It’s an interesting fact of life that we often take money for granted. While it is true that “money makes the world go around” (and is constantly the source of both misery and happiness for us), the concept of what money is and what it represented is not questioned. In the United States, we rarely consider the value of money and our currency in relation to others’. These are the sorts of issues that the government, currency traders, and corporations worry about – not the everyday citizen. However, what happens when these assumptions are challenged? What happens when the value of our currency can’t be protected or backed by our government?

This is just one of many questions which have been brought up in the wake of the advent of Bitcoin. Bitcoin is a relatively new form of currency that was created in 2009 by Satoshi Nakamoto (an alias created to disguise true identity of the individual(s)). Bitcoin is a unique form currency in many ways.

First of all, Bitcoin is an electronic form of currency. This means that one bitcoin can be split into almost infinitely smaller pieces, allowing people to spend just part of a bitcoin like they may spend part of a dollar in form of quarters or dimes. Bitcoins are stored in one’s secure wallet which has a unique address similar to a bank account number: disclosing the unique address to someone allows you to pay them or vice versa. Every legitimate transaction is kept on record on a public ledger called the ‘block chain.’ Each Bitcoin wallet involved in the transaction also ‘signs’ the transaction in order to prove that the transaction was approved by both parties and is coming from the owner of the wallet.

Bitcoin it also decentralised – there is no central bank or government that backs the value of bitcoin. In the U.S., for example, the U.S. Federal Reserve decides how much money should be circulating within the economy via interest rates in order to control inflation. Bitcoin, on the other hand, uses peer-to-peer technology in order to “operate with no central authority or banks; managing transactions and the issuing of bitcoins is carried out collectively by the network.” This implies that Bitcoin is a more democratic form of currency, whose value is dictated completely by the market and how much people are willing to pay for Bitcoins.

Because Bitcoin lacks a central authority to both regulate and provide the source of the money, the way in which bitcoins are created is also different. Bitcoins are created through the process of ‘mining’ – like how one might mine for precious metals. However in this case, miners use powerful computers in order to solve extremely complex computer algorithms. Upon solving these algorithms, the miner is rewarded with bitcoins. More specifically, bitcoin mining is the process of verifying bitcoin transactions.

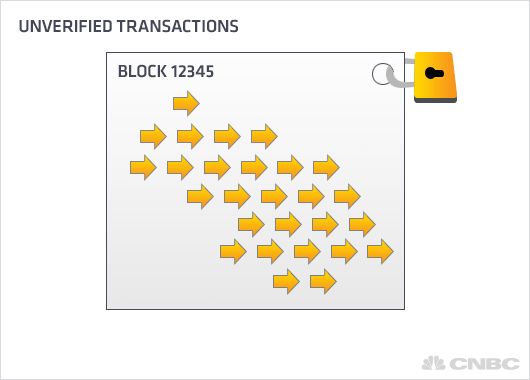

As mentioned previously, every bitcoin transaction is verified and encrypted so that others cannot undermine the integrity of the transaction by changing its details (time, amount, etc.) Since there are many transactions that happen every minute, transactions are compiled together in a box which is secured with an electronic padlock – “block chains.” Miners run software on their computers which attempt to open the padlock. Once the padlock is open, the miner is rewarded with bitcoins. According to blockchain.info, the average number of attempts it takes to unlock a block chain is 1,789,546,951.05. With a GTX 680 GPU and at the current difficulty level, a single miner can expect to mine one bitcoin in 98 years.

Because bitcoins are ‘mined,’ there are is a finite number of bitcoins available. The code that was written ensures that there will be 21 million bitcoins available. Today, there are more than 12 million bitcoins in circulation. The fewer the bitcoins are to be mined, the harder and more complex mining becomes, decreasing the rate at which bitcoins are mined. Currently, the a maximum of 25 bitcoins are able to be mined every ten minutes.

