After smothered in gravy and filled with, Americans across the nation begin to plot their plans of attack for the Black Friday sales. Since 1952 Americans have kicked off their Christmas shopping season at major retailers on the Friday following Thanksgiving.

The fact that Black Friday also takes place on a Friday – duh – every year is perfect for retailers looking to drive long weekend sale deals because Americans traditionally have not had to return to work the Friday after Thanksgiving. The commercial holiday is a long way from becoming outdated. In 2015, 90% of all Americans reported that they intended to shop on the commercial holiday. However, with the increasingly popularity and convenience of e-commerce as well as the advent of “Cyber Monday”, which made its debut back in 2005, has possibly had a negative impact on companies’ sales revenues.

Reports from 2016’s Black Friday have rolled in and while more Americans went shopping this year in stores and online than in any other year in the Black Friday weekend’s 64-year-old history, American consumers spent considerably less.

Special offers! 10 percent off! Mega Deals! Are all familiar gimmicks that attempt to grab the attention of unsuspecting bargain-loving buyers. Price discrimination is a tactic frequently used by stores around the holidays. It involves the selling of the exact same product at various prices based on different buyers willingness to pay.

There are three degrees of price discrimination. The first, which is alternatively known as perfect price discrimination, occurs when firms charge different rates for every unit consumed enabling them to capture all available consumer surplus. The second-degree involves charging different prices for different quantities, including quantity discounts for bulk purchases. An example of second-degree is when a movie theater offers discounts or deals on snack bundles as a way of getting moviegoers to spend more at the snack bar. The third-degree means charging a different price to different consumer groups like cheaper bus tickets for children and seniors or negotiated gym memberships.

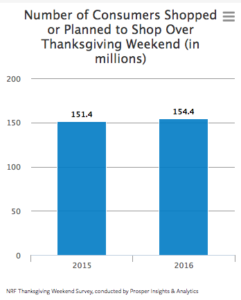

According to this year’s National Retail Federation survey – released the Sunday after Black Friday – approximately 154 million Americans went shopping over the Thanksgiving weekend. An estimated 108.5 million consumers shopped online alone. The numbers indicate a considerable increase, up from the 151 million shoppers that contributed to sales revenue in 2015. Average spending per person dipped slightly from the previous year’s $299.60 to $289.19. The fall in spending is somewhat surprising when taking into consideration wage gains, continued employment growth and a rise in consumer confidence as 2016 comes to its close.

The Friday deals are not necessarily the best offered throughout the year. The day is not geared towards the benefit of the consumers, but rather a device utilized by retailers to clear end of year inventories with artificial deals and storewide discounts. Professional shopper and Black Friday Veteran Dan de Grandpre explained it best in an interview with the New York Times: “Black Friday is about cheap stuff at cheap prices, and I mean cheap in every connotation of the word.”

Sources:

http://www.economist.com/blogs/economist-explains/2015/12/economist-explains

http://fortune.com/2016/11/27/black-friday-nrf-shopping/

http://www.economicsonline.co.uk/Business_economics/Price_discrimination.html