The day after Thanksgiving, otherwise known as “Black Friday,” was anticipated to reach record sales. The economy is improving, gas prices are low, and the savings were enticing; however, in the end, consumer spending disappointingly did not satisfy the hype for retail profits. Although there are multiple ways to analyze consumer habits during the holidays, Cyber Monday came out on top as the big money maker during the weekend shopping frenzy.

The one-day shopping event of the year has morphed into a week of savings. Thanksgiving has become “Gray Thursday,” then there is the penultimate “Black Friday,” followed by “Small Business Saturday,” and “Cyber Monday.” Although the intention is to initiate the spending spree early, the result may be less spending overall because the consumer expects better savings for a later day.

According to the National Retail Federation, spending on Black Friday was approximately 11% less than a year earlier. Consumer spending was $50.9 billion over the Thanksgiving weekend, compared to $57.4 billion in 2013.

The competition for retail stores to get consumers in their doors is increasingly difficult as shopping online is both easier to scope out deals, and can be done in one’s pajamas on the couch. With the lower price of gas, expectations were higher for in-store traffic, but this was not the case. According to IBM Digital Analytics, sales grew 8.5% on Cyber Monday, making it the largest online shopping day of the year. Holiday shopping online rose 17% to a record $2.04 billion – shedding light on consumer habits.

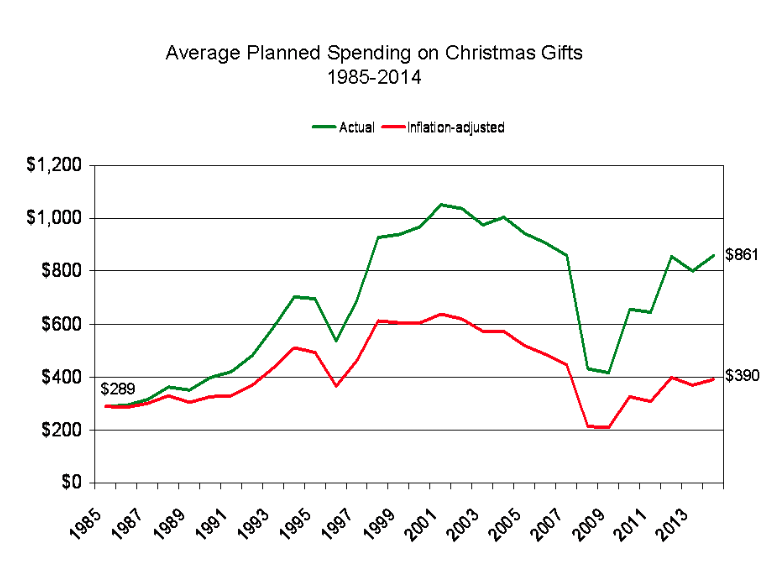

Although sales faltered on Black Friday, the amount consumers plan to spend on gifts has slowly increased the last couple years, showing the “gift-giving” is still alive in the American economy. The American Research group quantified a series of consumer habits for the holidays, including the trend for spending more money on gifts for 2014.

As consumers are shifting from in-store spending habits to online, it is evident that shopping overall is down from previous years. This, in part, could be due to shifting consumer priorities for their dispensable income. In an interview with Macy’s CFO, Karen Hoguet, she stated, “Shoppers are spending more of their disposable dollars on categories we don’t sell, like cars, healthcare, electronics and home improvement.” This seems to show that even though the economy is improving, it doesn’t mean consumers aren’t entirely comfortable with spending their income on nonessential goods.

As consumers are shifting from in-store spending habits to online, it is evident that shopping overall is down from previous years. This, in part, could be due to shifting consumer priorities for their dispensable income. In an interview with Macy’s CFO, Karen Hoguet, she stated, “Shoppers are spending more of their disposable dollars on categories we don’t sell, like cars, healthcare, electronics and home improvement.” This seems to show that even though the economy is improving, it doesn’t mean consumers aren’t entirely comfortable with spending their income on nonessential goods.

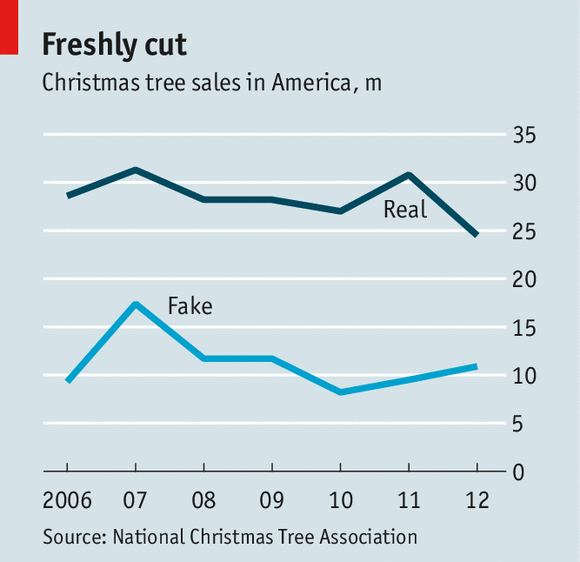

There are many other trends to size up the economy during the holidays, including the amount of money consumers are willing to spend on Christmas trees. The desire to bring some holiday cheer to one’s home can be used as an economic indicator. For example, spending money on a fake tree tends to be more economical when you can put up the same tree (with the same pre-hung lights) for many years to come. Although the sales of real trees still dominate this market, the trend to buy a fake tree has increased while the sales for real trees is on the decline.

A final last thought to wrap up the economics of the holidays– need help picking out a Christmas gift for a loved one? According to Joel Waldfogel, author of the books, “Scroogenomics,” people value gifts about 20% less than the price tag number. In his own words, Waldfogel believes, “The choice to buy presents turns out to destroy a lot of value.” It does sound a bit scrooge-like, but maybe giving a gift card isn’t impersonal after all – it’s just economical.

Leave a Reply

You must be logged in to post a comment.