Bitcoin is an attempt to address many of the flaws present in a traditional form of currency. Much like cash, using bitcoin is almost completely anonymous. One never has to disclose their credit card details, name or identity in a bitcoin transaction, so long as their bitcoin address is valid. There are also no required transaction fees or foreign exchange fees when using bitcoins. For larger transactions – where one may gather bitcoins from multiple addresses – a transaction fee is usually expected but still not mandatory. There is an incentive to pay and charge transaction fees, however; bitcoin miners who validate the transaction are the ones who receive the transaction fee. Paying a transaction fee is “an incentive on the part of the bitcoin user to make sure that a particular transaction will get included into the next block which is generated.”

However the advent of Bitcoin has also raised significant concerns and highlighted some controversy. Due to the relative anonymity Bitcoin provides, there are some who use Bitcoin to conduct malignant operations and purchase illegal goods such as drugs. The U.S. for example, has researched heavily into Bitcoin and has illustrated its concerns over the potential terrorist threat Bitcoin poses: “The introduction of virtual currency will likely shape threat finance by increasing the opaqueness, transactional velocity, and overall efficiencies of terrorist attacks.”

However, the U.S. is not alone in these concerns. Due to Bitcoin’s connection with illicit activities, Russia has banned the use of Bitcoin: “Systems for anonymous payments and cyber currencies that have gained considerable circulation — including the most well-known, Bitcoin — are money substitutes and cannot be used by individuals or legal entities.” Furthermore, Russia had emphasized that the Rouble is to remain Russia’s only official currency, and that any introduction of other currencies or other monetary units would be illegal.

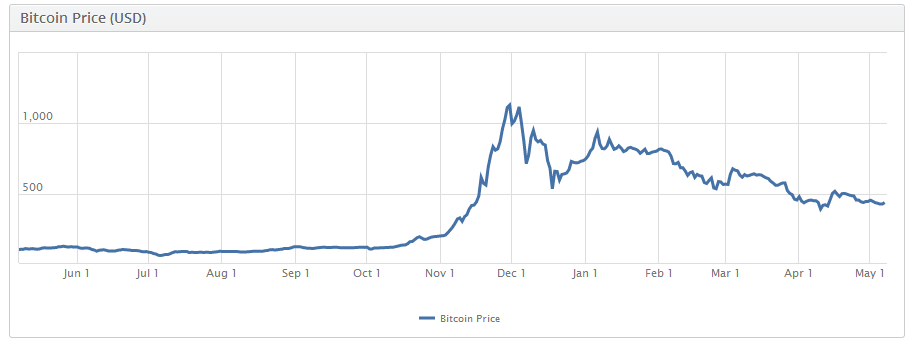

Because Bitcoin’s value at this point is completely on of public perception, it is an extremely volatile form of currency. While the lack of a central authority controlling its value means that political instability or corruption won’t affect its value, it also means that there is no force that is able to stabilize its value. In October, 2013, one bitcoin was valued at about $126 USD. Just one month later, the value skyrocketed to almost $1010 USD. In April, 2014 the value dropped back down to $420 USD. The extreme volatility of the currency is a serious cause of concern for many, preventing Bitcoin from being a universally accepted currency. Bitcoin is accepted by a few online merchants as well as select businesses and individuals around the world (mostly in Europe.)

Bitcoin remains a complex, innovative and experimental form of currency. While there have been variations of Bitcoin (such as Lightcoin and Dogecoin), its feasibility as a widely accepted form of money has yet to be tested.

Sources:

https://en.bitcoin.it/wiki/Mining_hardware_comparison

http://www.huffingtonpost.ca/2014/01/26/what-is-bitcoin_n_4661604.html

http://www.reuters.com/article/2014/02/25/us-bitcoin-mtgox-factbox-idUSBREA1O21M20140225

http://money.cnn.com/infographic/technology/what-is-bitcoin/

https://bitcoin.org/en/faq#what-is-bitcoin

https://bitcoin.org/en/how-it-works

http://www.theverge.com/2014/2/9/5395050/russia-bans-bitcoin

Leave a Reply

You must be logged in to post a comment.