On Sep. 24, the United States will begin imposing tariffs of 10 percent on another $200 billion worth of Chinese goods. That tariff rate will rise to 25 percent beginning Jan.1. Subsequently, China retaliated as promised on Tuesday that it would enact tariffs on $60 billion in U.S. goods from aircraft to liquified natural gas.

From July this year, the trade battle between the United States and China started that the U.S. imposed 25 percent tariffs on $34 billion worth of Chinese goods as part of President Trump’s tariffs policy. As the trade war escalates over time, an unavoidable question occurs to me: what’s the meaning of the continuously escalating trade war with retaliation?

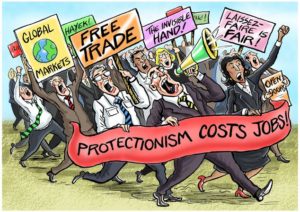

When searching “trade war” on the internet, the headlines like “Will tariffs hit American more than China?”, “What’s at stake for the U.S.?”, or “China once looked tough on trade. Now its options are dwindling.” popped up on the screen. Now that the negative effects of the trade war with retaliated tariffs can be realized by both sides, why not negotiate a peace treaty? A free trade is better than retaliated tariffs.

Early in 18th century, an economist Adam Smith wrote in his book The Wealth of Nations: “It is the maxim of every prudent master of a family, never to attempt to make at home what it will cost him more to make than to buy.” This is the core of free trade: businesses concentrate on services or goods where they have a distinct competitive advantage so that they could swap something with lower cost and all profit by doing so. However, a free market is being devalued and tariff is becoming a weapon for the state’s rivalry.

Generally, tariffs opposing free trade can be used for five reasons: protecting domestic employment, protecting consumers, protecting infant industries, national security, and retaliation. As President Trump claimed that US jobs got “stolen” by China and increased tariff on imported goods can boost American business interests, he enacted tariffs for protecting domestic employment, businesses, and consumers.

In terms of employment and businesses, it is true that jobs have been lost in America due to cheaper foreign imports under free trade. However, protectionism will destroy more jobs than it can create. The economist Milton Friedman famous for his support for free market wrote in his book Free to Choose: A Personal Statement (1980, p41): “our real objective is not just jobs but productive jobs—jobs that mean more goods and services to consume.” Increased tariffs do retrieve some labor-intensive manufacturing industries, but jobs provided by them will lead to increased producer costs, increased producer costs will lead to increased products costs, increased products costs will lead to fewer sales and fewer tax recipients, fewer sales will result in fewer jobs and fewer profits.

As for consumers, increased imported tariffs will limit consumers’ freedom to choose products and force consumers to pay more for products while free trade can increase the number of goods that domestic consumers can choose from and decrease the cost of those goods through increased competition. In the long run, the living standard and quality of consumers will be negatively affected by trade barriers. Also, the government has to spend more subsidies on an increased demand for public services because of increased living costs.

In addition to the US, China will also be negatively affected by the trade war in the same way although Chinese policymakers think they have a prudent financial and monetary policy to face the pressure from Washington. China’s economy is always much more vulnerable to exports than America’s economy and China is still trying to shift its growth model to one relying more on consumption and less on investment and exports. Thus, it could take a bigger hit from the escalating trade war.

The free market with free trade is not perfect but it can correct itself better than state, because sometimes government regulations will be used for political rivalry regardless of long-run losses, for example, the current trade war.

Leave a Reply

You must be logged in to post a comment.