In a small, rain-soaked town in northern Bavaria, a German company is trying to design athletic apparel and footwear that will appeal to the masses in America. And they’re failing miserably.

Adidas, the world’s second largest sportswear company in the world, has a problem: the American consumer doesn’t think they’re “cool.”

“At the moment, Nike is cool, very cool,” said Tammy Smulders, head of marketing consultancy at SCB Partners, to Reuters. “If you ask a 20-year-old, they are not going to pick Adidas right now.”

Part of this is due to the disconnect between their headquarters in Herzogenaurach, Germany, and the US market. Analysts and even the company itself have acknowledged the difficulty in recruiting top design and marketing talent to live in a German farm town with a population of less than 25,000 people.

Their products, while functionally sound, have recently lacked the style and marketing necessary to permeate the American market.

Nike, on the other hand, has been more willing to push the envelope. A recent illustration is their introduction of neon-yellow shoes for their athletes at the 2012 London games, a bright color scheme that has become a staple over the past two years.

The Swoosh has also introduced several well-received footwear innovations in recent years. Flywire, Hyperfuse, and Flyknit technologies, for example, have been hits with the US consumer because they are both stylish and practical.

“[Nike] understands the US consumer. Adidas does not,” said Matt Powell, head of Forbes’ Sneakernomics blog.

But Powell doesn’t believe the disparity between the companies is due to technological innovations, but rather their ability to market them.

“Adidas has a very credible technology in Boost [a new shock absorbing system],” said Powell. “They just have not exploited it here.”

Footwear expert Matt Powell believes Adidas has the tech to compete — they’re just not promoting it right

It certainly hasn’t helped that the North American faces of Adidas have been trending downward.

After signing a 13-year, $185 million extension with Adidas in 2012, Chicago Bulls guard Derrick Rose has dealt with a myriad of leg injuries that have kept him off the court for nearly two full seasons. While his $40 million in signature sales ranks fourth overall among athlete-endorsed basketball sneakers, it’s difficult to make a shoe look good when the lead endorser is wearing a suit on the bench.

Adidas’ other top endorser in North America, Rockets center Dwight Howard, has faired even worse. His line only moved a paltry $5 million in product. Big men generally don’t sell shoes as well as guards to begin with, and Howard’s Q Score, which measures “the familiarity and appeal of celebrities,” has fallen to 13. The average is 16.

Between the location of the company, its inability to market fashionable products, and its pitchmen failing to resonate, it becomes clear why Adidas has lost ground in the States.

Conversely, The fact Nike’s lead endorser, LeBron James, rarely wore his signature shoe and still generated huge returns speaks to the company’s Teflon status. As long as the shoe design appeals to the consumer, they’re willing to look the other way. This speaks to the underlying divide between the companies – that consumers feel Nike inherently makes a better and more desirable product.

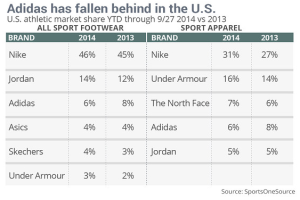

The numbers back this up. Combined, Nike and its largest subsidiary, Jordan Brand, account for 60 percent of all US footwear sales, ten times the market share of Adidas. The gap is also substantial in their apparel sales, with the Swoosh enjoying a 30 percent cushion.

And with Nike making inroads in Adidas’ home turf of Western Europe, the increasing divide between the world’s two biggest athletic companies has only become more glaring.

Nike’s nearly $28 billion in total sales for 2014 dwarfed their German rival’s most recent sales figures. In 2013, Adidas’ total sales were €14.49, equal to a little more than $18 billion. It represented a 2 percent drop from the year prior.

Adidas is headed in the wrong direction, and they’re looking for answers.

Where does Adidas go from here?

The Trefoil realizes it has to make its brand sexy again, both in America and internationally.

Adidas fears its headquarters in sleepy Bavaria has lead to being out-of-touch with the US market. To assuage this, they poached three of Nike’s top designers last month and pegged them to open a new design studio in Brooklyn this winter.

They’re also looking beyond athletes to help make an impact on the American market. Collaborations with hip-hop artists such as Big Sean, ASAP Rocky, and Snoop Dogg have been geared towards drawing the younger demographic back into the fold.

Adidas has also partnered with fashion designers Jeremy Scott and Raf Simmons in an effort to target the high-end casual shoe market, where products can run for several hundred dollars.

These moves point to a concerted effort from Adidas to reposition itself as a company that not only see itself as a sportswear brand, but a lifestyle brand.

Still, Adidas has a ways to go before catching Nike on this front, where the Swoosh has benefited from having artists turn up online wearing their performance and casual wear. In essence, celebrity is just as important as athlete product endorsement.

“[hip-hop artist] Wale wearing a pair of Durant’s is just as important as [Durant] wearing a pair Durant’s,” said Ian Stonebrook, writer for NiceKicks.com. His weekly “Celebrity Sneaker Stalker” column routinely ranks as the most-viewed page on their website.

Signing Kanye West to a design deal may be the biggest indicator Adidas has caught on to this phenomenon. West had previously designed two popular shoes for Nike – the Air Yeezy – but was upset over his compensation.

Adidas hopes the coup will cut into Nike’s stranglehold on cool.

“[Kanye’s] influence on the market is unmatched…he’s ahead of LeBron” said Stonebrook. “This could be the biggest move since Jordan.”

And if it isn’t, and their marketing continues to be second-rate, Adidas could see a change in leadership. With shares of ADDYY down more than 30 percent on the year, investors have started to grumble about the performance of CEO Herbert Hainer.

Powell believes this is a necessary move for Adidas to truly become a competitor again in North America. “The US must become design and product center for the brand,” said Powell. “Current management does not see that.”

It’s become apparent the latest maneuvers from Adidas will bring change in one form or another – either in market share or in the boardroom.

Leave a Reply

You must be logged in to post a comment.