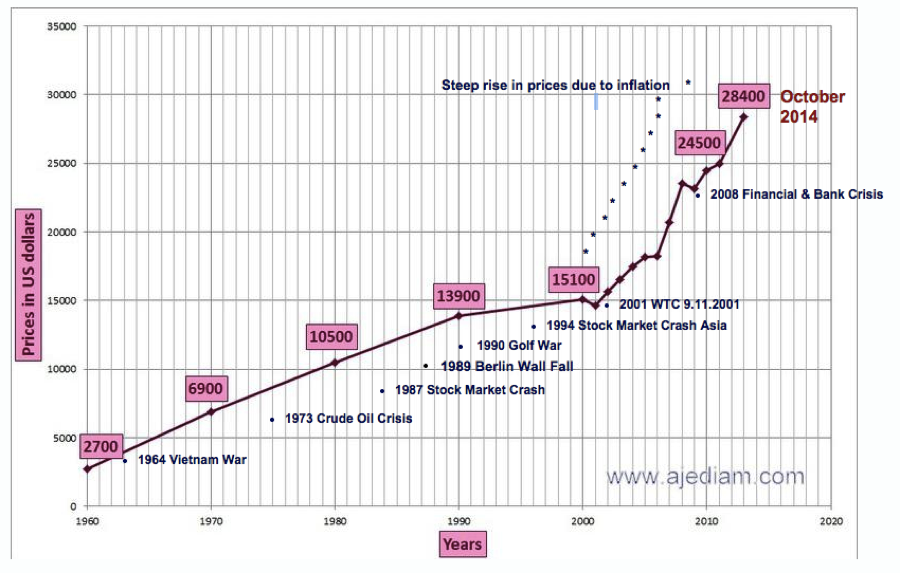

When Russia revealed vast diamond reserves in 2012, the diamond market was expected to suffer terribly. The Russian government kept the mine – whose deposit may last the next 3,000 years – classified for nearly half a century in order to protect its national benefit in diamond industry. However, two years have passed since the revelation and the price of diamonds doesn’t seem to have been affected much. On the contrary, the price has continued to rise, as we can see from the chart below.

Source: www.ajediam.com

This might prove the famous slogan: A Diamond is Forever. But what exactly does it mean? Indeed, the price of diamonds seems to be impervious to anything – from recessions, the laws of supply and demand, to even Antitrust Laws. This article will look into how the De Beers Group is able to dominant the diamond market by controlling supply, establishing a unique distribution system, evading antitrust laws, and positioning diamonds as a necessity of life, and thus reveal the secret of the whole diamond industry – why “A Diamond is Forever.”

- Are Diamonds Scarce?

Adam Smith put forward the paradox of value in his book Wealth of Nations: Water is extremely useful, yet people can trade diamonds – which are of little use – for a large amount of goods, but not water. It is the scarcity of diamond that endows it with such high value – the supply of water is abundant, but that of diamonds is rare.

Diamonds were rare in the eighteenth century. At that time, only a few kilograms of gem quality diamonds were yielded around the world every year. The royal families monopolized them because diamonds are solid, long-lasting, and beautiful. However, later in the nineteenth century, diamond mines were discovered in Canada, Russia, and Australia. According to Does Scarcity Make Diamonds Expensive, an article written by Zhuojun Xu in SWEEKLY Magazine, nearly 25 tons of diamonds were mined in 2011, but the price of diamonds kept increasing steadily.

Why? In 1970, Carl Menger, William S. Jevons, and Leon Walras, three economists from Austria, Vienna and France, separately but almost simultaneously developed the idea of marginal utility. They came to the same conclusion that price or exchange value is based on marginal utility, not total utility or use value. In other words, the more difficult it is to get one more unit of a certain product, the more expensive it will be.

Snap Lake Mine, located in Canada, the De Beers Group’s first diamond mine outside of Africa.

Resource: https://www.canada.De Beersgroup.com/Mining/Snap-Lake-Mine/

Soon after the De Beers brothers found the vast diamond mine in South Africa in 1870, British financiers who were in charge of keeping the mining business running realized that the price of diamonds depends solely on the fact that it’s rare. They then began to control diamond output to create an illusion of scarcity. Due to absolute control of resources, the public could only know what the diamond giants told them: Diamonds are rare, and so they’re expensive. The De Beers Group further put forward the Peak Diamond Theory in 2010. According to the company, the total existing diamond reserves on earth are about 3 billion carats, which will last for only another 30 years according to current mining rates. We all know that it doesn’t matter if something is scarce or not, but whether people believe so – this is even more true in the diamond industry, which is purely built upon “people’s vanity and greed.”[1] The Peak Diamond Theory throws the public in deeper fear of extinction of diamonds, and has further convinced them that diamonds are expensive for a reason. As long as they believe that diamond is becoming harder and harder to get, they’ll be willing to pay higher and higher prices.

