There was a lot that was confusing about the November Republican debate, when the economy took center stage as a topic.

Senator Rand Paul said he would like for the U.S. to get ride of the Federal Reserve. A couple candidates trotted out the idea of returning to the gold standard. But equally as puzzling was the consensus among the candidates that what America really needed to spur job growth was deregulation.

The candidates’ parroting the virtues of deregulation was puzzling for at least one major reason: a lack of federal oversight, according to many financial and policy experts, was one of the major causes of The Great Recession.

The deregulation that set up the financial crisis of the late aughts didn’t fall under the purview of any one administration. Under President Bill Clinton’s administration, for instance, the Glass-Steagall act was repealed — regulations that served to keep the business of main street (that is, things like mortgages) from the business of Wall Street (investment).

But Gramm-Leach-Bliley toppled those walls, allowing companies like JP Morgan and Goldman Sachs to use mortgages as a financial product, able to be packaged into CDO’s, bought, sold and bet against. And as those mortgages got riskier and riskier, because there was no federal regulation, there was no oversight, and thus, no one to pump the brakes.

All of this was pretty clear when the collapse happened. Main Street, right or wrong, pointed its fingers at Wall Street, as did the government. Round after round of congressional testimony berated Wall Street executives. In the wake of the public outcry, Dodd-Frank and the Volcker Rule were passed, which — at least in theory — put an end to investment banks having CDOs, restricted them from making certain kinds of speculative investments and limited the kinds of hedge funds banks are allowed to own.

But that was yesterday.

In today’s presidential race, many prominent candidates, particularly within the GOP, are once again touting the virtues of financial deregulation.

Which raises the question: are you freakin’ serious?

These are the candidates who are quick to say that we are still in financial recovery — a recovery that came about in large part by deregulation. So what gives? How can these candidates tout lack of oversight and call it “job creation” and “economic opportunity” with straight faces?

The answer is frustratingly simple: because there’s a lot of money involved.

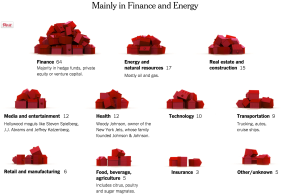

The New York Times recently completed an investigation into campaign donation thus far in the presidential race. They found that, so far, 158 families have provided almost half of all the early money to presidential candidates. These families tended to be rich, white, older, and headed by men. They leaned conservative. And of the industries they represented, the largest was finance.

As it turns out, they’re a very specific group of financiers that are backing GOP candidates: hedge fund owners, venture capitalists, and partners in private equity firms.

Of those 158 families, 138 are supporting GOP candidates. And of those 138, nearly half (64) are involved in finance.

The potential payoff is clear. Democrats have pledged to uphold Dodd-Frank, and have argued for changes that would introduce higher levels of corporate and investment taxation. The GOP, meanwhile, in the name of promoting economic growth and opportunities, has fought these policies, urging instead for broader tax cuts and deregulation of the finance and energy industries.

Adopting those policies makes smart business sense if you’re a Republican presidential candidate: the total amount those 158 families have donated thus far to presidential campaigns is about $176 million dollars.