We are all familiar with the story by now: on September 1, 2016, Colin Kaepernick, a quarterback for the San Francisco 49ers at the time, took a knee during the National Anthem to protest racial injustice in the United States. But, while that action and those that followed have been talked about endlessly in the media in the context of politics and sports, much less has been discussed about Kaepernick’s complex impact on the stock market and the American economy.

Kaepernick kneels during the National Anthem. Source: Boston Globe.

Although the movement began as an unnoticed protest, with Kaepernick sitting on the bench during the National Anthem, his actions eventually turned into a full-fledged movement. Not long after he began, players across the National Football League sat, kneeled, or showed a fist of solidarity during the patriotic song. While the American public was busy discussing whether Kaepernick was un-American and team owners and coaches were determining how to react, the NFL was experiencing an additional layer of complications, which only revealed itself later: a drop in ratings. In October of 2016, JPMorgan announced that ratings for the NFL had decreased 6% in Week 6 compared to ratings from the same time the previous season. Immediately, some football enthusiasts pointed to the retirement of long-time favorites like Peyton Manning and the injuries of other star players to explain the drop. Despite those arguments, Wall Street experts reduced their projected profits for the owners of major TV networks, and a Credit Sussie analyst lowered his forecasts for both Twenty-First Century Fox and CBS. To top it all off, in the summer of 2017 CBS released a study which showed that average TV viewership during the 2016 season dropped 8% from the previous year and that national anthem protests were “a factor” in the decline.

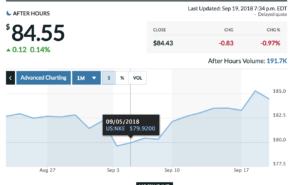

On September 5, Nike shared its ‘Dream Crazy’ ad campaign for the first time, featuring Colin Kaepernick. After a short immediate downturn, the stock has since been continually climbing. Source: Market Watch.

Fast forward a bit, and stop on Labor Day of this year. On that day, Kaepernick tweeted about his ad partnership with Nike for their campaign ‘Dream Crazy’, and his announcement was immediately met with harsh criticism and demands for a boycott of the company’s products. Although Nike’s stock price did take a fall when markets re-opened after the holiday, as of September 19, the stock is up to $84.43 a piece, or a 5.28% increase over 2 weeks. Additionally, Nike recently reported selling 61% more merchandise since airing the campaign, which shows that customers are actually broadly supportive of the brand’s advertisement decision.

How did Nike pull this off, given that not long ago Kaepernick was seen as so divisive some Americans chose not to occupy their time with something other than football? One major factor may be a different customer base for Nike than the NFL’s viewership. But, some have also pointed out that Nike’s controversial ad actually falls in line with the company’s values and history. One analyst from Piper Jaffray noted that Nike is “known for ‘pushing the boundaries of social and cultural norms,’” describing past campaigns featuring Lance Armstrong or tackling HIV/AIDS. Thus, although the decision was a bold step for Nike, the company had a history of success in the area.

The ‘Dream Crazy’ advertisement revealed by Nike across the country in September. Source: ABC15 Arizona.

So, at what cost does Colin Kaepernick come? For the NFL, team owners, and broadcast companies, it was not an indiscernible one in 2016. Kaepernick’s actions unleashed a chain of events that ended in clear economic impact, with less viewers watching NFL games leading analysts and investors to pull back. But today, Nike has stood to benefit from its intentional alliance with Kaepernick, showing that when the moment and the context are both right, embracing a complicated situation rather than avoiding it can pay off (quite literally).

Leave a Reply

You must be logged in to post a comment.