- Iron Hand

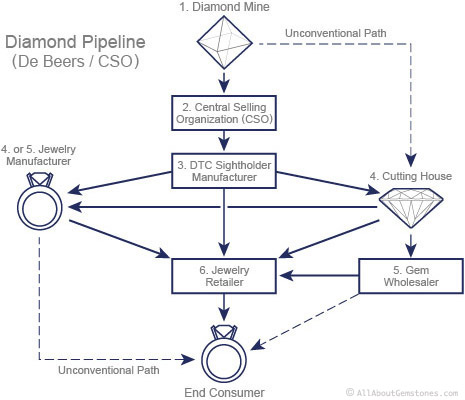

Now we know how diamonds are made rare, then how is the illusion of scarcity maintained? The De Beers Group introduced a way of controlling circulation of diamond in the open market, which is called Central Selling Organization (CSO). Since then, De Beers Group had been able to monopolize both production and distribution of diamonds for a very long time.

A flow chart of how CSO works. DTC (Diamond Trading Company) is the organization which holds the “sight” event.

Resource: http://www.allaboutgemstones.com/diamond_pipeline.html

The CSO worked through a corporation called Diamond Trading Company (DTC). The CSO employs “supplier of choice (SOC)” system. It sells to 125-250 sightholders selected by the company at sight visits, which are held by DTC every five weeks. Each of the sightholders is a leader in the industry, who owns large-scale factories and a huge distribution network. However, even these magnates are not able to negotiate with De Beers. The company puts diamonds in sealed boxes according to their quality. Sightholders can only see the price on the box but not the diamonds. They either take the entire box or none – De Beers Group has sole power to determine how many diamonds to sell and at what price. The founder of Harry Winston, a top fine jewelry brand in America, was once kicked out of the “sightholders list”, because he said CSO was “a most vicious sytem.[2]” However, he wasn’t able to find another diamond supplier, so he had to apologize in order to go back to the list again.

Matthew Hart wrote in Diamond: A Journey to the Heart of an Obsession that, in order to reinforce the CSO, if any small diamond producers try to sell diamonds without De Beers, the group will put a large number of diamonds onto the market to lower the market price to bring the competitor to the ground.

Under strong control of resources from De Beers Group, the diamond trading system is able to keep running, and that’s how the value of diamonds is kept stable.

- Battles Against Anti-Trust Laws

It seems that nothing can stop De Beers from taking control of the diamond market. However, it had been encountering setbacks for nearly 60 years when it tried to extend its branches in America, the largest diamond consuming market in the world. However, De Beers always seems to be able to find a way to regain its control of the market, directly and indirectly.

Since the mid 1940, De Beers had been sued again and again in the U.S. Court for violating antitrust laws, which prohibited the group from selling diamonds to American market directly – even appearance of employees from the company was forbidden in the U.S.. During that time, De Beers distributed only through intermediaries in the U.S. – for example, Harry Winston, as mentioned earlier. De Beers had been eager for transforming from supply-side to demand-driven management as more and more mines were discovered. Therefore, though De Beers was still controlling the market in effect at that time, it wanted to sell diamonds via its own brand.

A turning point took place in 2001 when Nicky Oppenheimer took over the position as CEO of the De Beers Group. He came up with an idea which helped the company bypass antitrust laws in the U.S.. De Beers created a joint venture with LVMH, a worldly renowned luxury retail conglomerate, and successfully opened its first retail store in Manhattan, New York. It doesn’t violate the laws because technically, it is LVMH who is selling diamonds as an agent of De Beers’s own brand, not the De Beers Group itself.

The De Beers Jewelry retail store in New York.

Resource: http://www.2luxury2.com/the-jeweller-of-light-opens-first-store-in-canada/

The move means that after disappearing in the U.S. for almost 60 years, De Beers was finally able to return to the American diamond retail market officially. De Beers used to monopolize the raw diamonds market since it controls majority of resources, but now it no longer needs to lean solely on limiting supply. Its legitimacy in selling at retail level grants the group not only a longer value chain, but also a new profit point. Henceforth, the De Beers Group has transformed from merely a monopoly in diamond production and distribution, to a giant who also has a place in the retail market.

- Higher investment value than gold?

