For every school dance I’ve ever had, the women in my family have helped to create a look screaming of class and elegance. But whenever I found the perfect dress, the Sax Fifth Avenue price tag was simply too steep for a junior prom. No individual in their right mind would send their daughter to a dance in a $14,000 dress. But those were the only dresses that exhibited some semblance of originality. It was an inner battle between being pragmatic about costs and being unique.

I am not the only one who experiences this cognitive dissonance. Generation Z’s consumption as a whole is characterized by expressions of individual identity and realistic decision-making. More and more, the individuals of my generation are turning away from spending for possession and are instead simply spending for access. Thrifting is making a comeback, rental is on the rise, and the sharing economy is taking over. Think of the streaming services dominating media consumption, or Uber and Lyft redefining transportation. This generation’s values are driving changes in almost every industry imaginable. The global economic sphere is shifting, and it’s all due to the fact that companies are learning to meet the needs of their present and future consumer base.

Enter, Rent the Runway.

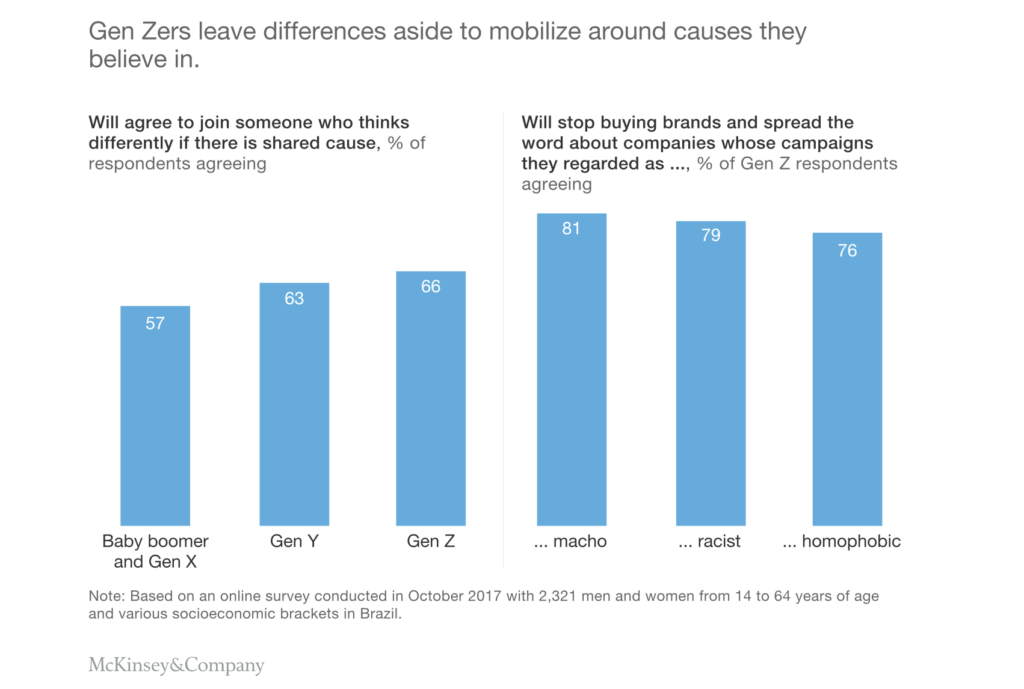

Rent the Runway was the perfect solution to my aforementioned dress dilemma. It is a service that allows one to rent high-fashion pieces for a limited amount of time. The sharing economy is entering the fashion world through services like these and changing the landscape. A study by McKinsey recently elucidated significant characteristics of Generation Z and their implications for companies today. Essentially, what we think and how businesses must adapt to stay afloat. Our main consumer habits reflect our preferences toward shared goods, singularity, and ethics. When inserting these qualities into the fashion framework, we can see where the shifts in the industry are and where they will be.

Ownership is Down For Gen Z

McKinsey notes that my generation isn’t as focused on possession as the generations before us. The sharing economy has produced companies like Zipcar and Airbnb, and the trend is growing into the fashion industry. Young adults find little value in a single expenditure that only produces one item. Purchasing a subscription or participating in the sharing of goods and services seems more pragmatic and efficient. Additionally, many clothing items, especially luxury goods, see only one use. The formal dresses I purchased in high school have never again seen the light of day, simply taking up space in my closet back home.

