The Great Depression. People waiting in line to eat for free. Source: http://reason.com/blog/2012/11/21/why-are-a-record-number-of-americans-on

The Great Depression was a scary time for America. A time full of poverty, hopelessness, fear, and especially, unemployment. Of course as economies tend to do, we were able to create stability, improve employment, increase hopefulness, and get through the Great Depression. We proved that we truly are the “land of the free and home of the brave,” emphasis on the brave. If we were able to get through the Great Depression, we could get through pretty much anything the economy threw at us, right? Wrong. Fast forward to the Great Recession of 2008 and it felt like, once again, that there was no hope. No hope for economic freedom, no hope for stability, no hope for anything. It felt how the photo to the left probably makes you feel. Millions of Americans lost their jobs, and the world was impacted by Wall Street “hotshots,” who thought they knew everything and simply would never lose the “game” of life. Well, life should never be a “game,” especially when that game ultimately affects millions of people. Case in point — the housing crisis and the declared bankruptcy of the Lehman Brother’s. Wall Street was and is shady.

Since the 2008 recession, markets have been on the rise. Stock markets are looking strong, consumer spending habits are great, and unemployment rates are at an incredible low of 4.2%. That said, it doesn’t mean we should keep following the yellow brick road. I’m all about positivity, but it feels like we are replaying history. Before the Great Recession, Wall Street bankers were ignoring the “good” signs and thought, “hey the markets are hot, housing is through the roof (no pun intended), and we are making millions of dollars. Nothing to worry about here.” Meanwhile, thousands of people were starting to get big houses they couldn’t afford, and so the deep, dark rabbit hole began.

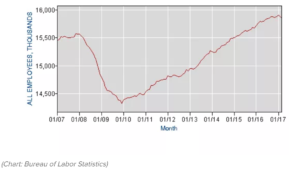

Are we ignoring the “good” signs again? If we look back at history, the truth of the matter is that we are overdue for a recession. Our “low” unemployment rate isn’t as low as we think, so it’s time to stop ignoring the “good” signs and start figuring out how to help our economy….before it’s too late (see picture below).

Source: http://money.cnn.com/infographic/economy/the-us-economy-to-the-brink-and-back/index.html

The “Good” Signs That We Are Ignoring –– Longest Economic Recovery

This is almost the longest we have been in economic recovery since a recession. If we look at history, we are due for another economic recession. History tends to tell a story, so why are we choosing to ignore it? While it is great that our economy has showed strength after the Great Recession, history proves that recovery can’t last more than a decade before seeing another economic recession. America has gone through 33 economic recessions, but the Great Recession was the first one that was as distressing as the Great Depression (hence the name).

Some economists are predicting another Great Recession after seeing such long economic recovery. What goes up must come down…? Even Barclays Capital is calling it a “Hakuna Matata” market. Everything is going up. The market isn’t worried” (Rapoza, 2017). Well, if I remember Lion King correctly, I started to cry when Mufasa died. All jokes aside, with everything going up, all the “good” signs are being ignored. This has been one of our longest economic recoveries, and even Janet Yellen, prior chair of the U.S. Federal Reserve believes we will experience more “major financial crises in our lifetime” (Rapoza, 2017).

While the length of economic recovery doesn’t really feel like an important indicator in the eyes of many people, it matters more than we think. Banks tend to “lower their standards over time [and] at the end at the end of very long expansions, banks and finance companies are willing to lend to almost anyone, because they become overly optimistic” (pbs). Kind of sounds like a similar situation to the housing crisis, doesn’t it? This is what is now happening with U.S. car loans. (Please see the example of how an industry can affect the economy, detailed in deck at end of presentation). According to Forbes, “a severe market crash will be followed by no growth in the U.S., possibly even two quarters or more of contraction.” Few are actually predicting this “crash” and ignoring the “good” signs similar to the 2008 Great Recession.

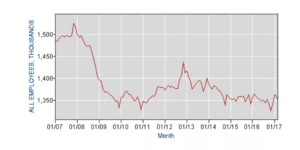

The “Good” Signs That We Are Ignoring –– Unemployment Rate

When the Bureau of Labor Statistics releases its employment information, many people are quick to focus on the unemployment rate since it’s a significant sign of how an economy is doing. Well, our economy is only showing “good” signs of low unemployment rates varying between 4.1-4.2%. Do most people, however, know what the unemployment rate consists of? The unemployment rate is the share of the labor force that is jobless, expressed as a percentage (investopedia). This percentage includes people actively seeking work. The percentage fails to mention the pool of people who are neither employed nor actively seeking work because of weak job opportunities (Economic Policy Institute). Thus, unemployment numbers are actually higher than we think. If we really dive into the numbers (which will be explained in more depth on the attached deck at the end of the post), we will quickly learn that we are leaning towards another recession. In fact, Trading Economics is already predicting a 6% or higher unemployment rate in 2020. Since October the number of long-term unemployed (those jobless for 27 weeks or more) was little changed at 1.6 million, and it accounted for 24.8 percent of the unemployed (Economic Policy Institute). Continuing jobless claims in the U.S. increased to 1,957 in the final week of November, after being 1,915 the week prior (Trading Economics). People who are actively seeking work aren’t getting hired and are entering into a new pool of people, as mentioned above. These are a pool of people who aren’t being accounted for within the “good” signs of our economy.

