Since the results of the 2016 United States presidential election rolled in on Tuesday, November 8th there has been plenty of speculation regarding what a Trump Presidency will mean for the United States. Issues regarding foreign policy, the environment, women’s rights, healthcare and so on were widely debated and contentious topics leading up to the election. One issue in particular – the US economy — is a burning question that’s left many Americans wondering who will benefit from President-Elect Trump’s economic plan.

Brexit and the subsequent economic implications including the devaluation of the British pound seemed almost like a harbinger or warning call of what the Armageddon-like results of 2016 would be like if Donald Trump won the election. In the days following the November 8th result the stock market responded in a way that left many economists, political pundits and speculators curious to say the least. The early stock market response was overly positive with the DOW, Nasdaq 100 and S&P 500 spiking up considerably in the morning after the election and continuing to show positive trends. But what exactly elicited such a positive response from the markets, which all seemed to signal economic victory?

Some experts believe that it may have to do with the Trump administrations promise to cut regulations, a vow to dismantle the Dodd-Frank financial reform, and the corporate tax rate, a move that would benefit the private sector tremendously. The “Trump-ed up” trickle down economics that Hillary oh so cleverly coined during the debates, refers to his plans to cut corporate taxes, from a top rate of 35 percent down to 15 percent; in addition, cutting taxes on America’s wealthiest from 40 to now 33 percent for top rates.

Others believe that the results motivated investors to pour money into major construction and engineering stocks in anticipation of a Trump stimulus package for America’s infrastructure that would include major improvements to roads, bridges, telecommunication, public transportation, “world-class” airports, security and utilities while simultaneously creating new jobs and higher wages.

“For the U.S. domestic economy, the obvious winners are infrastructure, with a focus on roads, bridges, and airports,” said Mark Burgess, global head of equities at fund company Columbia Threadneedle Investments (Dieterich).

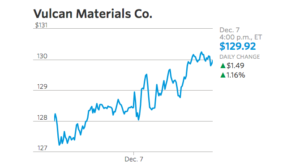

Burgess’s reasoning would explain why the DOW, Nasdaq 100 and S&P 500 companies dealing primarily with industrial materials and services have experienced continued growth in stock values since November.

“A Goldman Sachs report cautioned that the new U.S. infrastructure spending — which Trump has put at from $500 billion to $1 trillion — would not begin until the third quarter of 2017. Moreover, the price tag is a combination of private and public money, so the scope of Trump’s plan depends on how he counts,” (Mufson).

With all this in mind the question remains, where should we invest? In order to answer this question, it is important to first take a look at the President-Elect’s economic plan. While Trump’s plan could change at the drop of a hat as soon as he enters the Oval, analyzing his current proposal is one of the first steps prior to making investments.

Trump’s vision includes the creation of a dynamic booming economy with 25 million new jobs over the next decade. Trump believes that under his presidency there will be a 3.5 percent growth per year on average. Creating all of these new jobs will result from the Trump energy policy, which he plans to “unleash” as soon as he takes office. The energy policy main objective is to make the US entirely energy independent and in doing so create millions of new jobs and protecting clean and clean water. One of the main problems that has been cited with this plan though is that Trump wants to focus all of this energy plan’s efforts on coal, oil, and natural gasses – all of which contribute to pollution and directly contradict the Paris Climate change agreement. Shifting the focus away from environmental protections and issues could mean an overall increase in drilling everywhere, especially Federal land holdings:

“Lifting unnecessary restrictions on all sources of American energy (such as coal and onshore and offshore oil and gas) will (a) increase GDP by more than $100 billion annually, add over 500,000 new jobs annually, and increase annual wages by more than $30 billion over the next 7 years; (b) increase federal, state, and local tax revenues by almost $6 trillion over 4 decades; and (c) increase total economic activity by more than $20 trillion over the next 40 years,” (www.donaldjtrump.com).

The energy policy could mean big returns on energy investments. The big American oil companies, Exxon Mobil (XOM) and Chevron (CVX), will undoubtedly benefit from a pro-oil and natural gas administration. Companies dealing with energy infrastructure should also be given a closer look. Making federal land readily available and investing less in alternative clean energy would drastically support big oil in general. The appointment of Scott Pruitt, former Oklahoma attorney general, to President-elect Trump’s to run the Environmental Protection Agency is a clear signal that the Trump administration plans to shift energy policy’s attention away from clean and renewable energy. Mr. Pruitt, a Republican, is already noted as being a climate change denialist. During his time as Oklahoma’s attorney general, he fought vehemently against President Obama’s climate change policies battling on behalf of the coal industry. In fact, as Oklahoma’s top prosecutor Pruitt went so far as to sue the EPA. The appointment, while bleak does spell out good news for the fossil fuels industry and those who wish to invest their assets in the same companies that gave Pruitt under the counter campaign contributions.

