As a student graduating with some debt, I empathize with the approximately 44 million borrowers who begin their adult lives feeling financially behind. This is an issue that does not only hinder Americans throughout their lives but especially in the first 10-20 years after they graduate from college. Some of the first steps to becoming financially independent come from getting your own credit card, purchasing high-value items like your first car, groceries, insurance, and then putting money down on your first house. All of these transactions require you to have a certain amount of credit in order to do so, which is difficult when you have upwards of $100,000 of debt to your name before people even apply for their first credit card in their name. Though most importantly, understanding the debt that I will have, along with a lot of my friends, makes me feel nervous about future investments such as purchasing a house. But I am not alone in that concern. The housing market is only decreasing while student debt is skyrocketing, and the long-term effects of this situation are yet to be determined as the debt continues to accumulate.

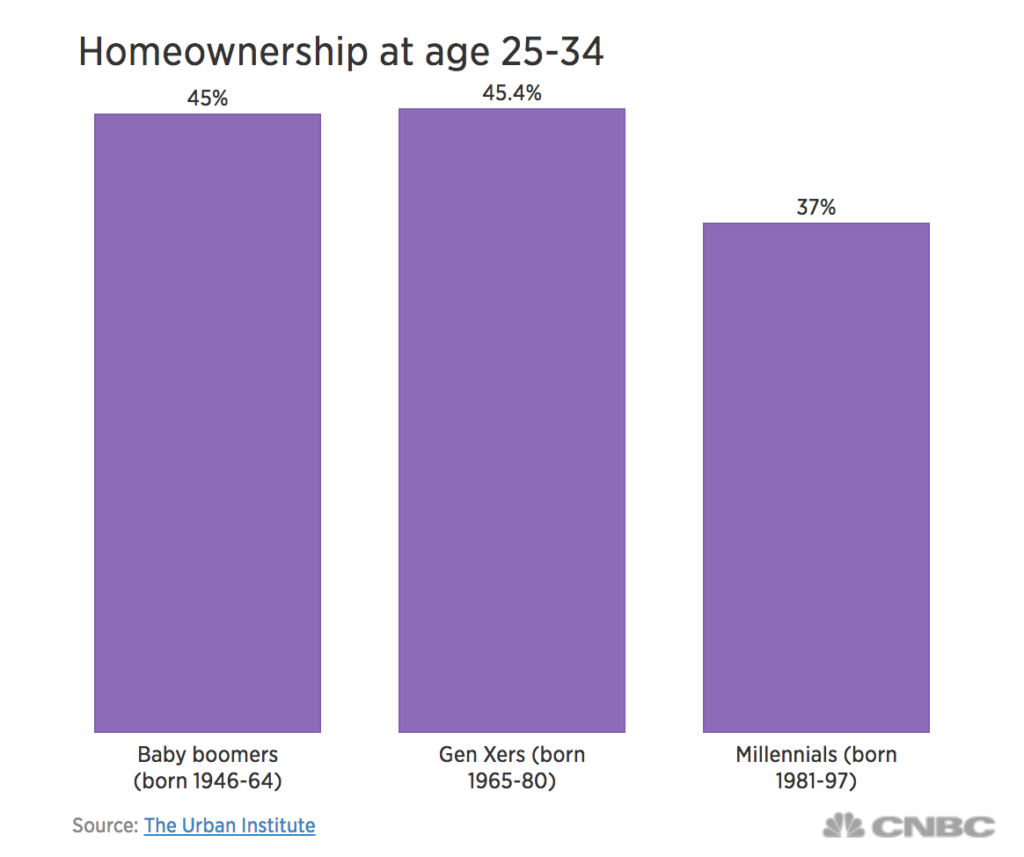

Millennials between the age of 24-34 are around 8 percentage points lower than baby boomers and Gen Xers when they were that age in homeownership, according to a report by the Urban Institute, a policy research group. Only 37% of millennials born between 1981 and 1997 are homeowners, which does not show a lot of promise moving forward as the housing and entrepreneurial markets have presented solutions to avoid taking out loans and mortgages. A main factor is also the regressing age of marriage. Societal norms are changing and evolving, normalizing the concept of getting married later and women completely joining the workforce, which was not the case, to the same extent, 30 years ago. The more single people in their 20’s the less people will be willing to invest in property because are not assuming that that will be their permanent residence. This is all very important information because as a borderline millennial and Gen Z individual myself, I believe it is important for us to understand the greater effect these changes are having on the economy and how it will affect the market down the line.