The Ugly Truth

The truth of the matter is that we are overdue for a recession. The proof is in the pudding. This is the longest our economy has been in economic recovery, and it seems like our “low” unemployment rates are unparalleled, but we are ignoring the fact that so many Americans can’t find a job. The worst part is that it feels like President Donald Trump is not ready to handle an economic crisis. In fact, “Many Republicans in Congress are firmly against dramatically increasing the size of the federal budget and railed against the last stimulus bill. And given that interest rates are so low already, the Federal Reserve would not be able to cut rates by much” (The Atlantic). Seeing the trend that Trump is taking with his presidency, it is possible that he is the one landing us in our next recession, and he won’t be able to get us out of it. If our predictions are right and we find ourselves in an another economic recession within the next year, it will prove truly damaging for so many Americans. According to Forbes, 61% of Americans do not have enough money saved to cover six months of living expenses, 49% of Americans are currently living paycheck to paycheck, 68% of all respondents’ investment strategy does not account for a recession, and 64% of Americans do not have secondary sources of income. Essentially, if we land in another recession, YES we will get through it, but we will go through a lot of pain in the process. Back to hopelessness, back to more poverty, back to skyrocketing unemployment rates, and back to the pain of losing your economic freedom. I am not an economist, far from it in fact, but I do think it is important to inspect the “good” signs that our economy is projecting, so we can avoid repeating a traumatic economic history. Here’s to you America…. land of the free and home of the brave.

(This medium does not support the viewing of the deck that goes with this article. Please refer to your e-mail if you wish to view the supported deck).

Sources:

https://www.theatlantic.com/business/archive/2017/03/is-the-economy-overdue-for-a-recession/519180/

https://www.pbs.org/newshour/economy/get-ready-economic-recession-coming-2017

https://www.forbes.com/sites/kenrapoza/2017/06/29/heres-what-would-happen-if-u-s-faces-another-recession/#13dc75457a79

https://www.forbes.com/sites/axiometrics/2017/04/21/is-a-recession-coming/#57ecbd6e6103

https://www.thebalance.com/could-the-great-depression-happen-again-3305685

https://tradingeconomics.com/united-states/continuing-jobless-claims

https://www.bls.gov/news.release/pdf/empsit.pdf

https://tradingeconomics.com/united-states/unemployment-rate/forecast

http://money.cnn.com/infographic/economy/the-us-economy-to-the-brink-and-back/index.html

