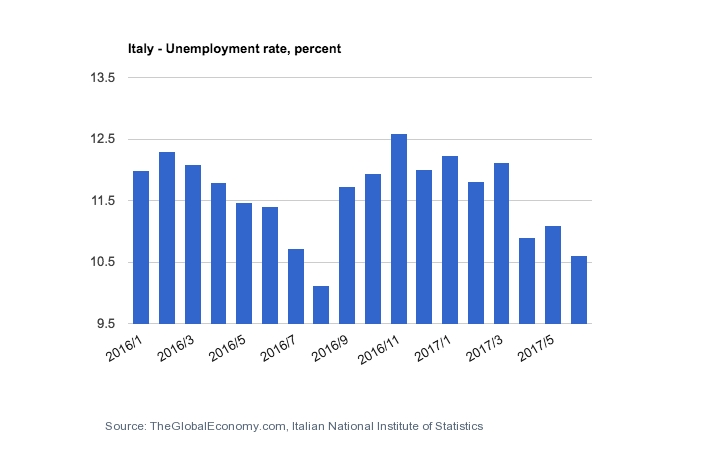

It is almost the end of August and this summer seems to have brought positive news to both the U.S. and European markets. The latter especially may now breathe a sigh of relief since, as the Wall Street Journal reported on Aug. 24, 2017, even the weakest European economies such as the Greek, the Portuguese, and the Spanish have been showing growth over the last year. Along with them, the Italian economy seems to be enjoying a substantial reversal in its usual downward trend, as shown by the steady decrease of the unemployment rate released by Istat, the Italian National Institute of Statistics, on June 7.

These developments are being reported just as the Federal Reserve’s annual conference is taking place in Jackson Hole, Wyoming, where Mario Draghi, president of the European Central Bank, and Janet L. Yellen, the Federal Reserve chairwoman, will speak about the future of the European and U.S. monetary policies for the year to come. Their speeches will focus on whether the current lenient regulations will be removed.

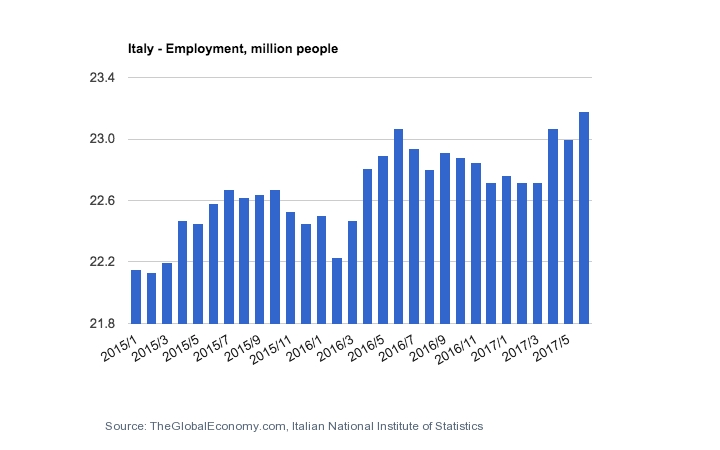

The decision on this very hot topic—appropriate for the end of summer—might affect the improvements shown by the delicate economies of the Eurozone, such as Italy’s, which has been reinvigorated by the positive unemployment and employment figures released in June 2017.

Why do these rates matter? Even though they are mere numbers, they stand for people; people who have been struggling to find jobs. As reported by the Italian business newspaper Il Sole24ore, the unemployment rate decreased 0.2 percent from May to June of 2017, and has settled at the level of fall 2012—when Italy reached its lowest unemployment rate. This news has created confidence among markets, entrepreneurs, and investors.

The recovery of Italy’s economy was also reported by Quartz and Bloomberg this month; these two media outlets showed that the Italian GDP increased by 0.4 percent in the last quarter, thanks to added value of manufacturing and services, as Lorenzo Totaro wrote on Aug. 16, 2017, on Bloomberg; this GDP increase reflects the larger number of employed people.

These indicators have also revealed another interesting aspect of the story: the employment rate of the female population has increased by 0.7 percent from June 2016 to June 2017, reaching the threshold of 48.8 percent. Women are more likely to be unemployed in Italy; this upturn signals a great change in the economy of the country.

In this scenario of mild recovery and optimism, the decision of whether to pull back the current stimulating monetary policy is very important for a country such as Italy, whose policies and efforts seem to be heading in the right direction. Certainly, as recently stated by Carlo Calenda, minister for economic development, and Ignazio Visco, governor of the Bank of Italy, the improvements observed through the lenses of economic indicators such as the GDP or the unemployment and employment rates do not mean that Italy has completely recovered from its financial crisis (Corriere della Sera, Aug. 24, 2017); the country still needs reforms to encourage business innovation, and support the work life of employees.

“For the first time in ten years all the major economies of the planet are growing,” (Marketplace, Aug. 24, 2017) and what might happen to Italy after the Federal Reserve’s annual conference concerns European countries as well as the U.S. We have to wait to see if this new wave of economic growth will be fostered and advanced by the new regulations that will be implemented by Mr. Draghi and Ms. Yellen at Jackson Hole. All we know now is that the enthusiasm about Italy’s steady growth is based on solid facts, and it is part of a remarkable turnover regarding the entire Eurozone.

Leave a Reply

You must be logged in to post a comment.