In Hollywood, there’s a luxurious hotel that provides three levels of modern and stylish suites, spa and wellness center, spacious playground and chauffeur service with luxurious vehicles like Ferrari, Lamborghini Gallardo, Bentley, Porsche or Rolls Royce. But it’s different from Hilton in that the customers here are all dogs.

The D Pet Hotel, opened 7 years ago, is one of the first luxurious dog hotels appeared in Los Angeles. Now it has developed into a chain hotel with two branches each locates in New York City and Scottsdale, Arizona.

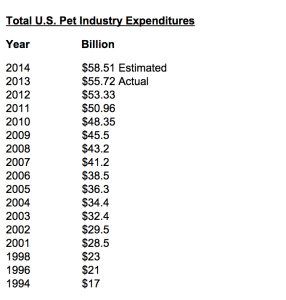

The growing of luxurious dog hotel business, as an example of the pet grooming and boarding industry, is only one aspect of the overall prosperity of pet industry. According to American Pet Products Association (APPA), the total U.S. pet industry expenditures has grown continuously during the past few years. Even during the Great Recession, the sales in this section didn’t come across a decline.

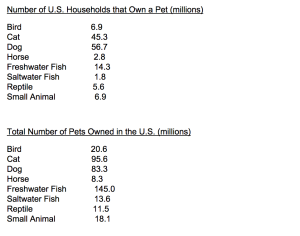

The increasing number of pet ownership, the rise of household disposable income and pet parents’ willingness to pamper their pets, are the three main factors that drive the prosperous trend. As the second graph shows, bird, cat, dog and freshwater fish are the four main popular pets in households. The number of pets outweighs the number of households also shows that some families owns more than one pet. According to Alissa Cruz, the owner of D Pet Hotel, one of her customer has seven dogs in her family, and there are several others have 4-5 dogs.

Single-person households and aging population are the major forces to drive up the pet ownership. Gay couples and middle-aged housewives are also two demographics that tend to have a pet companion, the general manager of D Pet Hotel said. For gay couples, a pet is the perfect alternative to a kid. For middle-aged housewives, a pet can keep their life busy when their children are pursuing college education in another city. In July 2014, IBISWorld Industry Research Division released a study report on Pet Stores in the U.S., in which it predicts the number of pets ownership will increase at an average annual rate of 2.1% during the next five years, which also benefits the revenue of pet industry.

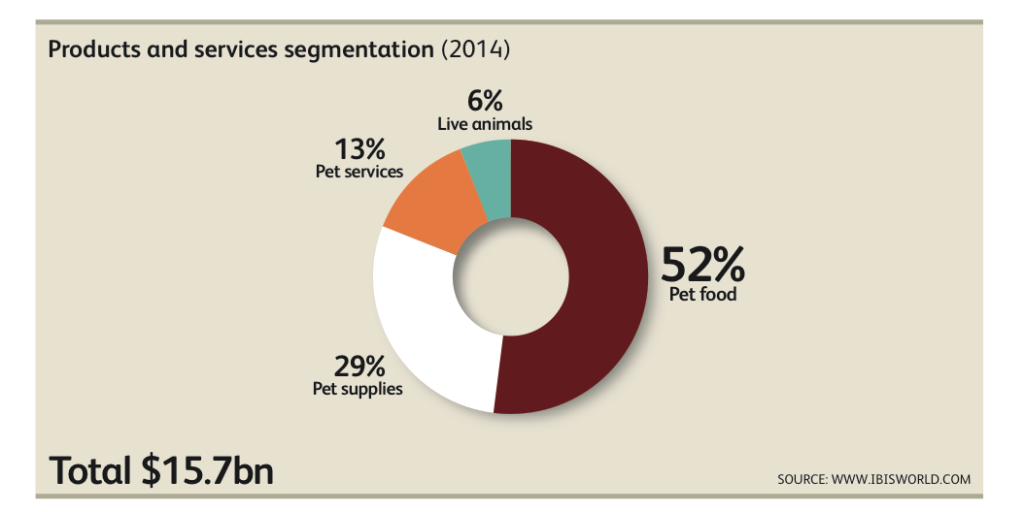

The same report shows that major spending in pet stores industry are made on the following sections, pet food, pet supplies, pet services, and live animals.

Live animals accounts for the smallest percentage as a pet is one-time purchase, but products in other segments will be purchased repeatedly during the whole pet’s life. In addition, more and more people choose to foster or adopt a pet instead of buying them from stores.

Although pet services only account for 13% percent of the total revenue, they “have been the fastest-growing product segment for the industry over the past five years”, says the IBIS report. Pet services include grooming, haircuts, baths, toenail trimming, tooth brushing, training, boarding, daycare and etc.

Thanks to the notion that pets are family members, pet parents are becoming increasingly indulgent. The rise of disposable income also enables pet owners to pamper their animal companions. That is how D Pet Hotel came into being.

Pet supplies include over-the-counter medicines, food bowls, collars and leashes, pet clothing, crushes and combs and various accessories for pets. According to IBISWorld report, this segment is mainly driven by the rising spending on over-the-counter medicine products, for the cost of pharmaceuticals and the standards of routine care has increased during the past five years.

As the largest segment in pet store industry, pet food has been experiencing a trend towards premium standards. All-natural and organic can no longer satisfy indulgent pet parents’ needs, various premium pet foods like raw diet food, weight-control food, specialized formulas for sensitive stomachs, and freshly baked cakes and cookies as treats have appeared in the market. The increasing number of pet numbers also contribute to the large chuck of revenue.

However, pet supplies and pet food segments are highly competitive. Supermarkets and mass merchandisers, like Walmart and Costco are selling similar pet products at more affordable price and offer the convenience of one-stop shopping, so customers are lured from specialty stores. IBISWorld report shows, from 2009 to 2014, due to the competition from supermarkets, and department stores and some online retailers, “the number of industry operators contracted at an average annual rate of 0.6% to an estimated 13,195 companies”.

Generally speaking, the pet store industry is mature. The estimated product saturation will be reached in 2019. But as pet owners tend to humanize their pets more and more, services will be further diversified and become premium. The estimated revenue annual growth in pet store industry will be 2.3% from 2014 to 2019.