http://reason.com/blog/2012/11/21/why-are-a-record-number-of-americans-on

http://www.nber.org/cycles/cyclesmain.html

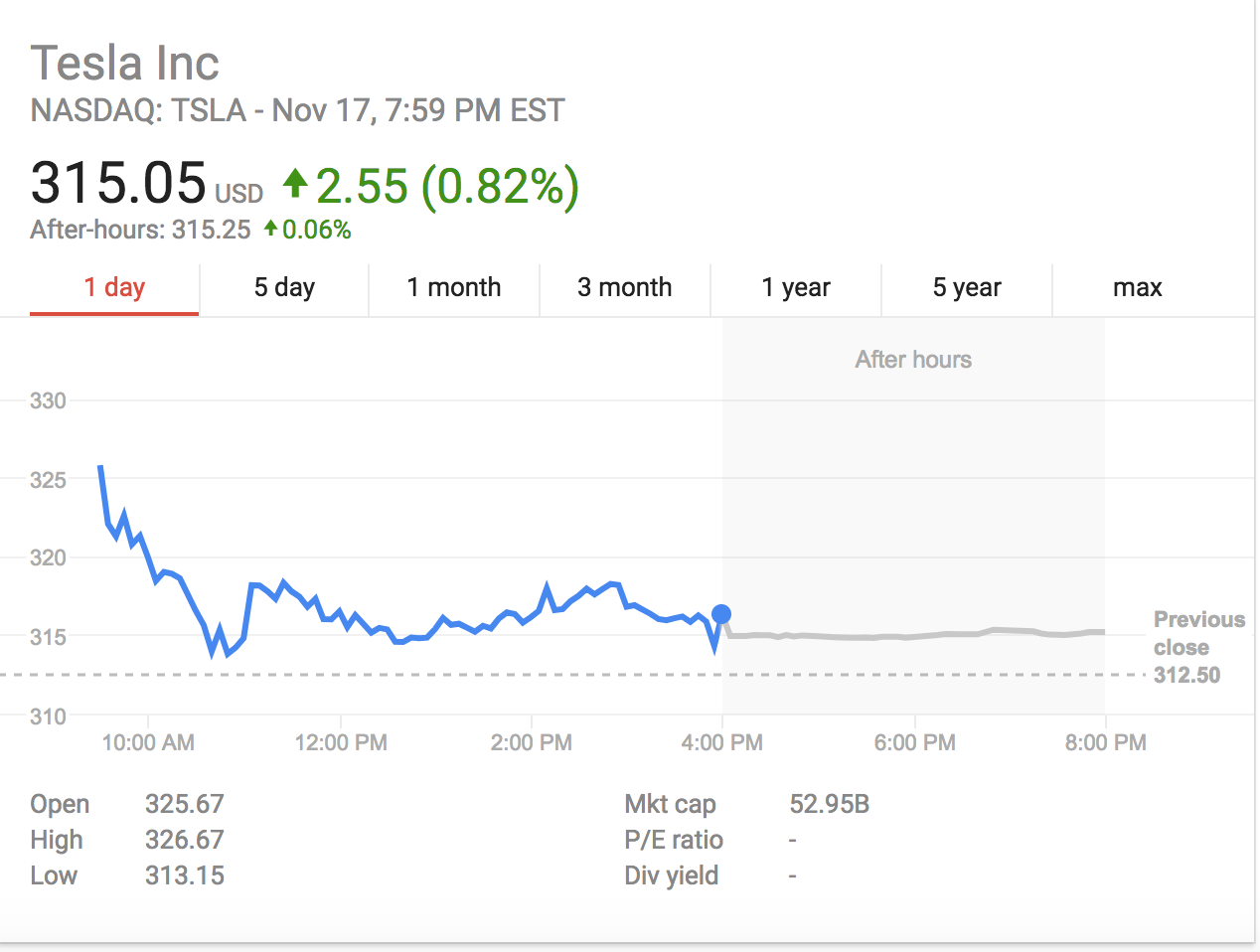

]]>After Tesla’s start in 2003, it’s been slow to hit the ground running and make money. Tesla’s stock continues to have highs and lows — starting at $19 a share and going up and down between $100-$300 dollars. According to Wired, “2017, however, is the formative year to see whether Tesla becomes the unbeatable car company, or just another company that tried to beat the competition but failed.” With excitement surrounding the release of Tesla’s truck in 2019, it could turn out to be a make year rather than a break year after all. Tesla’s stock went up following the announcement of the truck and is up nearly 50% so far this year.

On top of that, Musk is already seeing pre orders roll in from WalMart, Meijer, and J.B. Hunt to name a few. The first issue that comes to mind, though, is how are these trucks going to be of much use beyond small routes? As an electric car, especially a self driving car, it will run out of energy after a couple hundred miles. That means that on long truck hauls a lot of time ends up being added to the commute. Essentially, the truck will only be able to add value to routes that are local. While this does still reduce emissions, it still doesn’t fix the issue of long commuter hauls unless Musk has a new idea on charging station efficiency and productivity — this could take even more money and more time. Considering the lack of charging stations on these commutes and the slow history of Tesla production, will Elon Musk even be able to roll out this truck by 2019? In the past, Musk has fallen short on lots of promises and production has been late up to two years past the publicly announced date of release. There is a lot of pressure on Tesla Motors and especially Elon to perform. So many people are rooting for Tesla, especially the sustainability behind it, but at the end of the day its hard to know if the sustainability model behind Tesla is worth fighting for, or profitable. The headlines are saying one thing, yet the sales of Tesla are saying another. They are reaching record high’s with profit margins equivalent to that of Apple (25% margins) — this is huge for the auto industry when it usually sees a break even number or a loss in profit.

So, what’s the big idea behind this truck? In order to understand and predict the future of yet another Tesla hyped release, one must know what makes this truck so amazing. Tech Crunch says that the Tesla Semi, “will go 0 to 60 mph in just 5 seconds, which is incredibly fast compared to a diesel truck. It can go 0 to 60 mph towing 80,000 lbs, its max tow load, in just 20 seconds. It can go 65 mph up a 5 percent grade, which is way better than the 45 mph max that a diesel competitor can do. And for range, it can go 500 miles at highway speed, and less than 80 percent trips are at 250 miles. It also has a better drag coefficient than a super car thanks to its extremely aerodynamic design.” Now, I am sure that all of that sounded like a bunch of numbers and words that made no sense, to me too. The most important thing to note, however, behind all these facts is that it truly is bigger, better, faster, stronger. The Tesla Semi will get the job done, according to Musk, because of it’s aerodynamic design. The features of the truck are like nothing we have seen before and its deemed safer than any other normal diesel truck we see on the highway. It’s capabilities are endless and all outlined in the TechCrunch article here.

While consumers and investors continue to feel good and bad about Tesla, it is still being talked about and stirring up controversy and at the end of the day, that means you’re doing something right. The innovation and ability behind Elon Musk is unprecedented and has the ability to truly change the world. If accomplished right, we could be looking at a game changer for our economy and the longevity of our planet. It’s time to continue to sit back, relax, and see what these automatic driving cars can achieve.

https://www.wired.com/2016/12/2017-will-year-tesla-reigns-supreme-finally-flops/

http://money.cnn.com/2017/11/17/investing/tesla-semi-orders/index.html

http://www.businessinsider.com/what-tesla-is-doing-right-2017-11

]]>

Source: Los Angeles Times

Because the port of Buenos Aires is in a heavily populated area, they continue to receive more and more trade imports to keep up with their economy. This revamping project will not only allow Argentina’s ships to get access to more trade countries, but also increase capital during cruise season. A win win situation. That being said, they are using a lot of their revamping money to turn their port into an experience for consumers. They are now offering a variety of services including but not limited to transportation services and restaurants (there are no further details on what these services will do besides cater to cruise ship goers). Argentina is utilizing their port in a really strategic and effective way so that they can garner more trade access as well as appeal to tourists coming in and out during cruise season.