So why are young people not keen on re-wearing big ticket clothing items? To put it simply, they don’t want to be seen wearing the same outfit more than once on social media. Polls from the The Hubbub Foundation, a British charitable organization, found that 1 in 6 individuals would not wear an outfit if it had already been featured on Instagram or Facebook. I even find myself pausing before posting photos with the same clothing combination, or at least attempting to wait before repeating a look.

This is why fast fashion finds such a stronghold in society. Fast fashion produces the opportunity to cheaply purchase a clothing item and throw it away after a month of use. That way, no one has to repeat outfits. But fast fashion comes with its own consequences, both surface level and environmental implications.

Gen Z Craves Singularity

With everyone purchasing clothing from the likes of H&M, Forever 21, and Zara, it’s difficult to have a unique identity. There were three different girls at my senior prom wearing the exact same dress. The dress was cute in a traditional sense, but it was popular because it offered an alluring price tag. One of these individuals was a friend of mine, and I remember her fury. Few members of Gen Z wish to blend in with the pack. Rather, individuals want to stand out among their peers, be original and unique. It’s difficult to achieve this with traditional retail models, which is why practices such as renting and consignment are on the rise.

These practices allow young people to seek out the pricier brands that they would otherwise sport. Renting and consignment open doors to the segment of the fashion industry normally closed off to those pragmatic spenders, allowing for increased opportunities for originality. Gucci’s brand is unique, and now it can be accessed by multiple social classes. The classic pair of Gucci Cat Eye sunglasses retails for $485, but you can rent them at 85% off, wear them for your week-long staycation in San Clemente, and then send them back.

The same can go for unrivaled vintage items on the Real Real and other similar consignment sites. In 2019, It’s almost too easy to be unique, just ignore the Forever 21’s of the world. In 2019, It’s almost too easy to be unique, just ignore the Forever 21’s of the world.

Gen Z Has a Heart

With fast fashion, it’s difficult to be one-of-a-kind. But fast fashion poses a problem exponentially more severe: its threat to the environment. Purchasing vast amounts of cheap clothing and tossing it after a few uses is terrible for the planet. According to the Ellen Macarthur Foundation, textile production accounts for 1.2 billion tons of annual greenhouse gas emissions. To put that in perspective, that’s more than maritime shipping and international flights combined. Moreover, when these garments are washed, they release plastic microfibers that contribute to ocean pollution. Big names like Stella McCartney have called for change in the fashion industry, urging high and fast fashion alike to change the way they do business. This change will come in the form of rental and thrifting, and while it will help the environment, it will also be very lucrative.

As represented in the graph above, Gen Z genuinely cares about the ethics of the companies they support. It’s the rise of the conscious consumer. A generation that grew up using the internet knows exactly how to access any and all information about the practices of brands and companies. If they find that a brand does not actually support a cause they claim to align with, or if some sector of their company is participating in socially or environmentally detrimental activities, they will lose business.

