rely heavily on only four companies – GrubHub, DoorDash Inc., Postmates Inc., and Uber Eats. Combined, these four companies have a 95% share of the market, which makes GrubHub’s latest quarter seem even more ominous. In a letter to investors, GrubHub stated that it did not believe “that a company can generate significant profits on just the logistics component of the business.” In other words, delivery will always be a low-margin business, so profits cannot significantly be derived from conducting only deliveries.

More specific to GrubHub, the company found that new customers tend to order fewer deliveries than earlier users. Customers are losing their brand loyalty and are more willing to switch to rival services, which may be due to an increase in competitors in the online food delivery industry. Lastly, those rival services now offer delivery from a wider range of restaurants than GrubHub. This all resulted in a net income of $1 million for GrubHub versus $22.7 million in the same quarter a year before.

In defense of these results, GrubHub has argued that its value to restaurants lies in its potential as an online advertising partner and that delivery services are just a vehicle for generating ad sales. Therefore, GrubHub is profitable, but meal delivery just isn’t where the money is. However, where does that leave DoorDash and Postmates, both of which are unprofitable and have a combined valuation of $15 billion? Both companies must now strive to accept the initial public offerings each received this year since no one would want to bother putting more money into these unprofitable companies when investors can buy shares for much less in GrubHub.

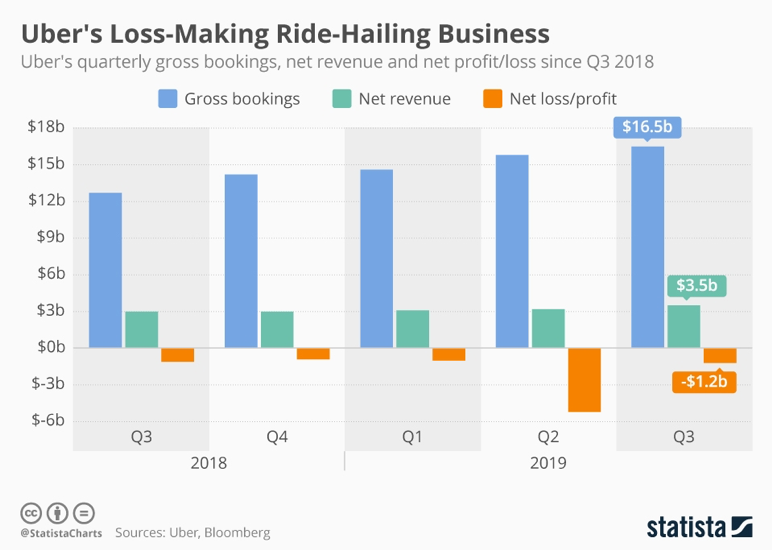

Uber Eats is a slightly different case than DoorDash and Postmates because of its parent company, Uber Technologies Inc. However, Uber is a huge money loser, and its shares have declined by almost 30% since the company went public in May and investors are looking for signs of profitability. Therefore, despite having a parent company, Uber Eats is in a similar predicament as DoorDash and Postmates.

A Painful 2020 for the Restaurant Industry

If food-delivery services start cutting back because of its lack of profitability, then this will affect the restaurant industry tremendously in 2020. For example, in a conference call to discuss its latest quarterly results, Cheesecake Factory Inc. said that off-premise sales now comprise 16% of revenue with delivery being 35% of that amount. Cheesecake Factory uses DoorDash for its deliveries. This means that restaurants are currently dependent on companies with a significant amount of risk associated with it.

So, if GrubHub continues to hurt its own stock, then there is a high chance that the restaurants it works with will be hit as well in 2020.

Sources

- https://www.statista.com/chart/12059/uber-revenue-bookings-and-net-loss/

- https://thespoon.tech/call-for-grubhub-antitrust-investigation-suggests-deep-scrutiny-of-third-party-delivery-is-on-the-way/

- https://www.forbes.com/sites/sarwantsingh/2019/09/09/the-soon-to-be-200b-online-food-delivery-is-rapidly-changing-the-global-food-industry/#71942388b1bc

- https://www.bloomberg.com/opinion/articles/2019-10-31/food-delivery-is-a-dead-end-for-grubhub-doordash-and-postmates

- https://secondmeasure.com/datapoints/food-delivery-services-grubhub-uber-eats-doordash-postmates/

- https://s2.q4cdn.com/772508021/files/doc_financials/2019/q3/October-2019-Shareholder-Letter.pdf