Soure: http://www.cruisemapper.com/ports/buenos-aires-port-103

A big part of the improvement plan, according to Gonzalo Mórtola, the head of the General Ports Administration (AGP), “is to make ports self-financing so that the state no longer has to provide any money for them” (portstrategy.com) The way he will do that, however, is still not announced to the public.

Before the improvement plan was announced, Argentina was already known for having a very strong port system. It is one of the strongest port contenders in Latin America and the Caribbean. In fact, in 2013 it joined the Green Awards ports program: “The Green Award is well-known in the maritime world for its reputable certification of ships that apply the best practices and exceed the industry statutory regulations in terms of safety, quality and environmental stewardship.” Argentina earned the first Green Award port in South America, and continues to ensure that they effectively maintain their Green Award efforts. Because they are a part of this, they receive a 10% discount on vessel dues for their Green Award ships. For Argentina, and Buenos Aires especially, this a big feat considering that where the port is located is a very metropolitan area. The port is putting forth its best efforts to maintain the greater good of the population within that area, and the country as a whole, and ensuring a clever and strong revamp in order to gain more global capital.

With the improvement plan set in place it will be interesting to see what this does for Argentina’s economy. In fact, seeing as European trade and Latin American trade don’t even compete, they should consider banning together and coming up with ways to innovate and ensure the utmost efficient level of import and export trade. After all, with the approval of a plan such as this, Argentina should get all the advice it can get to ensure it makes the right moves and builds out the right strategies.

http://www.latimes.com/travel/cruises/la-tr-cruises-argentina-port-improvements-20171029-story.html

http://www.portstrategy.com/news101/world/south-america/all-change-for-buenos-aires

http://www.greenaward.org/greenaward/703-buenos-aires-is-the-first-green-award-port-in-south-america.html

]]>Germany continues to maintain a strong economy. In fact, German workers have paved the way for economic success while utilizing fewer working hours with more productivity.

