One of the victim babies who had used poisoned domestic infant milk powder.

In 2008, baby formula milk powder scandal broke out in China. Several domestic Chinese milk powder brands used melamine as protein adulteration, and thus affected more than 53,000 babies. Nearly 14,000 kids were severely sick. Many of them became permanently disabled, and four of them even died. Since then, Chinese consumers began to turn to foreign infant milk powder. They don’t even want to buy it in Chinese retail stores, because they’ve lost faith in made-in-China.

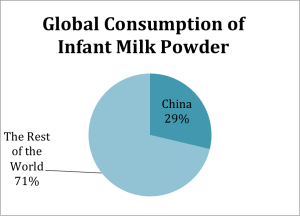

Source: World Bank

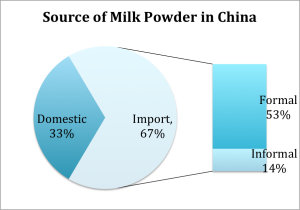

Source: General Administration of Customs of the People’s Republic of China

Infant milk powder resell industry was thus born. This secondary market has fully utilized Chinese market’s massive demand for infant milk powder to profit. As shown above, according to a report conducted by World Bank, China consumes nearly 1/3 of baby formula milk powder around the world each year. General Administration of Customs of the People’s Republic of China further pointed out that two out of three families in China will choose import milk powder, and 14% of all foreign milk powder comes from informal channel, which means from individual resellers. Fourteen percent might sound like a small number, but it actually accounts more than 60 million cans every year, which means nearly 170 thousand per day – and it finally leads to a business valued more than $3 billion.

A photo taken in a Germany retail store. Many products were sold out on the infant milk powder isle.

As a consequence of Chinese excessive demand, infant milk powder is consistently out of stock in some areas in foreign countries. However, the phenomenon isn’t caused only by Chinese consumers.

The first reason that needs to be taken into consideration is the supply chain of milk powder industry is a typical model of low-elasticity. This means that even if manufacturers want to respond to the massive demand, they can’t. First, it takes at least three years to raise cow from its birth to the day it can produce. In other words, it will take at least three years for manufacturers to increase supply. Besides, manufacturers just won’t take the risk to increase the supply of cows to cope with the unknown market after 3 years. Imagine that if demand dropped after 3 years, it would cost them even more to take care of the surpluses.

The second reason that also leads to insufficient demand is the marketing strategy of milk powder manufacturers themselves. Aptamil and Milumil are 2 sub-brands under Milupa, the best milk powder brand in Germany. These two brands use the same milk resources. Chinese consumers love Aptamil, but they don’t buy Milumil. Usually, milk powder brands distribute their products both online and offline. They’re free to adjust prices online, but not offline, because they’ve signed contracts with retail stores.

Aptamil had been out of stock in retail stores since the beginning of January. However, Aptamil were off-shelf not only because it was sold out. Milupa said that there were problems with Aptamil’s milk resources, and they decided to stop producing Aptamil temporarily.

But interestingly, at the mean time, Milumil, which uses the same milk resources, was still on shelf. Even more interestingly, Milupa was still selling Aptamil online, with an increased price. Around the middle of April, after 3 months, Milupa reproduced its new Aptamil as a new product with a higher price in retail stores. The infant 1 milk powder used to be 15 euro, now it is 23.

It’s obvious that this has increased resellers’ cost dramatically. However, except for strategic price change from foreign milk powder manufacturers, new policy implemented by China Customs has also brought pressure to the secondary market. In order to protect domestic brands and control informal milk powder import, China Customs decided to tax packages that values more than $150 – the number used to be $1,350. To be more specific, in the past, reseller could send 26 cans in one package each time. But now, they can send only 2.

The new policy has further squeezed profit, because shipping companies charge much less for additional pounds. For example, here in Los Angels, the first pound costs $11, and only $4 for each additional pound. How does shipping price affect infant milk powder resellers’ profit? Resellers in the U.S. used to be able to earn more than $13 a can; now the number is around $9.

The existence of infant milk powder second market is no doubts an interesting phenomenon, which reflects many problems in Chinese market. The government’s move to protect domestic market is understandable. However, if it doesn’t reinforce food administration in China to gain back consumers’ trust, its attempt to solve the problem merely by isolating external forces will be eventually in vain.