The energy policy makes a stipulation that under a Trump administration the President-Elect would like to see the US become the world’s leader in energy technologies including nuclear power. A company like BWX Technologies (BWXT), which specializes in energy infrastructure –more specifically nuclear energy technology – with a large government, services and facilities management division could see a rise in stock earnings over the next few years. The day of the election BWX Technologies stock traded at 36.63 before spiking up the next day to 39.54, with continued growth since the election and a 5-year record high on November, 25th at 40.52.

“Analysts at Cantor Fitzgerald recently predicted that there would be a “violent increase” in uranium prices at some point, theorizing that as much as 80 percent of the uranium market might be uncovered in terms of supply by 2025, and that demand would by then outstrip supply,” (Stafford).

Beyond the infrastructure and energy sectors, there are several top industries that will be impacted by the upcoming Presidential administration. Defense will be huge, YUGE! Trump has already indicated that he wishes to expand the size of the Army and Marine Corps dramatically, build new vessels for the Navy and jets for the Air Force, all while modernizing the US’s nuclear arsenal. Lockhead Martin (LMT), Raytheon (RTN), General Dynamics (GD), and BAE Systems (BA), are just a few of the big name defense stocks that have enjoyed growth in investments following last month’s presidential election. Trump’s rhetoric of slashing corporate taxes while beefing up America’s military was the perfect concoction for what resulted with investments in the defense sector.

“‘Trump’s win is good news for the defense industry, especially when coupled with Republican majorities in the House and Senate,” said Loren Thompson, a defense consultant who advises many of the nation’s top-tier contractors,’” (Heath).

Defense shares have continued to hold on to steady numbers and still offer new buying opportunities for interested investors. Lockheed Martin alone, experienced a 20-point stock jump following the election results and — as of December 7th — continues to hold on to a solid 266.38 valuation (Carson). Trump’s eagerness to increase the size and capacity of the military will directly benefit defense contractors like BAE Systems and General Dynamics, as well as helicopter and plane manufactures like Boeing.

“Eaglen acknowledged that “‘the major defense contractors are part of the establishment he’s railing against.’” But she said Trump does not really have a choice but to stick with them. “‘If he wants to show results, he’s got to live with the contractors he has,” she said. “‘You have to go with the production lines you have open,’” (Heath).

A conservative estimate of Trump’s promised budget has been projected at an additional $55 billion in defense spending. A question that remains though is where exactly Trump plans to find the money to pay his steep tab.

Speculative investments on defense contractors have run rampant in the past month. One company that drew attention, in particular, was Magal Security System (MAGS), the company responsible for building the infamous high-tech fences and walls along Israel’s volatile border. Magal Security System was also responsible for the erection of a massive separation barrier along the West Bank, which includes cameras, sensors, and robotic technology. The supposed wall that Trump plans to build across the US-Mexico 1,933 mile long border likely has something to do with Magal Security System’s uptick in stock prices. The company’s shares were up 24 percent from its 4.45 closing price on Election Day.

“‘We believe that the U.S. government is going to increase its security budgets in the upcoming years and definitely we look forward to take part in it,’” the company’s chief executive, Saar Koursh,” (Scharf).

If your consciousness has not already felt besieged by the possibly lucrative albeit morally ambivalent ways in which you can see investment returns over the next 4 — hopefully 2 — years than prepare yourself for the next industry that might be headed for an upswing. Private prisons.

It was only two months ago that the Justice Department announced a plan to abolish the use of private facilities for its federal inmates. The decision led to a correlated stock dip in corrections companies – an arguably rightly so.

Unfortunately, Trump’s win has revived the stock earnings of America’s controversial industry. While the President-elect has yet to mention any specific plans of private prisons during his presidency his Nixon-esque “Law-and-Order” candidate rhetoric has left many people believing that he will ensure and protect these private facilities. Investors are speculating heavily that the administration will require the private prison infrastructure to carry out its “feasible” plan fro a mass-scale deportation plan.

Two of the largest private prison companies – CoreCivic (CXW) and the Geo Group (GEO) – saw spikes in their stocks following the election results (Harlan).

Ultimately – though – our hot Cheeto President-Elect has a hot temper and trigger finger when it comes to shooting out tweets and absurd statements that have the power to increase and decrease the value of stocks in a matter of seconds. Just yesterday morning, Trump tweeted out:

“Boeing is building a brand new 747 Air Force One for future presidents, but costs are out of control, more than $4 billion. Cancel order!”

The problem with his tweet? Other than falsely overestimating the budget of the Air Force One replacement program by roughly $2.0 billion is the impact his words had on Boeing stock. The Boeing stock took a momentary nosedive before recovering by the closing bell. The event is just one example of how the reckless and ill-informed words of America’s soon to be leader could have dire impacts on the US economy and stock market.

Sources:

http://www.thefiscaltimes.com/2016/12/07/Nuclear-Power-Could-Boom-Under-President-Trump

http://www.nytimes.com/2016/12/07/us/politics/scott-pruitt-epa-trump.html

http://www.nasdaq.com/article/how-to-invest-during-the-trump-presidency-cm708605