Seizing Opportunities

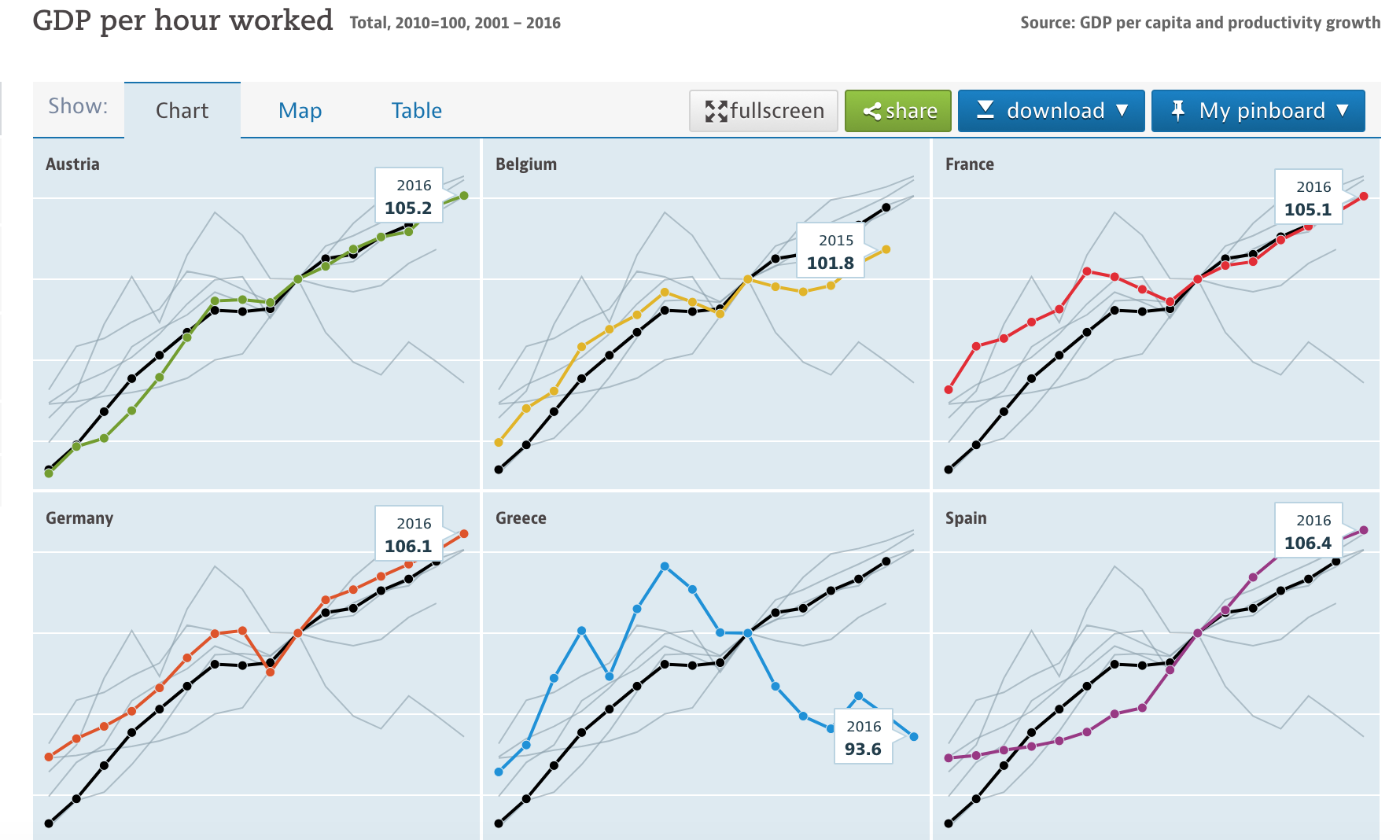

Ironically, the hours worked by Germans are significantly lower than other countries in the EU. Some of the strongest economies have an average of 32-hour work-weeks, whereas Germany, the leading economy of the EU, only has a short 26-hour work-week. The trick to Germany’s success? Productivity. By definition labor productivity is “the amount of goods and services produced by one hour of labor; specifically, labor productivity measures the amount of real gross domestic product (GDP) produced by an hour of labor” (Investopedia). German workers see success in productivity because they are investing in advanced technologies and machineries in order to “seize the opportunities of digitization, remain internationally competitive and drive innovation” (Nienaber, 2017). The graph below highlights the GDP per hour worked for various countries in the EU, ranking Germany with nearly the highest GDP per hour worked.

As seen in the data above, Germany produces more goods per hour than its competing countries and works fewer hours. In order to see growth in that productivity, an economy needs physical capital, new technology, and human capital, which Germany has (Investopedia).

A Strong Work Environment

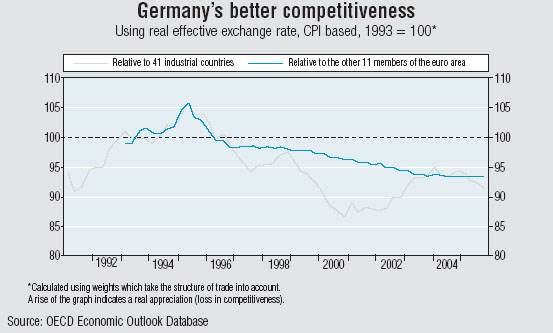

Many different aspects factor into Germany’s economic and productive success. Whether it is that German work culture is very by-the-book –– when you are at work all you do is work — or they have been trained as a population to maintain efficiency, they have found success in business. Essentially, they move quickly but also remain focused. Starting at age 15, German students leave their education to go into apprenticeships. Rather than staying in school and learning, they experience the working world and learn from there. At a young age they are automatically conditioned to be more efficient and productive in the work place. Adding light to Germany’s productivity makers, The World Economic Forum’s 2012-2013 Global Competitiveness Report ranks Germany 5th in higher education and training and 3rd in infrastructure and business sophistication. In fact, as the world’s 2nd largest exporter and one of the most highly advanced manufacturers, Germans would be expected to work off the clock, non-stop. But, that is not the case. Again, this goes to the point of their ability to seize opportunities because of their investment in advanced technologies and choice to constantly innovate. The ‘—‘ mark below indicates Germany’s competitive success relative to 41 other countries and 11 other members of the European Union. This demonstrates that they have remained a strong and leading export country since the fall of the Berlin Wall. So, what made the fall of the Berlin Wall such a strengthening factor in Germany’s economy? Let’s look at a brief history.

A Brief History

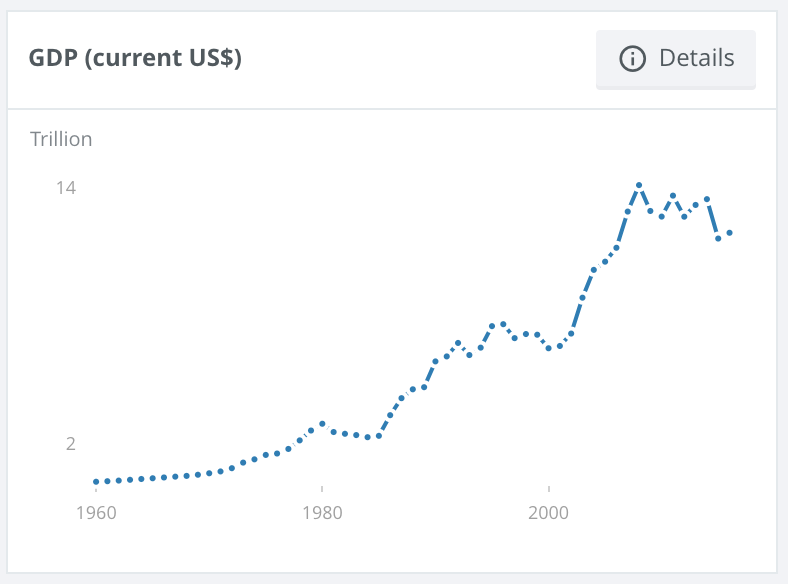

Looking back to the Industrial Revolution of the 1830s, Germans had an innovative and entrepreneurial mindset which led them to be early adopters of coal production and rail transportation (Brenner, 2014). That’s just a mere example of the beginning of their strong economic trajectory. In order to properly look at their success, let’s fast forward to 1989 with the fall of the Berlin Wall. This historical moment finally ended the divide between East Germany and West Germany and brought forth a whole new labor force and marketplace of ideas. Germany acted fast and placed an emphasis on the complex manufacturing of products by which other countries simply could not compete. For example, they have created a thriving auto industry producing the world’s most innovative, luxurious and strongest car brands. Through advanced manufacturing and trade exports, they quickly became a top net exporter to other countries. Not only did this pave the way towards a healthy economic future for Germany, it also made them a key country in the expansion of the EU –– mending the European financial crisis with one currency: the euro. For reference, the graph below represents the significant raise in GDP of the Eurozone after enacting the euro.

