It is not surprising that President Trump has launched of tariffs against China. However, he is now acting on these threats on a very large scale, so the consequences are being felt. The United States has, so far, implemented duties on $400 billion of Chinese imports. This course of action has caused China to retaliate by announcing tariffs on $60 billion of US goods. When tariffs raise the price of imported goods, costs become inflated for businesses and so prices go up and demand goes down. This would cause harm for the US economy and could ultimately result in an economic decline.

In China, stocks and currency have already been harmed due to concerns about an upcoming trade war. The Shanghai composite index is down 18.657. Trump has threatened to expand tariffs to cover basically all imports from China to the US. China is trying to avoid following Trump’s lead as its economy is already feeling the negative effects of these tariffs. China believes that escalating the trade war will cause harm to the global economy. If Trump continues to push the country, China may retaliate by swamping US firms operating there with red tape or by using a weaker yuan as a weapon to create demand for Chinese products. President Xi Jinping has become powerful by elevating China into a global power and so he can not afford to let the US destroy its progress. President Trump does not seem like he will back down anytime soon, however, as he believes that he can win in this dangerous game of chicken.

Opposingly, many US investors don’t seem concerned about the brewing storm with China, as the Dow Jones Industrial average is up 6.96% this year. Others are preparing for the worst in the belief that these tariffs will cause the US economy to decline. The CBOE SKEW Index rises when option trades signal the concern of an unexpected event that could have a major impact. This index is close to the highest that it’s been since records began in 1990. Part of this fear stems from the reality that no one knows how far these trade wars will actually go. Many American companies operating in China have already started to confront obstacles and are becoming increasingly worried about Chinese retaliations. These companies are faced with tariffs as well as increased inspections and slower customs clearance.

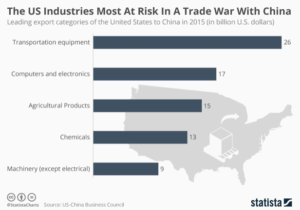

This graphs illustrates the specific industries that would face the most harm due to the disputes with China. However, Trump is attempting to help these industries. He has stated that he would may impose tariffs on basically all Chinese goods if the Chinese government retaliates on the current tariffs by targeting US farmers and workers. Trump has announced $12 billion in aid to US farmers to offset retaliating tariffs. This may not be enough for workers who are putting their livelihoods in the hands of Trump’s negotiations.

While the United States has yet to be harmed economically due to the trade wars with China, the future is uncertain. There are signs that point to an economic decline. Many of future concerns stem from how far Trump is willing to take these tariffs and the extent to which China will retaliate.