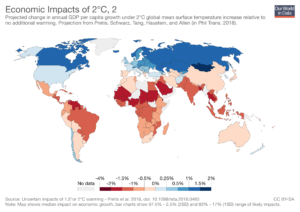

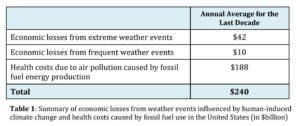

Increasingly warm summers, terrible wildfires, destructive hurricanes—these are just three visible and tangible impacts of our warming planet. But these symptoms of climate change also have another destructive impact, which is an economic one. A 2017 estimate by the Universal Ecological Fund found that the “economic loses from weather events influenced by human-induced climate change and health damages due to air pollution caused by fossil fuel burning are currently costing an average of $240 billion a year—or about 40% of the current economic growth of the United States economy.” Furthermore, researchers have found that if we managed to slow the rising earth’s temperature to be 1.5 degrees Celsius above pre-industrial temperatures instead of 2.0 degrees, “per capita GDP would be 5% higher by 2100.” Thus, the higher the temperature rise, the greater the negative impact on GDP.

Source: CarbonBrief

One potential solution that seeks to curb both the negative environmental and economic effects of climate change is a carbon tax. According to the World Bank, a carbon tax sets a direct price on carbon by defining a tax rate on greenhouse gas emissions, or the carbon content of fossil fuels. If implemented across the globe, $200 billion in potential revenues could be created to be re-invested into the economy to reduce emissions, promote energy efficiency, and move away from our world’s destructive reliance on fossil fuels.

Source: The Economic Case for Climate Action in the United States

Some countries have already employed such a tax. In 2012, Japan implemented a carbon tax, but to some, “at less than $2 per ton it provides a weak incentive.” This year, Canada has also set plans to implement a carbon tax. Perhaps the most robust supporter of such a tax has been the Nordic nations, where in Denmark the tax is $25 per ton, in Norway and Finland around $50 per ton, and in Sweden a whopping $130 per ton. Carbon is also taxed in some capacity in other nations like Ireland, Chile, Australia, and New Zealand.

With no sign of such a policy in the works by Congress in the United States, states are taking action. In Boulder, Colorado, where a carbon tax has been in place since 2007, emissions have been reduced by over 100,000 tons a year and $1.8 million is raised by the fee. Tomorrow in Washington, voters will evaluate a carbon tax on the ballot—for the second time. In 2016, citizens said no to a similar initiative on the ballot because it was “revenue neutral,” meaning that the money raised from the duty went back to poor households. This year, Initiative 1631 puts the proceeds of the tax to programs specifically focused on reducing the impacts of global warming, such as lowering greenhouse gas emissions, preserving environmental habitats, improving public transit, and upping the use of clean energy.

The benefits are theoretically twofold—a tax forces people to slow their use of unsustainable energy sources, and also redirects funds from those who continue to burn fossil fuels towards addressing global warming. In this key difference, the ballot this year does not propose a tax, but instead a fee – it’s a regulatory mechanism that can collect revenue to specifically address climate change.

Those skeptical of carbon taxes argue that such a levy would hurt our nation’s economy, since fossil fuels produce around 85% of the energy we consume in the US. In Washington specifically, supporters of the tax have been up against the entire oil industry, which has spent over $31 million to get voters to vote against the initiative. Furthermore, The Seattle Times came out in opposition to the tax after concluding that the initiative would originally cost a suburban family with two vehicles around $240 a year. However, that argument assumes that families will continue to use the same amounts of gas, electricity, and other sources of energy that they do currently, even though the entire purpose behind the levy is to get corporations and regular people to think twice about how they can better incorporate renewable sources of energy into their lives.

Ultimately, Washington’s choice tomorrow comes down to whether the state wants to be a progressive leader on climate change in our country. While experts admit that the measure isn’t perfect, those serious about combatting climate change agree that Initiative 1631 seems like a reasonable way to address the environmental—and the resulting economic—impacts of global warming while still funneling money back into the economy. While the shift towards sustainable sources rather than harmful fossil fuels is sure to be an upward battle, given the current state of our planet, it’s also one worth fighting.

Leave a Reply

You must be logged in to post a comment.