Source: data world bank

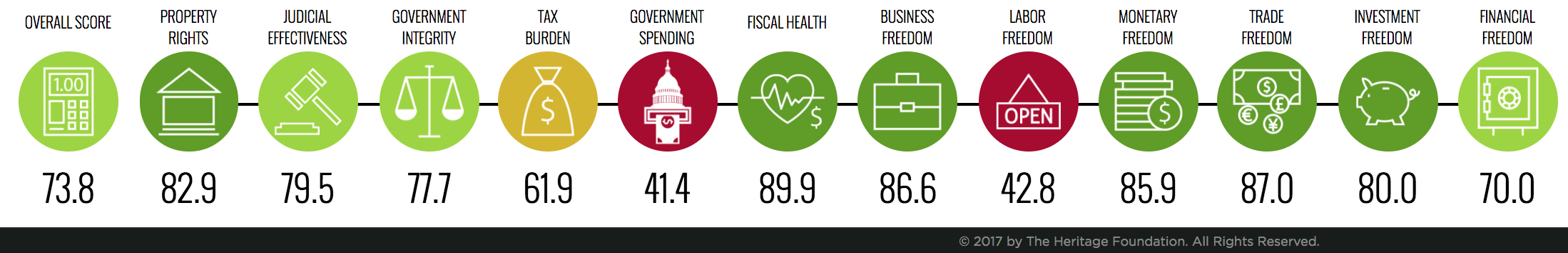

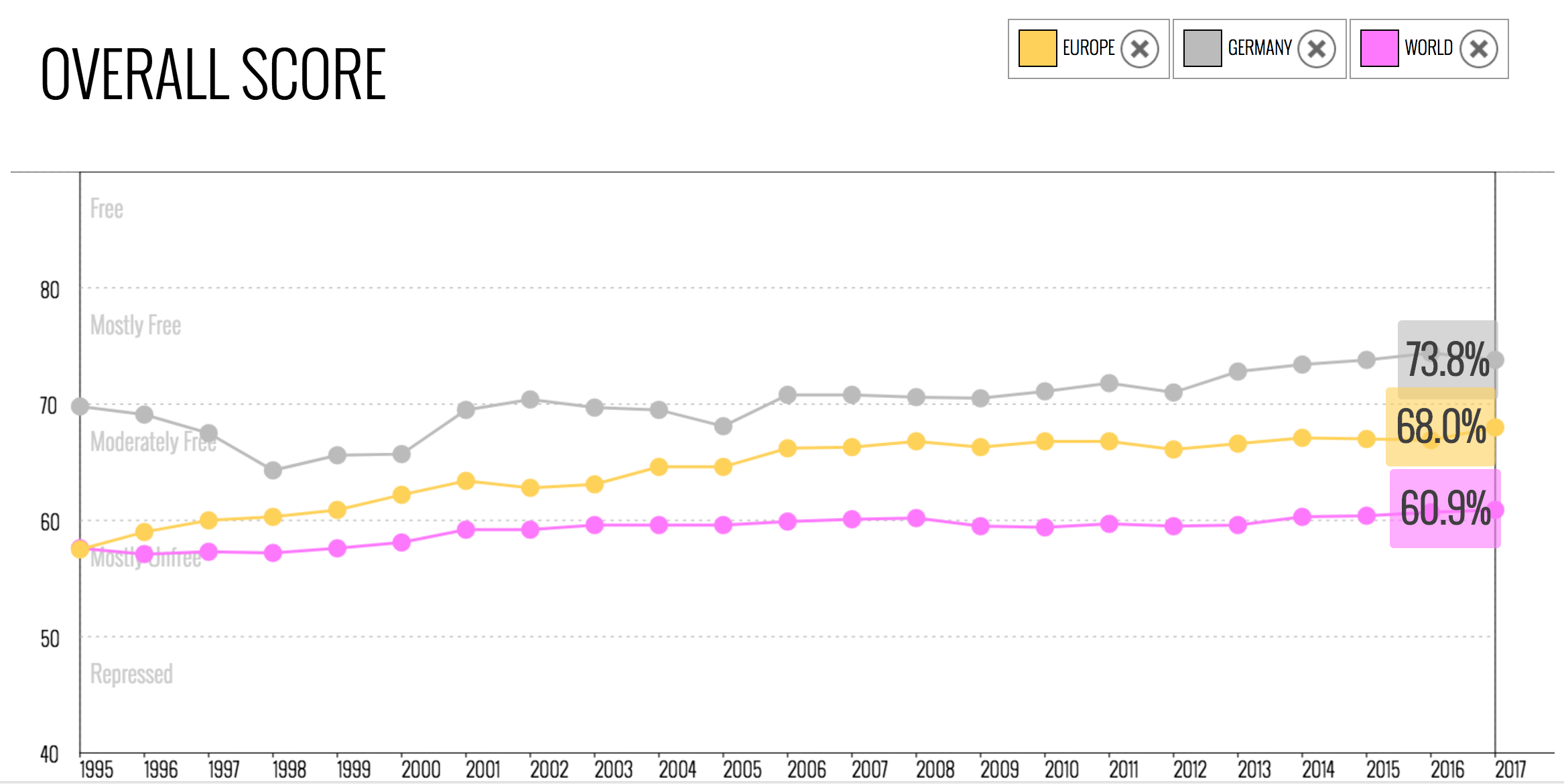

According to current (2017) data from The Heritage Foundation, Germany’s overall economic score is a 73.8 out of 100. A country’s economic score “focuses on four key aspects of the economic environment over which governments typically exercise political control – rule of law, government size, regulatory efficiency, market openness” (Heritage). Within these four measures, there are 12 sub-components that are measured on a scale of 0 to 100 which “are equally weighted and averaged to produce an overall economic freedom score for each economy” (Heritage). Where Germany’s numbers show strength is under fiscal health (government size), business freedom (regulatory efficiency), monetary freedom (regulatory efficiency), trade freedom (open markets), investment freedom (open markets), and property rights (rule of law), as identified in the graphic below. What is so great about Germany is that they continue to show success in business freedom — both on the business side and the investment side. To that end, Germans are willing to start their own businesses, invest in businesses, and overall innovate a business because they have the capital for it.

If you wish to view this further and get directed to the site, click here.

If you wish to view this further and get directed to the site, click here.

Now that the economic score of Germany is clear, below is a graph of Germany’s score in comparison to both Europe and the world, with Germany ranking higher against each.

If you want to compare other countries and view the graph in real time, click here.

If you want to compare other countries and view the graph in real time, click here.

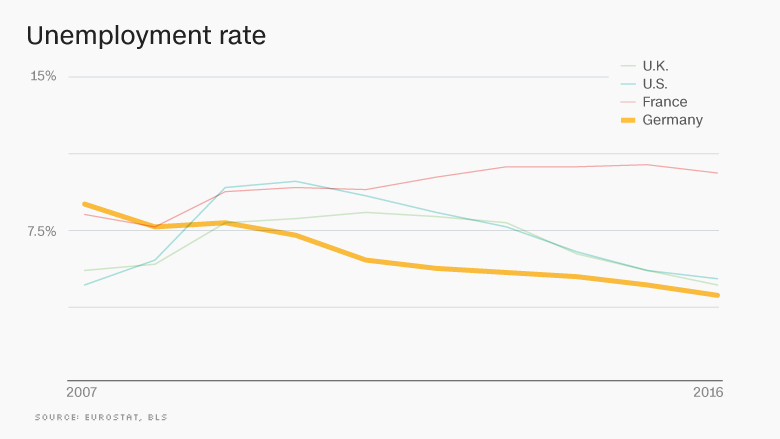

Unparalleled Unemployment Rates

Without high employment rates, productivity would remain low because typically it means there is not as much work to be done. In the simplest terms, Germany has more money to invest in business, therefore they have more money to invest in workers, which leads them to more employees getting the job done. Germany went from a steep 5 million unemployed workers in 2005 to a low 2.7 million unemployed, as shown in graph A titled “Germany unemployed persons.” Graph B, titled “Unemployment rate,” demonstrates Germany’s unemployment rate in regards to the U.S., U.K., and France.

