The Chinese government has poured 33.4 billion yuan in subsidies since 2009. The government decided to establish a world-leading industry and increase jobs and exports, and to reduce oil dependence and the urban pollution. The incentive policy offers subsidies to encourage the companies that build electric cars, plug-in hybrids and fuel-cell vehicles to produce and sell electric vehicles (EVs). But a report from the Ministry of Finance of China exposed that at least five automakers defrauded the government for a total of 1 billion yuan ($150 million) in subsidies aimed at promoting EVs in September 2016.

Since some incentive regulations were vague and under weak supervision, speculators learned how to reap the benefit from a poorly crafted subsidy system the government had launched. For example, a big portion of the subsidies flowed into unqualified or non-existing cars made by dishonest companies. One of the bus manufacturers involved in the scandal was the Higer Bus in Suzhou, which received about a half billion yuan in subsidies through sales inflation. The five companies defrauded an average of 25,000 yuan per car, according to the government report.

In some cases, the manufacturers sold unqualified or faulty cars to related parties (for example, the companies’ own leasing subsidiaries). After the companies received the subsidies from the government, the buyers returned the cars. In other cases, the makers installed dysfunctional batteries or even one battery in different vehicles.

The high profit under the government support cultivated another deal model between the sellers and the buyers. An electric bus worth one million yuan would be priced at two million yuan. The buyers only needed to pay one million yuan, but the sellers forged a two million yuan receipt to apply for the government subsidy.

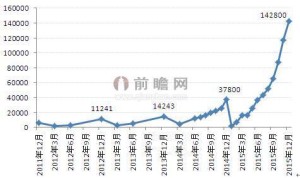

China saw a big boom of EVs in 2015

The government planned to phase out the subsidies on the EV industry from 2016 to 2020. The manufacturers stepped up the production by adding incomplete or unlicensed vehicles, especially in the end of 2015. The total number of EVs sold in the fourth quarter increased by 92,000 dramatically. The monthly production in December 2015 quadrupled compared to the number in December 2014. Higer Bus sold 2,000 EVs with 83.9 percent incomplete in December 2015, which amounted to one-fifth of the company’s yearly sales.

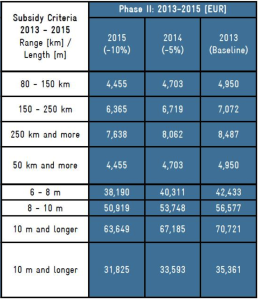

China’s EV Subsidy Criteria during 2013-2015

The policy designed to support the EV industry hurt the market instead. The vague criteria in the incentive policy lowered the threshold for receiving subsidies. Under the standard from 2013 to 2015, the amount of subsidies an EV could receive was mainly based on its range (mileage) or length. There were no rigorous standards for the vehicles’ technology and actual quality.

The subsidies have been blamed for attracting the ‘wrong crowd’ according to Zhang Zhiyong, a Chinese market commentator and auto-analyst based in Beijing. Many new players in the market decided to make EVs just to get the subsidies. They came not with previous manufacturing experience or R&D input, but with a gold-rush mentality.

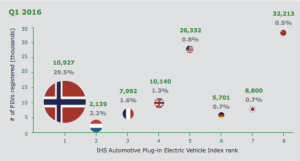

China registered the largest amount of plug-in electric vehicles (PEVs) in the first quarter of 2016, yet ranks lowest on the Plug-In Electric Vehicle Index, which is a quarterly index tracking the production effectiveness and impact of the PEV market in different countries. “Despite having more than 200 manufacturers of new-energy passenger vehicles, buses and special-use vehicles, China still lags behind global leaders in terms of quality, reliability and key technology,” said Wang Cheng, an official at the China Automotive Technology and Research Center.

According to the subsidy policy from 2013 to 2015, a qualified minibus with a length of three to four meters can help its maker receive subsidies ranging from 300,00 to 600,000 yuan. To get the subsidy, the company didn’t even need to know how to manufacture the electric bus; the company only needed to buy a 20,000-yuan diesel-engine bus and install an electric battery.

Though unqualified EV companies have cheated on the subsidy system, it does not mean the government support is unnecessary. Government incentives for EV industy are common practice in several national and local governments around the world, such as France, Germany, Japan and the United States. EV programs in these countries also encourage the residents and local bus transit agencies, which target more relevant parties than just the car makers. For example, California established the Clean Vehicle Rebate Project, which allows residents to get up to $7,000 for the purchase or lease of an EV. The transit agencies can benefit from the program of Electric Vehicle Supply Equipment Loan and Rebate. “They are set up to encourage local agencies to purchase electric vehicles like those from BYD, which help the environment while growing jobs here in California,” said the PR spokesman Joshua Goodman from BYD USA, an EV bus manufacturer with its headquarter in Los Angeles, “the California Air Resource Board also offers several different incentives to us (the EV manufacturers).”

Foreign countries’ practice offers good examples that China can learn from. The leading industry does not contradict the support from the governments. But a germane policy is in need. The Chinese government is trying to improve its policy now . The regulators plan to impose tougher policies on incentives, such as stricter technology standards on manufacturers. The government also considers limiting the number of startup EV makers to a maximum of ten.

Works Cited:

Bloomberg News. China Swats ‘A Few Flies’ to Temper Electric-Car Maker Excesses. Web. 11 September. 2016.

An Limin, Bao Zhiming and Han Wei. China Hammers out Tougher Subsidy Plan for Electric Vehicles. Caixin News Online. Web. 30 September. 2016.

Sustainable Transport In China. New Policy on Electric Buses Published in China. Web.

Bloomberg News. 95% of China’s Electric Vehicle Startups Face Wipeout. Web. 28 August. 2016.

Leave a Reply

You must be logged in to post a comment.