Once a wealthy country in the 1970s, Venezuela is now experiencing political turmoil and its citizens are living in poverty. With over 298 barrels of proven oil reserves, why is Venezuela, the country with the largest oil reserve in the world, the poorest performer in terms of GDP growth per capita? What happened to one of the richest countries in Latin America?

- It’s ongoing economic crisis

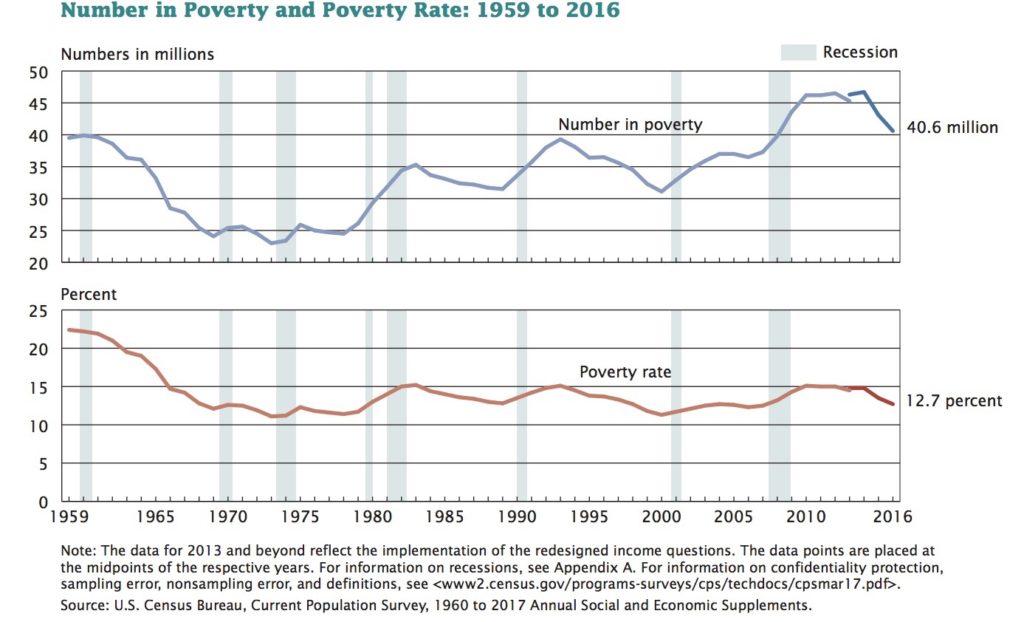

Venezuela is now in its fourth year of recession. With the economy shrinking, the price of goods keep increasing. The price for a dozen eggs is equivalent to US$150. So, this means devaluation of their currency, the Bolivar. To put it into perspective, one U.S. dollar was 100 bolivars in 2014. In 2016, one dollar got you 1,262 bolivars. On top of this, years of the excessive government spending and poorly managed government programs led Venezuela to experience its worst economic crisis in history.

- The currency split

Venezuela established three different exchange rate systems for the bolivar; one rate for “essential goods”, the other for “nonessential goods and another one for its citizens. The two primary rates overvalue the bolivar, and the black market values bolivar near worthless. The government has tried increasing the number of bolivars to tackle this problem, but the money in circulation isn’t enough.

- Venezuela is running out of cash and gold

Venezuela is struggling to pay its bills. It owes approximately US$15 billion while its central bank only has US$11.8 billion in reserves. The oil company, PDVSA (Petroleum of Venezuela), is pumping less oil and is at risk of defaulting. China used to come to Venezuela’s aid and loan it billions of dollars at a time. But even China has stopped giving out cash. Interestingly, most of Venezuela’s reserves are in the form of gold and has being making debt repayments in the form of gold bars.