According to The Guardian, “a strong economic backdrop has helped Germany post a record budget surplus of €23.7bn in 2017, fueled by higher tax revenues, rising employment and low debt costs. It was the highest budget surplus since reunification in 1990 and the third successive year the government has had a budget surplus” (Monaghan and Wearden, 2017). Clearly, the Germans productivity is paying off in more ways than just being a leading exporter. They are truly a financially sound country.

The German Way

Germany finds its way as a leading economy due to the productivity it has retained from its workers, the strength in their manufacturing technology, their education systems, and their overall ability to constantly innovate. German workers are unafraid to pave the way for business freedom. With an abundance of capital to invest toward business success, a strong workforce, and overall economic strength, Germany continues to be a force to be reckoned with. Fewer hours doesn’t always mean less work! Use Germany as that example.

http://money.cnn.com/2017/09/06/news/economy/germany-election-merkel-economy-inequality/index.html

https://www.expertmarket.co.uk/focus/worlds-most-productive-countries-2017

https://www.theguardian.com/world/blog/2017/feb/23/germanys-gdp-shows-19-rise-over-last-year

https://qz.com/586547/germany-is-the-worlds-strongest-economy/

http://www.cnn.com/2014/10/16/world/europe/germany-25-years-of-success/index.html

http://www.investopedia.com/terms/l/labor-productivity.asp

http://stats.oecd.org/Index.aspx?DatasetCode=ANHRS#

http://www.heritage.org/index/heatmap

http://www.heritage.org/index/country/germany

https://data.worldbank.org/region/euro-area?view=chart

]]>

The Economist is calling it an “Equifailure” and we could not agree more. Talk about an incredible fall in share prices, taking about a 15% dip after TransUnion, Equifax, and Experian stocks were on a stable, upwards spiral that showed growth in price from January 2017 to May 2017 (The Economist, 2017). Not only are we looking at a huge loss in the market, but a huge risk for millions of Americans. This poses the danger of identity theft and the potential for the government to have to cover the losses. And to make matters even worse, Equifax employees sold shares of the company when they heard about the breach and didn’t even notify the public until weeks later. We don’t like the sound of that.

