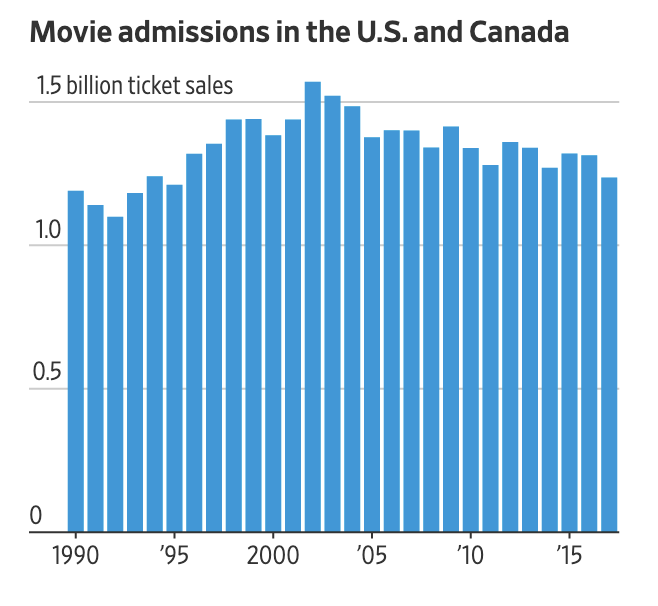

In 1894, the Lumière brothers created a device called the Cinématographe which was used to photograph and project film. The Lumière brothers would shoot footage of everyday life in France and began opening theaters in London, Brussels, Belgium, and New York after hosting numerous private screenings at the Grand Cafe in Paris. The Lumière brothers have pioneered the way for how we view films. Now you can find a movie theater in almost every town across the United States and many throughout the world. With technology evolving, the film industry is continuing to stay lucrative but the distribution methods are now continually changing. Movie theaters are no longer the sole method of distribution for films which means that their business model needs to change to stay competitive in the current market. For movie theaters to thrive in the future they are going to need the change the customer experience as well as figure a way to create a pricing model that can retain continual customer loyalty.

The film experience was changed forever in 1905 when the Nickelodeon opened in Pittsburg, Pennsylvania. Films went from being a middle act in vaudeville shows to a novelty that brought out the masses. Movie theaters have become an experience where all age groups could come and enjoy a theater experience at a reasonable price while getting to enjoy concessions with the film. As film studios grew larger and movie theaters began to expand, the number of movies that hit the theaters continued to grow. Studios began creating deals with movie chains such as AMC, Regal Entertainment Group and Cinemark, where they agreed to take a percentage of ticket sales depending on the film that was being screened. But since the great depression, theaters were able to notice early on that popcorn and concessions are where the real revenue could be generated. According to the Smithsonian, during the days of the depression popcorn was a relatively cheap investment for purveyors and $10 bags would be able to last for years. Many theaters were unable to accommodate for having popcorn machines in their lobbies because of the lack of proper ventilation. Vendors quickly jumped on this opportunity and were able to gain “lobby privileges” which allowed them to sell popcorn in front of the theaters. Eventually, theaters realized that they could cut out the middleman and profits rose significantly once they began selling their popcorn. This helped many theaters stay around through the depression. Any theater that failed to start selling varieties of snacks through the 30s struggled significantly and eventually went out of business. In 1945, more than half of the popcorn consumed in the United States of America was consumed in movie theaters.

According to Time Magazine, movie theaters make around 85% of their profit from the concession stands. In 2015, AMC announced that they say a drop from ticket sales from $1.85 billion in 2013 drop to $1.77 billion in 2014. But as for concessions, revenue went up to $11 million from 2013 to 2014. Now that films are becoming more accessible within your own home, theaters are going to need more than just provide tasty snacks to draw in more customers.

When Netflix was created in 1997, the internet was in its early stages and people didn’t realize that this website would be able to compete with a rental movie chain as large as Blockbuster at the time. The film industry did not see that this website would become the behemoth of a streaming service that it is at a market capitalization of $130.29B. This has completely changed the distribution method of films by not only beating out film rental services but also now taking out movie theaters as the middleman. Now Disney, Warner Brothers, and even Apple have created their own streaming platforms. These large studios are deciding to even put certain films straight to streaming. Ted Mundorff, President and CEO of Landmark Theaters, spoke with IndieWire about the future of theaters in the streaming era and he states that the money is still there, “We have gone through theatrical slumps forever and we always recover. Some bloggers love to talk about attendance going down every year. Well, attendance goes down at baseball games and football games. You want to name a place where attendance is going up? It’s not. Our $10.5 billion-$11-billion-a-year business is very strong.” People are still coming out to the theaters but are only there to see the blockbuster of the season. According to Variety, this past year Avengers: Endgame earned $853 million in the domestic box office which makes it the second-highest-grossing film behind “Star Wars: The Force Awakens” ($936 million). In an interview with the New York Times, the director Kumail Nanjiani spoke about how it’s only the large budget films that are getting people out of the house, “I read a stat somewhere that the average person goes to the movie theater around four times a year, and these huge movies come out and kind of suck up all the air. You look at comedy especially, and it’s been pretty tough going at the box office for the last couple of years. I think it’s because there’s this sense that only certain movies are worthy of watching at the movie theater.” In 2011, a San Francisco based company named Movie Pass began a monthly subscription service that allows you to see one movie a day in a theater at a monthly rate. This service quickly faltered after being unable to generate profits and certain theaters stopped accepting the subscription. In 2018, AMC decided to create their own subscription service that charges $19.95-per-month subscription. The service has earned more than 860,000 subscribers. The theater chain Regal, a competitor of AMC, saw this success and created its own service as well titled Regal unlimited. Having a subscription service for the handful of movie buffs may work temporarily but other companies are seeing that theater chains are going to need to do more to improve the overall experience for consumers.

