Chinese e-commerce giant Alibaba on Tuesday filed for its long-awaited initial public offering, one of the largest in history.

Alibaba –described as eBay, Amazon and Google rolled into one – was evaluated at $150 billion to $200 billion. Its stock debut immediately gave it a higher market value than Facebook and Amazon.

It was estimated that the Hangzhou-based tech behemoth to raise $15 billion to $20 billion, exceeding Facebook’s record-breaking $16 billion IPO in May 2012.

Alibaba was founded in 1999 by Jack Ma, who was turned down for a number of jobs before starting his own e-commerce empire, including a manager post at a Kentucky Fried Chicken store.

Alibaba’s businesses include online shopping, business-to-business sales, online payments, shipping, wholesale trade and cloud computing. Alibaba’s retail marketplace last year processed 11.3 billion orders from 231 million active buyers for a total of $248 billion in purchases, more than the transaction volume on eBay and Amazon combined. On Singles Day in November, a popular holiday in China for online shopping, the company’s online retail portals processed $5.8 billion in spending. Alibaba earned net income reached about $1.4 billion last year with $5.6 billion in revenue.

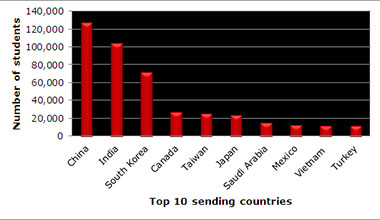

While little known outside of China, Alibaba dominates the e-commerce market in the world’s second biggest economy. The company’s Taobao service has 800 million product listings from 8 million sellers. About 80 percent of all Chinese e-commerce transactions go through Alibaba.

The company also has strong U.S. ties. Yahoo owns a 22.6% stake in Alibaba. The IPO is great news for Yahoo investors and Yahoo shares rallied on that report. The Alibaba IPO filing followed the debut of Weibo , Chinese version of Twitter, which raised $286 million in April.

In the past few months, Alibaba invested $215 million in Mountain View mobile messaging service TangoMe, pouring $250 million into San Francisco ride-sharing app Lyft and $206 million worth of investment into ShopRunner, a delivery service for online purchases.

Alibaba has dropped billions of dollars to acquire other Chinese companies as well, including a $1.2 billion purchase last week of 16.5% share in China’s Youku and Tudou, Chinese equivalent to YouTube and Netflix.

However, Alibaba faces the challenge of convincing investors it will be a good buy.

The biggest concern has to do with transparency. People have suspicions about the way Chinese companies are operating, and they want know specific numbers and details about Alibaba’s books.

Analysts estimate the company could be worth $136 billion to $245 billion when it started to sell stocks, according to Wall Street Journal.

One key concern is where Alibaba’s core revenue growth is coming from and the company’s system for recording and reporting sales.