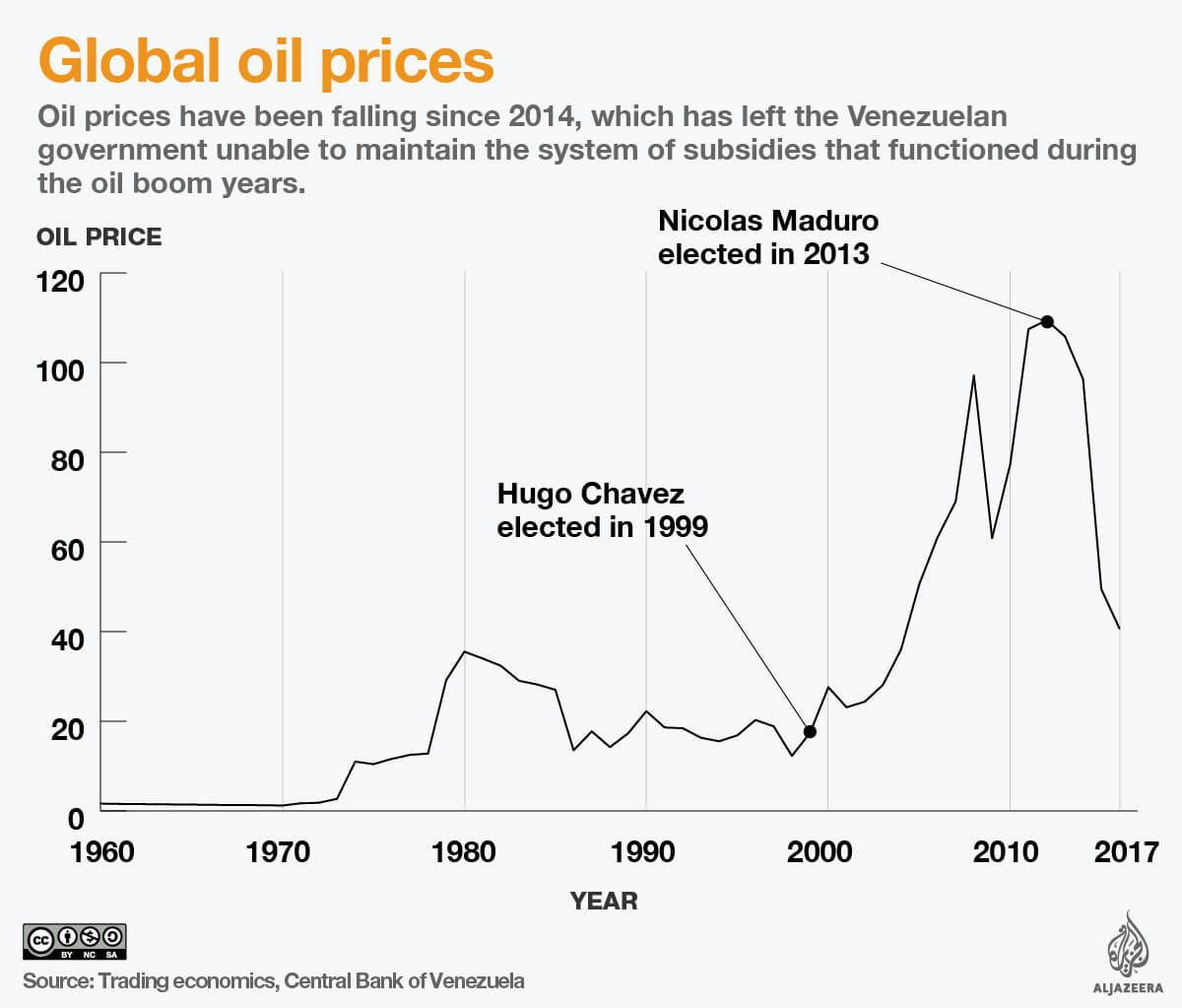

- Its hottest commodity, oil, isn’t “hot” anymore

Venezuela has the world’s largest oil reserves, but the problem is that oil is the only commodity it has to offer. Ninety-five per cent of Venezuela’s revenue comes from exports, so if it doesn’t sell oil, the country hasn’t got much money to spend. Venezuela’s situation went downhill pretty quickly when oil prices plunged in 2014. It’s been struggling to recover ever since.

- Government control

The Venezuelan government enforced strict price controls on golds sold in supermarkets. It also stopped food importers to cease importing basically everything because they would have to sell their products for a major loss. In 2016, the government stopped enforcing price control. However, prices are still so high that Venezuelans can’t afford even the most basics supplies.

There are many factors that have contributed to Venezuela’s economic and political turmoil. The challenge for the country will be to escape the cycle it is stuck in, and that’s only if they can sort out the state of their government first. There won’t be a quick fix solution, it will be long and arduous journey for the country.