According to The Wall Street Journal, AMC renovated 247 of its 640 locations to add recliner seats into all of its auditoriums. A Mississippi based company named VIP Cinema seating created a large business out of this and now controls 80% of the market for luxury seating. AMC has been tracking the data of moviegoers and they noticed that consumers are not looking at what movies are playing but rather which theaters were playing around them. AMC’s executive vice president of global development stated to The Wall Street Journal “A traditional movie theater sees attendance decline 1% or 2% a year as the facility ages. Attendance overall at Lakewood ( an AMC theater location) doubled within 18 months of all auditoriums getting the recliners.” China’s Dalian Wanda Group Corp. is the majority shareholder in AMC and they plan to invest $600 million in re-modeling their auditoriums. AMC compared to other chains are pushing innovations in the traditional movie theater model and are even embracing technological advancements as well.

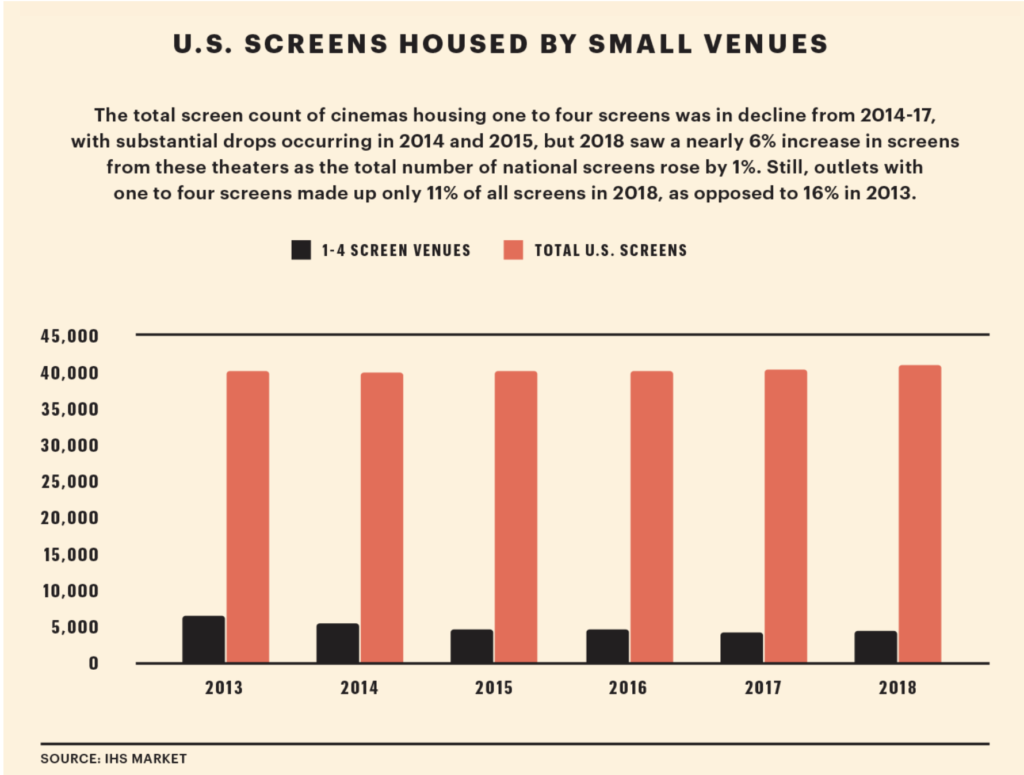

In 2016 a company titled Dreamscape opened up its flagship location in Los Angeles that provided an immersive virtual reality storytelling experience. In the early stages of the company Bruce Vaughn, former head of Disney Imagineering, was appointed CEO and helped build the company into what it is today. This immersive storytelling experience could best be described as a Disneyworld dark ride that is at the cost of a movie and located in the middle of your mall. AMC saw this as an investment opportunity to continue to change the movie-going experience by partnering with Dreamscape and allowing them to set up the VR experiences inside their theaters. They are currently testing out the first AMC location in Dallas Texas with plans to develop in more locations by the end of 2020. What has been a noticeable trend since the great depression is that movie theaters are forced to innovate or else their existence will fade. For chains like AMC, it is easier to invest in innovation and completely remodeling because they have the capital for it. But as for local theaters, it is very hard to stay competitive as well as save enough money to stay around. As Eric Handler, an exhibition industry analyst at MKM has pointed out, “Your revenues are inconsistent. Your rent keeps going up. Unless you have some deep-pocketed investor, you don’t have the capital to do what they’re doing in theater chains by investing in high-end food items and fancier seating.” The failure to innovate is a common theme across all industries but in an era where entertainment is more accessible than ever, old practices can become stale very quickly. Large theater chains will be able to thrive if they continue to invest in new customer experiences but only if they continue to innovate and adapt to current market trends with technology. But once again we are seeing that technology is making our lives more convenient but at the cost of the local mom-and-pop shop.

ADDITIONAL SOURCES:

https://www.history.com/news/the-lumiere-brothers-pioneers-of-cinema

https://fortune.com/2015/02/18/movie-theaters-concessions/