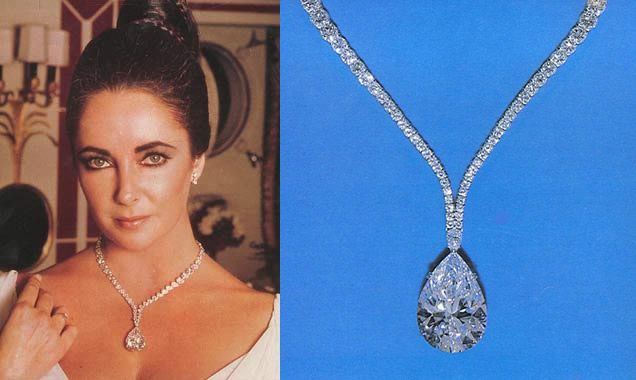

Elizabeth Taylor and her 69.42-carat pear-shaped diamond – Taylor Burton

Resource: http://www.jointventurejewelry.com/blog/2011/03/the-many-jewels-of-elizabeth-taylor

Speaking of impervious pricing, we have to talk about the investment value of diamonds, because people are likely to invest in things with stable value, such as gold. But are diamonds the same case? The public is constantly fed with stories of making money by reselling diamonds. We all know the story that Richard Burton gave Elizabeth Taylor one of the biggest diamonds in the world whose price was $1 million, and Taylor auctioned it for more than $3 million. Jewelry companies and the media always claim that diamonds weighed more than one carat have high investment value, and it keeps increasing by 5% every year – but is this true?

In 1970, a London magazine company spent 400 pounds on two 1.5-carat diamonds, in order to verify if their value would go up. Eight years later, when the chief editor Dave Watts tried to sell the 2 diamonds, most of the stores refused to pay in cash. The highest offer was 500 pounds for 2 diamonds. Taken the inflation at that time into consideration, the 2 diamonds only worthed 167 pounds if it had been in 1970.

The Netherland Consumer Organization had conducted a similar experiment. They bought a diamond weighed more than 1 carat, and tried to sell it to the top 20 jewelry brands after 8 months. Nineteen of them refused to purchase. The only one company who was willing to buy the diamond offered a price much lower than it cost.

Zihong Wan is the founder of MAKELUMER, the first diamond retailor in China. According to him, if consumers buy diamonds in traditional department stores, 25% of the market price goes to the store, 42% to the brand, and 33% to the supplier. He also pointed out that the retail price of diamonds of general brands is 4 times the factory price, with a markup rate of 300%, and that of luxury brands, such as Cartier and Bulgari, can reach as high as 500% to 700%. Suppose a consumer buys a diamond ring for $20,000 in 2010, and he wants to sell it after 10 years. According to the pricing structure, he can only sell it at around 20% of the diamond ring’s market value in 2020 at most. Even if he just wants to not lose money –not taken inflation into consideration – he will need to sell it for more than $100,000. This means that the market price of the diamond ring in 2020 has to be 5 times that in 2010. However, if we take a look at the first graph in the article, we can easily find out it used to take price of diamonds about 30 years to quintuple, and then another 20 years to double. From the calculation, it seems that investing diamonds is not that profitable, especially that we were not considering inflation. Lack of reselling channels and the pricing structure of diamonds bring doubts to the investment value of diamonds.

- Will the Price of Diamond Fall?

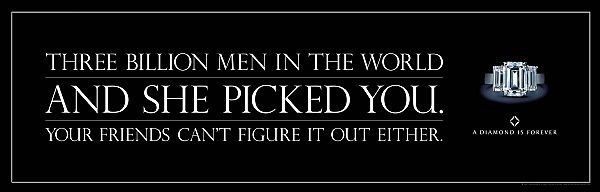

As mentioned earlier, the value of diamond depends not only on its actual value, but also how much people believe it is worth. Since Harry Oppenheimer hired Ayer – an advertising company – in 1938, it has been trying to associate diamonds with timeless love, upscale fashion, and unique art. It employed celebrities, designers and famous paintings from Picasso, Derain and Dali to reinforce advertising effect. In 1947, the most renowned slogan of De Beers Group was born: A Diamond is Forever. Since then, diamonds’ status as a symbol of “eternity” has been well establishd. Besides the illusion of scarcity, people believe that diamond is no longer merely a “product,” but a synthesis of love, status, power and wealth. Consumers are willing to pay for not only what diamond is, but also what it means. Moreover, the De Beers Group is trying to position diamonds as a possible form of heirloom, to encourage people to keep their diamonds instead of selling them for profit, which will further stabilize the market price.

One of the advertisements for De Beers Group’s “A Diamond is Forever” campaign.

Resource: http://www.globalchange.umich.edu/globalchange2/current/workspace/sect008/s8g7/diamond_general.htm

As mentioned earlier, Zhuojun Xu, a journalist from Sweekly Magazine, stated that vanity and greed are the two essential factors that keep the whole diamond industry functioning – one day they exist, the industry will keep flourishing. However, since the whole industry lives on a beautiful bubble, diamond merchants have to keep it from shattering by ensuring people’s desire for diamonds and their willingness to keep them. Edward J. Epstein, the author of the Rise and Fall of Diamonds, told people not to sell their diamonds, or the market price won’t be stable – maybe, that’s what “A Diamond is Forever” really means.

[1] Zhoujun Xu, Does Scarcity Make Diamonds Expensive, SWEEKLY

[2] http://edwardjayepstein.com/diamond/chap18.htm

Leave a Reply

You must be logged in to post a comment.