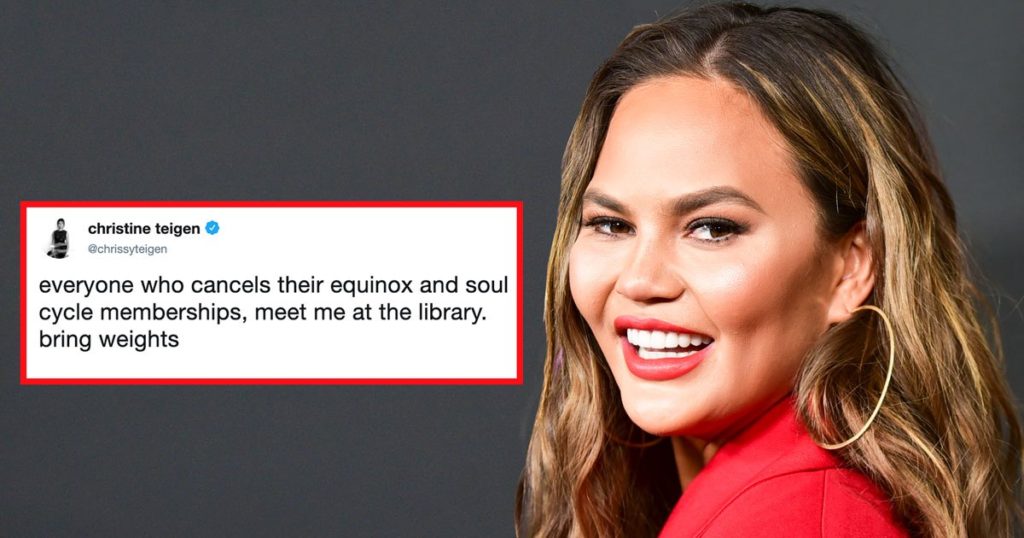

Recently, the fitness giant SoulCycle, experienced black-lash after a member of its leadership planned to host a fundraising event for President Donald Trump’s campaign. As the president is widely seen as the embodiment of nationalism gone wrong, many young people raised their voices on social media against SoulCycle, claiming they would take action. A study compared sign-ups at various locations across the country before and after the news hit. There was an average decline of 12.8%, which is a very notable shift for a fitness company.

On the other hand, if a brand is actively crusading for a cause that makes sense for them and improves some sector of society, they will generally see an influx of business. Urban Outfitters has come out with their own clothing rental service, Nuuly, for itself and its subsidiary brands (Free People and Anthropologie). Additionally, Bloomingdales has created their own rental segment of the company, My List, which allows customers to rent different pieces of clothing, also allowing them to purchase the product after the rental period. Like the others, RealReal, a luxury consignment company, promotes re-commerce and environmentally friendly methods of consumption.

These brands are promoting a change in the fashion industry, and young people have and will take that into account when choosing where to spend their money.

Luxury Retail’s Snootiness Needs to Go

(Gen Z alone will account for 40 percent of global consumers by 2020. (Mckinsey fashion thing)

Some luxury brands like Chanel and Louis Vuitton are showing resistance to the trends of rental and thrifting. They believe that these practices force their products to appear second-hand. But those who purchase them don’t find this to be true. They see it as giving something a second life. Wearing something with a rich history and remaking it as their own. It all depends on how you look at it, but what’s certain is that these luxury brands have an opportunity to expand their audience to the youth who crave originality and rarity. According to McKinsey’s State of Fashion Report, Gen Z will account for 40 percent of global consumers by 2020.

Moreover, it doesn’t seem like high fashion has any choice but to change their businesses. Luxury stocks are down, and according to a Forbes article, Goldman Sachs and many other financial institutions are claiming that luxury sales growth is and will continue to slow. You can check this yourself and put actual numbers behind it. And the stock price might be a consequence of many different factors. You might want to look at annual sales of Gucci and LVMH as a proxy.

