With the $1.8 billion donation from the former New York City Mayor Michael Bloomberg, students at Johns Hopkins University could enjoy greater access to financial-aid packages and scholarships starting next fall. This billion dollar’s worth of gift would allow the University to permanently adopt a “need-blind admission”, meaning that the admission board will not take into consideration students’ financial ability during the selection process, a report from Bloomberg says.

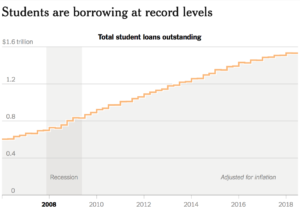

Even though the contribution has marked a record high in the U.S. education realm, it only accounts for a tiny share in the overall amount of student debt in the country when we look at the bigger picture. According to the 2018 student loan debt statistics from Make Lemonade, a free personal finance website, student debt has ballooned to more than $1.5 trillion with over 44 million borrowers in the U.S.

Students in the Class of 2017 owe an average of $40,000 in student loan debt, up from $37,172 for the Class of 2016. It has become the second-largest consumer debt, following mortgages. At the same time, more than 10 percent of the mounting student loans were at least 90 days overdue.

Students have borne the brunt of the drop in house values, as it becomes tougher for parents to take out mortgages to pay for their children’s education, an article published by The New York Times says. Students have no choice but to shoulder the financial burden in exchange for a college degree.

So is this borrowing sign pointing to a grim picture of the future economy, or is it reminiscent of the decade-old financial crisis?

While the student loan market is smaller and less complicated than the mortgage market, it is less likely to create ripple effects across the world as the mortgage market did 10 years ago. The housing crisis in 2008 was unstoppable because a slew of financial institutions was involved in the mortgage world, with fledging crackdown on lending activities. As the federal government is the biggest lender of student debt, it gives people more confidence that the student loan market is better shielded from a debt explosion.

Although the speculation about the next economic recession is in gradual crescendo, the student debt market is expected to have limited impacts on the overall economy.

Leave a Reply

You must be logged in to post a comment.