Millennials between the age of 24-34 are around 8 percentage points lower than baby boomers and Gen Xers when they were that age in homeownership, according to a report by the Urban Institute, a policy research group. Only 37% of millennials born between 1981 and 1997 are homeowners, which does not show a lot of promise moving forward as the housing and entrepreneurial markets have presented solutions to avoid taking out loans and mortgages. A main factor is also the regressing age of marriage. Societal norms are changing and evolving, normalizing the concept of getting married later and women completely joining the workforce, which was not the case, to the same extent, 30 years ago. The more single people in their 20’s the less people will be willing to invest in property because are not assuming that that will be their permanent residence. This is all very important information because as a borderline millennial and Gen Z individual myself, I believe it is important for us to understand the greater effect these changes are having on the economy and how it will affect the market down the line.

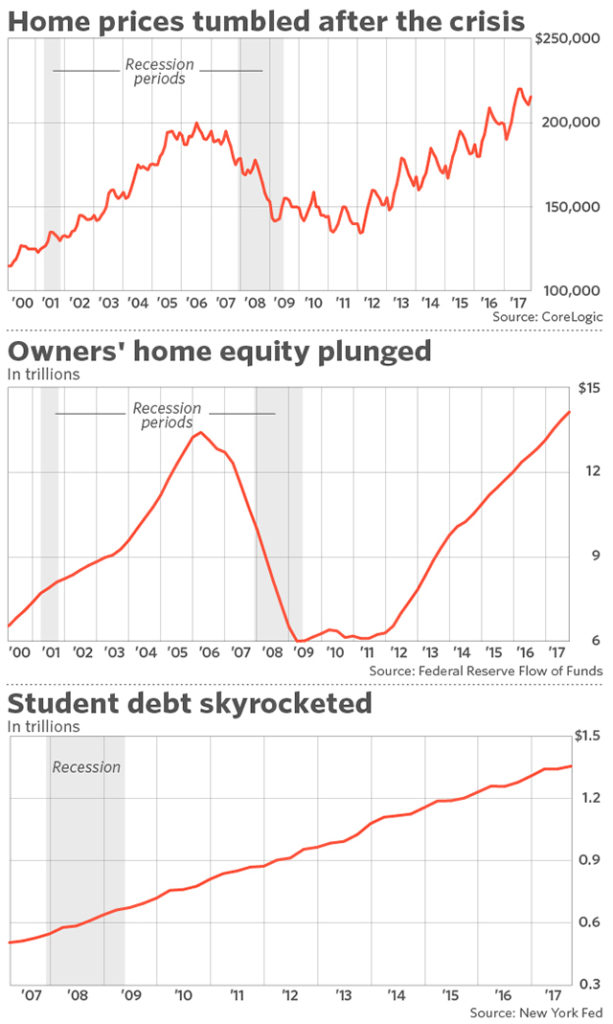

According to the graphs created by the Federal Reserve Flow of Funds on Market Watch’s Capital Report, home prices since 2010 have only gone up at a steady rate, making it increasingly more difficult for the skyrocketing amount of student loan debt. Economists are worried about what this challenge will present for future homeowners. The New York Fed shows that the there is approximately $1.4 trillion of student debt accumulated in the United States, while the GDP is $19.4 trillion. Which means that the student loan debt makes up approximately 7% of the total GDP. With that being said, the amount of people investing in the housing market is decreasing which is a strong contributing factor of why housing prices are high. It also makes it difficult that the millennial generation is so keen on leases and rentals rather than making long term investments.

With new companies such as Airbnb entering the space, and co-ops providing short term housing, they are effectively changing the perception and future of the housing market. Conceptually, it will be very challenging to reverse a generation’s perception of long and short term goals with investing, marriage, and daily spending habits. So it will be interesting to see how the value of the housing market shifts and if reforms will be made to help appease the student debt crisis at the whole.

Sources:

https://www.nar.realtor/sites/default/files/documents/2017-student-loan-debt-and-housing-09-26-2017.pdf

https://www.cnbc.com/2018/03/29/these-are-the-ways-student-loans-stop-people-from-buying-a-house.html

Leave a Reply

You must be logged in to post a comment.