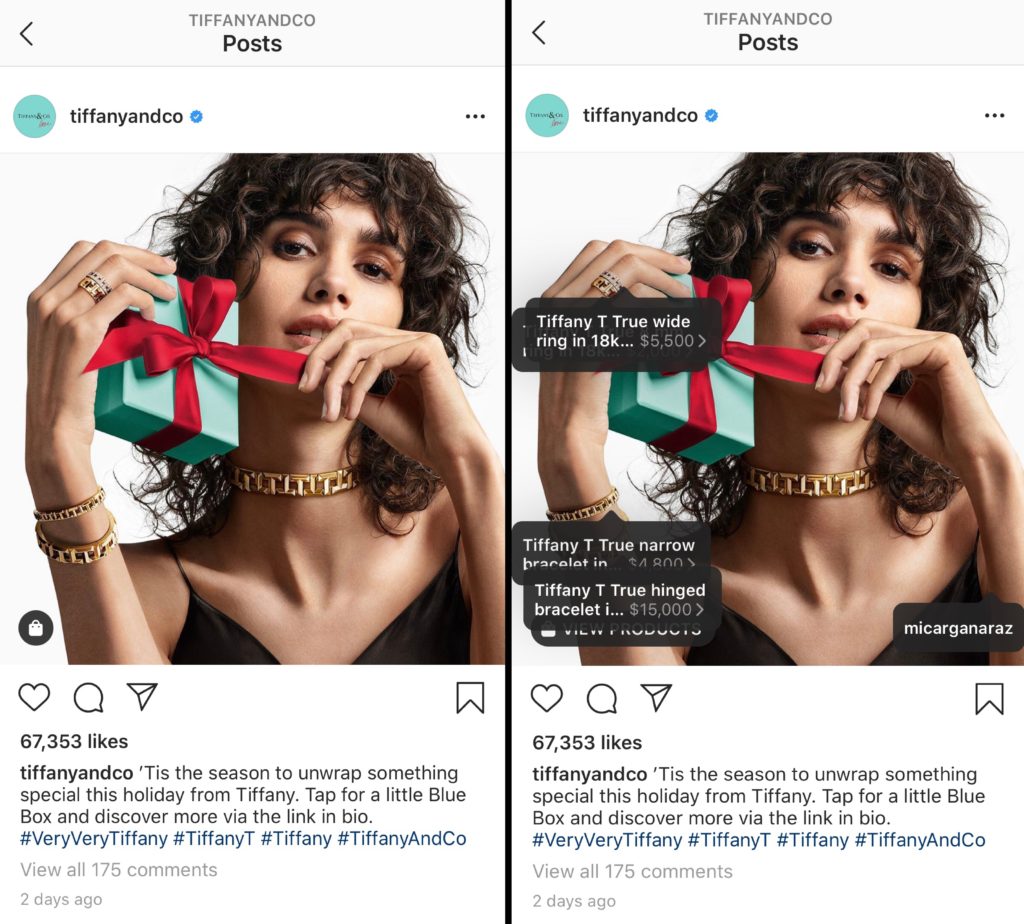

But digitization and joining in on the trends of tomorrow could help these brands maintain their dominance. Euromonitor claims that luxury sales grow online at a faster rate than physical retailing. Social media sites like Instagram have released features that allow users to purchase products directly through the application, simply by clicking on an influencer or company’s post. Generation Z is relying on social media and the internet more, and the antiquated luxury brands must capitalize on this behavior to stay afloat. Tiffany & Co has used social media like no other luxury brand has. The company has truly taken advantage of social media marketing, and the luxury world must look to them as the example. At the conception of their business, the RealReal partnered with the infamous Kardashian family when the women released 200 pieces from their closets onto the consignment site. The traditional fashion landscape wouldn’t expect wealthy members of the elite to participate in thrifting behavior, but there the Kardashians were, supporting the brand.

The RealReal’s stock is performing tremendously well. While it’s still in its early stages and slightly volatile, most fashion brands exhibit similar trends. The Nasdaq reports a relative strength index of 59.84, which means it’s solidly within the ideal 30-70. Every day, more and more Fashion companies are adding themselves to the lucrative field. Rent the Runway, one of the first luxury rental services, had so many orders they had to put their entire operation on hold to catch up. In the very near future, fast fashion will be obsolete and the industry will be sustainable and cost-effective. Gen Z has a message for you, and it’s to “Buy Less, Wear More.”

Sources

- https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/true-gen-generation-z-and-its-implications-for-companies

- https://go.euromonitor.com/webinar-luxury-goods-2018-luxury-goods-trends.html?utm_source=blog&utm_medium=blog&utm_campaign=WB_18_12_06_REC_Luxury%20Goods%20Trends&utm_content=luxury_goods_trends

- https://www.forbes.com/sites/pamdanziger/2018/12/18/whats-ahead-for-the-luxury-market-in-2019-expect-turmoil-and-slowing-sales/#296e011c6578

- https://www.ellenmacarthurfoundation.org/assets/downloads/publications/A-New-Textiles-Economy_Summary-of-Findings_Updated_1-12-17.pdf

- https://www.hubbub.org.uk/blog/can-the-fashion-industry-become-sustainable

- https://www.theatlantic.com/health/archive/2019/09/soulcycle-boycott/597478/

- https://nysenewsguru.com/2019/10/28/shocking-alteration-the-realreal-inc-nasdaq-real/

- https://www.mckinsey.com/~/media/McKinsey/Industries/Retail/Our%20Insights/The%20State%20of%20Fashion%202019%20A%20year%20of%20awakening/The-State-of-Fashion-2019-final.ashx