The big question is why are they still allowed to store people’s data? Wouldn’t you think that after numerous hacks they would be able to re-locate people’s most important data, or at least protect it? As one of the biggest credit holding agencies, Equifax should not be easily hacked. The issue, however, is that it is extremely “central to the American financial system.” That means that nothing can be done to fix the issue and Equifax will just keep going on as if nothing happened in the future and keep storing data even if we don’t know about it. To make matters worse, it is regulated by the Federal Trade Commission and Consumer Financial Protection Bureau, and they aren’t even choosing to halt business (The New York Times, 2017). The real question is why not? Do they not think it is a monetary concern by any means? The employees of Equifax knew what they were doing when they each sold their stake and ended up 2 million dollars richer, while the losses of millions of Americans, frozen credit accounts, and stolen identities leaves them with nothing but fear and financial burden.

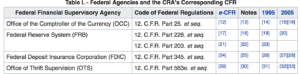

Let’s examine a CRA further to understand why our data will continue to live on and potentially, get hacked again. First of all, it is regulated by some of the biggest economic players –– each federal agency regulator is detailed in the photo below (this photo keeps uploading as low-res but the regulators are the OCC, the FRS, the FDIC, and OTS)

There is a lot of power attached to a CRA. If that power wants a CRA to continue, it will, especially if it is helping the economy. Beyond these federal agencies, CNN explains that the market can’t fix this either. “Markets can’t fix this because buyers choose between sellers, and sellers compete for buyers. In case you didn’t notice, you’re not Equifax’s customer. You’re its product.” (CNN, 2017). This hack was the result of millions of Americans valuable information, in which Equifax is in the business of ‘selling’ that valuable information. Our information is out there, and it’s only a matter of time (if not already) until it is completely exposed and stolen. The only solution is government involvement, but to the government this is not a big enough issue, or an issue that they need to take care of because it happens in data security a lot. Beyond that, so many people are choosing to complain to Equifax when the real entity that needs to step in is the government. Currently, though, there is not the proper data to support the government’s involvement in this hack and Equifax, and other CRAs will continue to “collect and sell our data [because] don’t need to keep it secure in order to maintain their market share. They don’t have to answer to us, their products” (CNN, 2017). Let’s continue to be weary of the information we share especially when it comes to CRAs. We never know what can happen.

https://www.economist.com/news/finance-and-economics/21728956-financial-industry-worries-about-who-next-big-data-breach-suffered

http://www.cnn.com/2017/09/11/opinions/dont-complain-to-equifax-demand-government-act-opinion-schneier/index.html

]]>The CEO of Urban Outfitters, Richard Hayne described this issue in accordance with the housing market when he said, “Retail square feet per capita in the United States is more than six times that of Europe or Japan. And this doesn’t count digital commerce. Our industry, not unlike the housing industry, saw too much square footage capacity added in the 1990s and early 2000s. Thousands of new doors opened and rents soared. This created a bubble, and, like housing, that bubble has now burst. We are seeing the results: doors shuttering and rents retreating.”

So, what does a massive hit in retail mean for jobs? Unsurprisingly, retailers have publicly announced over 200,000 lay-offs in the last four years and a growing 89,000 in 2017 alone. According to Business Insider, stores are closing at a rate not seen since the recession. When looking at the data, there is an interesting story being told. This chart shows that both traditional and online retail are soaring since the Recession. However, when diving deeper into particular industries is when we see a hit in job loss.

This chart shows the decline of employment from appliance and electronic stores which were a huge industry to shut their doors to the public.

And then we have, of course, the struggling clothing and retail market chart that shows the loss of employment in the last few years.

With no surprise, e-commerce has soared in the last couple of years, but are they hiring those transitioning out of traditional retail positions? Probably not. While the retail industry is known for high turnover rates it is also known for hiring 1 out of 10 American workers within a large age range. That said, most of these workers being laid off do not hold the set of skills that an e-commerce job would entail.

So, is this weird retail hit of 2017 an economic indicator of what the future of the economy holds? Well, according to Mark Cohen, the Director of Retail Studies at Columbia University, the huge hit that retail continues to take is creating a “slow-rolling crisis.” The large amount of people that have lost their retail position and will continue to lose it (considering the way retail is going) are now going to spend less money since they are going through a period of unemployment which will create a “cascade of economic challenges,” says Cohen.

It will be interesting to continue to see the trajectory of retail, but right now it is looking like the start of a very interesting and slow rolling economic indicator. Would it be too big to say that we could be on the path towards another economic recession?

Sources:

http://www.businessinsider.com/retail-job-losses-are-hurting-the-economy-2017-4

https://psmag.com/news/the-long-and-painful-decline-of-the-retail-store

https://www.theatlantic.com/business/archive/2017/04/retail-meltdown-of-2017/522384/

]]>